Manufacturers in the automotive and aerospace industries seek ways to enhance production efficiencies, reduce costs, and improve product quality. As a result, they deploy metal processing machines that offer high precision, flexibility, and automation capabilities in their facilities. These industries rely heavily on metal processing machines for applications such as component fabrication, assembly, and surface finishing. In the automotive industry, metal processing machines are used mainly in the manufacturing of engine parts, chassis components, and body panels. The demand for metal processing machines is expected to rise in the coming years with the continuous introduction of new vehicle models and the need for advanced manufacturing techniques. The US is the largest manufacturer of automobiles. The growing demand for automotive vehicles is resulting in continuous investments in the automotive sector in the country, e.g., the assembly plant of the Mazda–Toyota joint venture for manufacturing in Huntsville in 2021. This indicates a vast need for metal processing machines in this industry.

Further, the aerospace industry increasingly focuses on lightweight materials and advanced manufacturing techniques to improve fuel efficiency and performance. In this industry, metal processing machines are critical in producing aircraft components such as fuselage structures, wings, and landing gears. The expanding aerospace manufacturing activities with huge investments, coupled with an upsurge in the need for aircraft fleets, would continue to favour the progress of the North America metal processing machine market, as there are used in a wide range of processes in this industry, including cutting, bending, and designing.

North America consists of the US, Canada, and Mexico. The availability of well-established infrastructure in developed countries, such as the US and Canada, helps manufacturing firms explore the limits of science, technology, and commerce. Across North America, technological advancements have led to high competition in the manufacturing industry. According to the National Institute of Standards and Technology (NIST), the manufacturing sector in the US was valued at US$2.3 trillion and held a 12.0% share of its total GDP in 2021. In manufacturing machinery and equipment, the US is the second largest country in the world. Also, the country is a leading fabricated metal product manufacturer across the world. All these factors drive the North America metal processing machine market growth in North America.

Furthermore, the aerospace & defense industry in North America is reporting tremendous growth owing to the stable economy, developed infrastructure, high technology adoption rate, and increasing investments by governments. In March 2023, the Government of Canada announced an investment of ∼ US$ 7.44 million to support Swiss business H55's opening in Canada. This investment is expected to attract global leaders in aircraft manufacturing to make Greater Montréal as its North American platform for manufacturing its products. The rising trend of prototyping with on-demand laser metal cutting in the aerospace industry offers effective ways to rapidly manufacture aerospace sheet metal parts without complicated manufacturing setups. Thus, the growing trend of rapid prototyping may generate a huge demand for laser metal cutting, which is expected to bolster the North America metal processing machine market growth in North America during the forecast period.

Strategic insights for the North America Metal Processing Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Metal Processing Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Metal Processing Machines Strategic Insights

North America Metal Processing Machines Report Scope

Report Attribute

Details

Market size in 2023

US$ 5,522.63 Million

Market Size by 2030

US$ 7,133.98 Million

Global CAGR (2023 - 2030)

3.7%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Press Brake

By Laser Cutting Machine

By Bending Machine

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Metal Processing Machines Regional Insights

North America Metal Processing Machines Market Segmentation

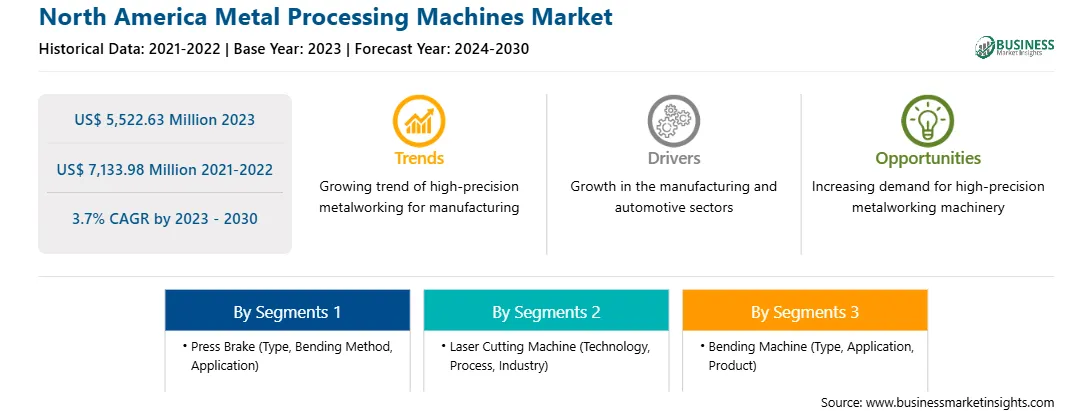

The North America metal processing machines market is segmented into press brake, laser cutting machine, bending machine, and country.

The press brake market is further categorized into type, bending method, and application. By press brake, the type segment is further sub-segmented into manual, hydraulic, and electronic. The hydraulic sub-segment held the largest share of the North America metal processing machines market in 2023. The bending method segment, by press brake, is classified into air bending, bottom bending, and coining. The air bending sub-segment held the largest share of the North America metal processing machines market in 2023. Also, the application segment, by press brake, is sub-segmented into automotive, aerospace, metal, furniture, and others. The automotive sub-segment held the largest share of the North America metal processing machines market in 2023.

The laser cutting machine market is further categorized into technology, process, and industry. By laser cutting machine, the technology segment is further sub-segmented into fiber laser and plasma laser. The fiber laser sub-segment held the largest share of the North America metal processing machines market in 2023. The process segment, by press brake, is classified into fusion cutting, flame cutting, and sublimation cutting. The flame cutting sub-segment held the largest share of the North America metal processing machines market in 2023. Also, the industry segment, by press brake, is sub-segmented into automotive, aerospace & defense, consumer electronics, industrial, and others. The industrial sub-segment held the largest share of the North America metal processing machines market in 2023.

The bending machine market is further categorized into type, application and products. By bending machine, the type segment is further sub-segmented into electric, hydraulic, pneumatic, and electromagnetic. The electric sub-segment held the largest share of the North America metal processing machines market in 2023. The application segment, by bending machine, is classified into manufacturing, precision machinery, metals and mining, automotive, and building and construction. The automotive sub-segment held the largest share of the North America metal processing machines market in 2023. Also, the products segment, by bending machine, is sub-segmented into sheets, tube, and others. The tube sub-segment held the largest share of the North America metal processing machines market in 2023.

Based on country, the North America metal processing machines market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America metal processing machines market in 2023.

Bystronic AG; Dener USA LLC; Durmazlar Machinery Inc; Ermaksan Machinery Industry and Trade Inc; LVD Company NV; Prima Industrie SpA; Salvagnini Italia SPA; and TRUMPF SE + Co KG are the leading companies operating in the North America metal processing machines market.

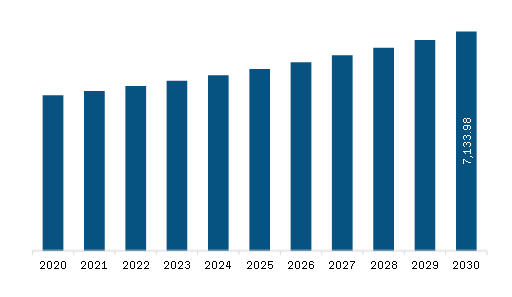

The North America Metal Processing Machines Market is valued at US$ 5,522.63 Million in 2023, it is projected to reach US$ 7,133.98 Million by 2030.

As per our report North America Metal Processing Machines Market, the market size is valued at US$ 5,522.63 Million in 2023, projecting it to reach US$ 7,133.98 Million by 2030. This translates to a CAGR of approximately 3.7% during the forecast period.

The North America Metal Processing Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Metal Processing Machines Market report:

The North America Metal Processing Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Metal Processing Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Metal Processing Machines Market value chain can benefit from the information contained in a comprehensive market report.