feed the growing population, food production must also increase to match the rising demand; failing to do so can lead to people starving. Moreover, as the lifestyle of people is improving and the protein demand is increasing, meat consumption is also expected to increase sharply. This factor will increase the requirement for protein-rich animal feed to feed the livestock. According to the current estimates by Food and Agriculture Organization (FAO) and the United Nations, 80% of the world's agricultural land is used for growing ingredients for animal feed and grazing livestock animals. According to the International Institute for Sustainable Development (IISD), 85% of the world's soybean production is for animal feed to fulfill the protein requirement of livestock animals, which puts a lot of pressure on land, water, and other natural resources. The production of soy protein is a significant contributor to deforestation, loss of biodiversity, and pollution. According to industry experts, nearly 70% of the world's freshwater is used for cultivating crops to feed livestock animals. On the other hand, fish meal, an excellent animal-feed protein source, is also putting tremendous pressure on the ocean ecosystem. The livestock industry, especially aquaculture, relies heavily on wild-caught fish to produce fish meal, leading to the overexploitation of global fish stocks. Thus, there is an urgent need for sustainable protein sources for the animal feed industry to minimize the environmental footprint and meet the rising demand. Microbial protein is one of the excellent alternatives to conventional sources of proteins such as soybean and fish meal. It is produced using cost-effective substrates such as industrial gases (carbon dioxide, methane, and natural gas), wastewater, and poultry waste (feathers) fermented in a reactor using bacteria, yeast, fungi, or microalgae. According to the feed industry journal "WattAgNet," if 13% of the protein in animal feed is replaced with microbial protein, worldwide cropland usage will be reduced by 6%, and agricultural greenhouse gas (GHG) emissions will be reduced by 7%. Moreover, by 2050, the researchers expect that microbial protein will replace 10–19% of the demand for conventional crop-based feed protein.

There is already intense pressure on livestock farmers to reduce their environmental footprint. In contrast, rising arable land prices and feed production costs drive the demand for sustainable feed protein. This factor boosts the growth of the microbial protein for feed market.

North America is one of the significant markets for compound feed in the globe with the US market being the major contributor to the market growth of compound feed. The animal feed manufacturing industry in the US largely relies on the country’s free-trade agreement with Canada and Mexico. In addition, the expanding livestock industry in North America favors the animal feed market progress in the region. Currently, the demand for poultry feed is high in North America, while pig feed and aqua feed are gaining popularity in the overall animal feed market in the region. According to the American Feed Industry Association, there are more than 5,800 animal feed manufacturing facilities in the US, producing more than 284 million tons of finished feed and pet food each year. According to data from the US Department of Agriculture (USDA), livestock and poultry account for over half of agricultural cash receipts in the US, often exceeding US$ 100 billion annually. Cattle production is the most important industry in the country; thus, with the growing livestock industry and animal feed production, demand for new innovative feed additives is also increasing. Microbial protein is one of the sustainable protein sources in animal feed. The North America microbial protein for feed market is growing significantly in North America. Key market players in North America are adopting strategic initiatives such as product launches, acquisitions, and partnerships to sustain themselves in the growing market. In 2019, BP Ventures invested US$ 30 million in Calysta, Inc., a California-based start-up producing alternative proteins. With this investment, BP intends to use its natural gas to produce protein for fish, livestock, and pet feeds. The company is working on supporting its strategy of creating new markets in which natural gas can play a material role in delivering a more sustainable future by establishing a strategic relationship with Calysta Inc. Calysta is a world leader in cellular agriculture, creating protein without limits via a patented fermentation platform that uses no arable land, and plant or animal products. Such initiatives from manufacturers are contributing to the augmentation of the North America microbial protein for feed market in North American countries.

Strategic insights for the North America Microbial Protein for Feed provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

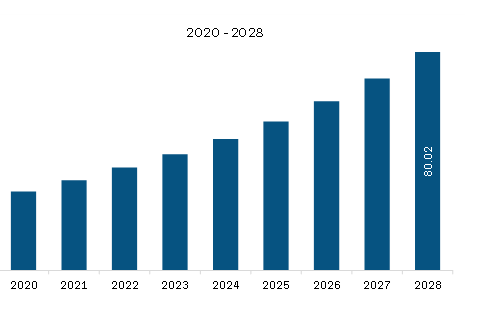

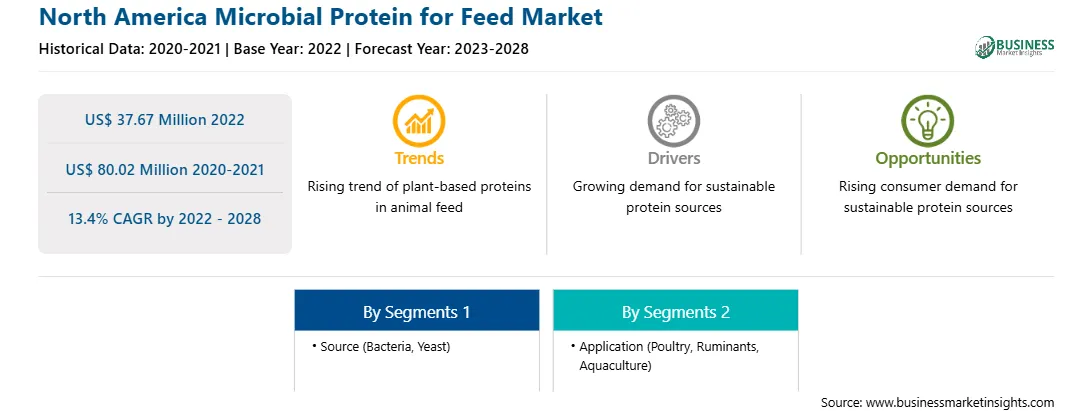

| Market size in 2022 | US$ 37.67 Million |

| Market Size by 2028 | US$ 80.02 Million |

| Global CAGR (2022 - 2028) | 13.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Microbial Protein for Feed refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America microbial protein for feed market is segmented into source, application, and country.

Based on source, the North America microbial protein for feed market is segmented into bacteria, yeast, and others. In 2022, the bacteria segment registered a largest share in the North America microbial protein for feed market.

Based on application, the North America microbial protein for feed market is segmented into poultry, ruminants, aquaculture, and others. In 2022, the aquaculture segment registered a largest share in the North America microbial protein for feed market.

Based on country, the North America microbial protein for feed market is segmented into the US, Canada, and Mexico. In 2022, the US segment registered a largest share in the North America microbial protein for feed market.

Alltech; Arbiom; CALYSTA INC.; ICC; and KnipBio are the leading companies operating in the North America microbial protein for feed market.

The North America Microbial Protein for Feed Market is valued at US$ 37.67 Million in 2022, it is projected to reach US$ 80.02 Million by 2028.

As per our report North America Microbial Protein for Feed Market, the market size is valued at US$ 37.67 Million in 2022, projecting it to reach US$ 80.02 Million by 2028. This translates to a CAGR of approximately 13.4% during the forecast period.

The North America Microbial Protein for Feed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Microbial Protein for Feed Market report:

The North America Microbial Protein for Feed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Microbial Protein for Feed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Microbial Protein for Feed Market value chain can benefit from the information contained in a comprehensive market report.