Micropumps are small volume devices designed to transmit fluids with high precision. These pumps are used for numerous functions in the medical industry, such as preparing samples for medical diagnoses & therapeutics and dispensing precise dosages of medications. Micropumps are key components of microfluidic systems with applications ranging from biological fluid handling to microelectronic cooling. Their small size, potential cost, and improved dosing accuracy have led to increased adoption by medical device manufacturers.

Strategic insights for the North America Micropump provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

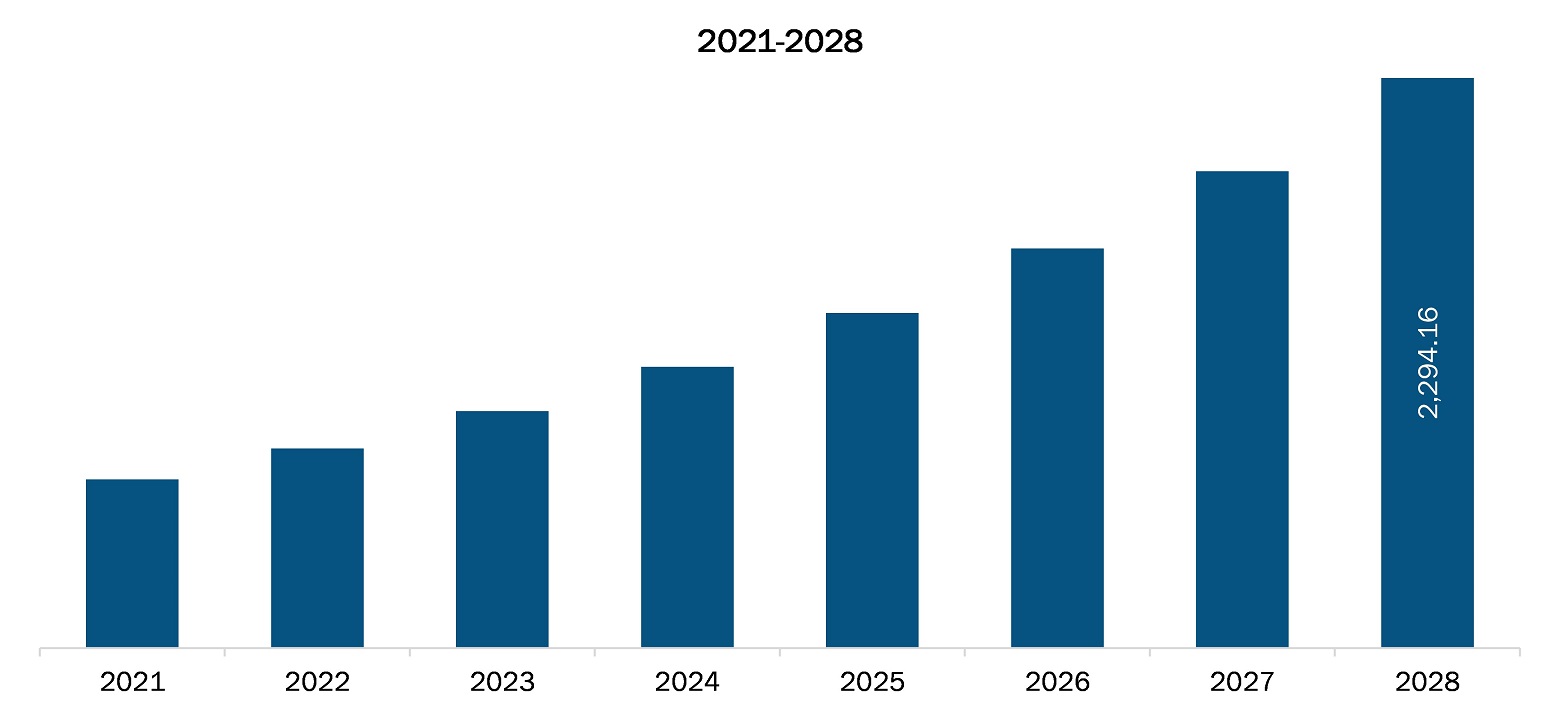

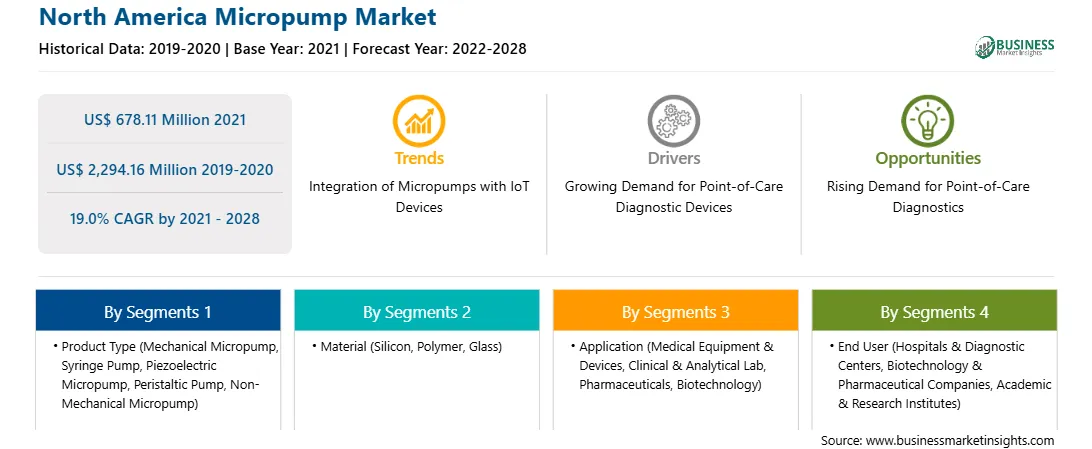

| Market size in 2021 | US$ 678.11 Million |

| Market Size by 2028 | US$ 2,294.16 Million |

| Global CAGR (2021 - 2028) | 19.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Micropump refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America micropump market is expected to reach US$ 2,294.16 million by 2028 from an estimated value of US$ 678.11 million in 2021; it is likely to register a CAGR of 19.0% from 2021 to 2028. Growing applications in microfluidics and improved accuracy over traditional drug delivery devices are boosting the micropump market growth. However, stringent medical device regulations are hindering the growth of the North America micropump market.

In recent years, controlled release of drugs faced challenges such as the release of a suitable quantity of drugs at the right time with the least invasiveness and raised demand for advanced drug delivery devices. The emergence of micro-electro-mechanical systems (MEMS) that combine mechanical and electrical components provides a solution to overcome these challenges. The rising adoption of miniaturized medical devices has helped reshape the medical device industry. Owing to the rising healthcare costs and the shift to home-based outpatient care, the demand for smaller, lighter, and portable products has increased tremendously. The miniaturization of a medical device can be achieved in various ways—one of the most important is through micropumps. Micropumps are associated with lower production costs, fewer leaks, decreased power consumption, and increased accuracy owing to the controlled flow of fluids and delivery of drug dosage into the body. They can handle extremely small volumes of liquid efficiently. Micropumps are being developed for a variety of medical applications including transdermal insulin delivery, blood transportation through artificial hearts, injection of glucose and drugs, hormone treatment, and pain and wound-care management. Additionally, manufacturers are releasing a wide range of micropumps to cater to the rising demand of the medical device industry.

North America has been witnessing an increasing number of COVID-19 cases since its outbreak. Several measures are being taken to contain the disease and prevent the transmission. The exorbitant number of COVID-19 cases have resulted in cancelation of doctor's appointment, decrease in demand for elective neurosurgery, and disruption in supply chain due to long period of lockdown. In the US, many doctors, hospitals, and other healthcare facilities are delaying or canceling the cancer procedures, surgeries, and sometimes screenings or other treatments, if they are not considered urgent, emergencies, or otherwise indicated for life-threatening conditions. More research is being conducted on COVID-19 vaccines than on any other disease. Pharmaceutical companies are halting ongoing studies and delaying the launch of new trials. Therefore, it is likely to affect micropumps market owing to above mention points.

The North America micropump market, by product type, is subsegmented into mechanical micropump, syringe pump, piezoelectric micropump, peristaltic pump, and non-mechanical micropump. The mechanical micropump segment is likely to hold the largest share of the market in 2021. However, the non-mechanical micropump segment is expected to register the highest CAGR during the forecast period.

The North America micropump market, based on material, is segmented into silicon, polymer, and glass. In 2021, the silicon segment is likely to hold the largest share of the market. However, the polymer segment is expected to register the highest CAGR during the forecast period.

The North America micropump market, by application, is subsegmented into medical equipment & devices, clinical & analytical lab, pharmaceuticals, biotechnology, and others. The medical equipment & devices segment is likely to hold the largest share of the market in 2021 and is also expected to register the highest CAGR during the forecast period.

The North America micropump market, by end user, is subsegmented into hospitals & diagnostic centers, biotechnology & pharmaceutical companies, and academic & research institutes. The hospitals & diagnostic centers segment is likely to hold the largest share of the market in 2021 and is also expected to register the highest CAGR during the forecast period.

A few of the primary and secondary sources associated with this report on the North America micropump market are the Centers for Disease Control and Prevention (CDC), International Diabetes Federation (IDF) and Food and Drug Administration (FDA).

The North America Micropump Market is valued at US$ 678.11 Million in 2021, it is projected to reach US$ 2,294.16 Million by 2028.

As per our report North America Micropump Market, the market size is valued at US$ 678.11 Million in 2021, projecting it to reach US$ 2,294.16 Million by 2028. This translates to a CAGR of approximately 19.0% during the forecast period.

The North America Micropump Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Micropump Market report:

The North America Micropump Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Micropump Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Micropump Market value chain can benefit from the information contained in a comprehensive market report.