Market Introduction

The North America metabolomics services market has been segmented into the US, Canada, and Mexico. The US held the largest share of the North America metabolomics services market in 2021. Increasing adoption of technological advancements and rising research and development activities are projected to accelerate the growth of the metabolomics services market. Moreover, the presence of large healthcare businesses and the growing usage of metabolomics services is propelling the market's expansion in this region. In North America, the US holds the significant share of the metabolomics services market. The growth of the market in the country is primarily driven by increasing prevalence of chronic diseases such as cancer. For instance, according to the National Cancer Institute, the country will see 1,735,350 new cancer cases in 2020. Breast cancer, lung and bronchus bronchial cancer, prostate cancer, colon and rectal cancer, melanoma cancer, and liver cancer are the most common types of cancer. Cancer incidences are increasing at an alarming rate in the country, resulting in an increase in demand for cancer diagnosis. Besides, the increasing investments and rising funds dedicated to the pharma manufacturing companies as well as academic and research institutes for the development of various medicines, growing geriatric population, infectious disease, and other therapeutics is one of the major driving factors. Rising incidences of cancer is the major factor driving the growth of the North America metabolomics services market.

In North America, countries such as the US has reported the highest numbers of COVID-19 cases. The pandemic has led to chaotic situation in the healthcare sectors, with excessively increased demand for diagnosing and therapeutic devices in the hospitals. For instance, demand for ventilators, respirators, and in vitro diagnostic (IVD) tests has risen drastically in across North American countries. The demand for personal protective kits has also gone up significantly. The FDA has increased its efforts to support the health of people and has rolled out several guidelines for hospitals and healthcare companies. Companies have also enhanced their research and development activities for diagnostics tests and therapeutic devices. For instance, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, EverlyWell, and Abbott, among others, are ate the forefront of COVID-19 diagnosis kit production. Thermo Fisher Scientific has increased its production to be able to produce 5 million tests per week in April. Likewise, Abbott has received Emergency Use Authorization (EUA) for a point-of-care test that can provide results in minutes.

Strategic insights for the North America Metabolomics Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Metabolomics Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Metabolomics Services Strategic Insights

North America Metabolomics Services Report Scope

Report Attribute

Details

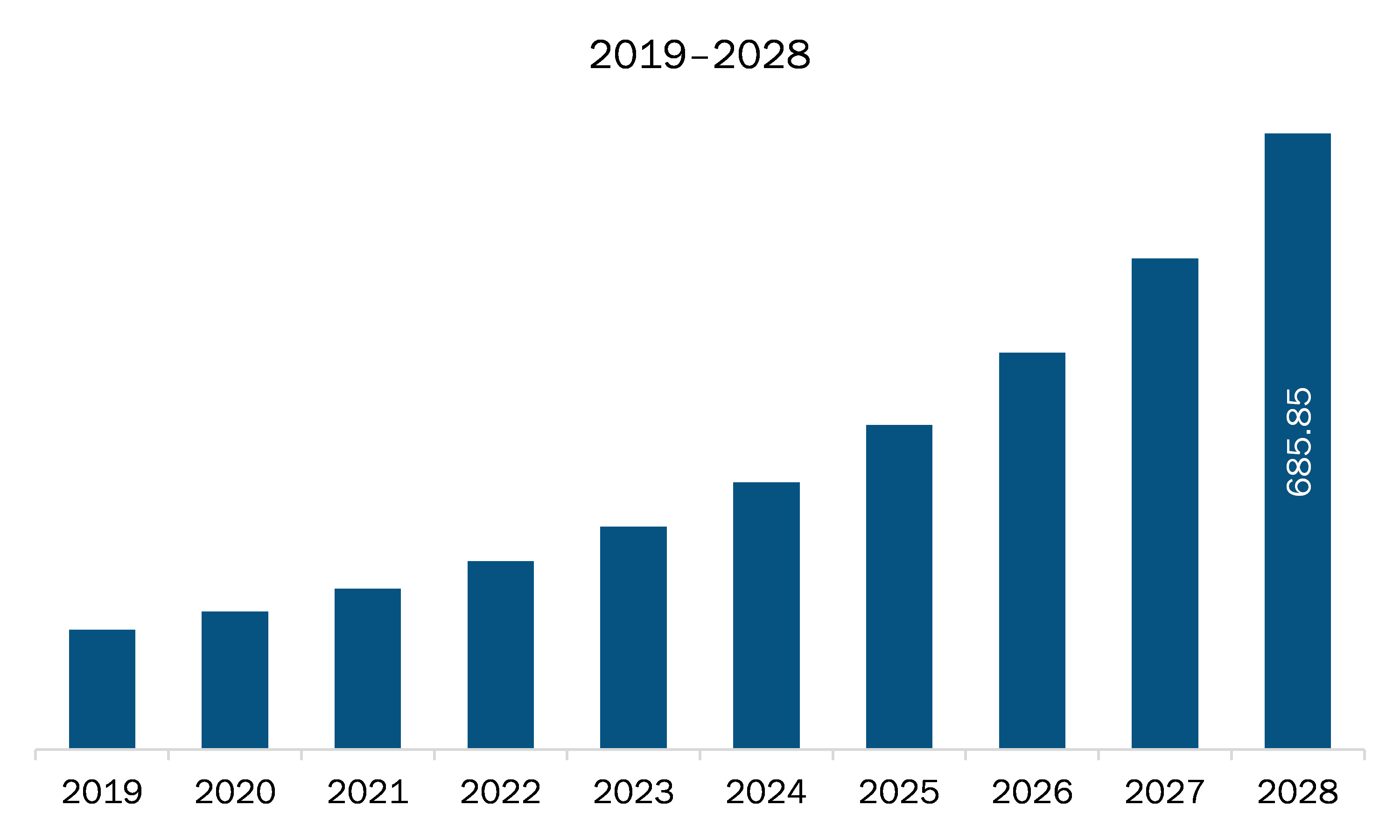

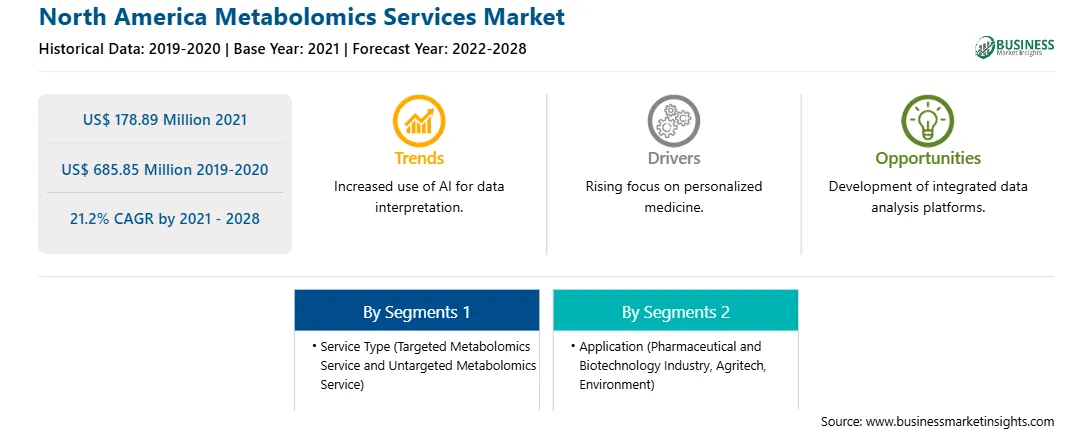

Market size in 2021

US$ 178.89 Million

Market Size by 2028

US$ 685.85 Million

Global CAGR (2021 - 2028)

21.2%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Service Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Metabolomics Services Regional Insights

Market Overview and Dynamics

The metabolomics services market in North America is expected to grow from US$ 178.89 million in 2021 to US$ 685.85 million by 2028; it is estimated to grow at a CAGR of 21.2% from 2021 to 2028. The economies across the region are creating significant opportunities for the key market players to expand their businesses. The majority of players concentrate on big countries, owing to the large population suffering from chronic diseases in these countries. With rising production costs against their practices, the healthcare companies are striving to produce sufficient revenue to entertain their investors. The markets in a few growing economies are expected to be an essential part of offering more reliable and profitable growth opportunities for the major players to expand their industry. Advancements in biotechnology have increased the demand for diagnostics in the healthcare market, encouraging the introduction of more analytical systems and facilitating the shift toward personalized medicine. There are new opportunities in infectious disease testing, molecular oncology, and pharmacogenomics in emerging countries. Hence, healthcare companies can target patients or consumers in several nations. Various players in the industry have been investing a significant amount of their revenue in R&D activities to develop better and advanced products and technologies to be used in the healthcare industry. Thus, the rising number of diseases such as cancer and advancements in several countries are likely to boost the market and are anticipated to provide significant growth opportunities to the players operating in the market during the forecast period.

Key Market Segments

The North America metabolomics services market has been segmented based on service type, application, and country. On the basis of service type, the North America metabolomics services market is segmented into targeted metabolomics service and untargeted metabolomics service. The targeted metabolomics service segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Based on application, the market is segmented into pharmaceutical and biotechnology industry, agritech, and environment. The pharmaceutical and biotechnology industry segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Likewise, the pharmaceutical and biotechnology industry segmented is categorized into biomarker discovery, drug discovery, toxicological testing, and others.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on metabolomics services market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE; BGI; biocrates life sciences ag; Chenomx Inc.; Creative Proteomics; Fred Hutchinson Cancer Research Center; Metabolon, Inc.; Molecular You; RTI International; TMIC; and West Coast Metabolomics Center are among others.

Reasons to buy report

North America Metabolomics Services Market Segmentation

North America Metabolomics Services Market –By

Service Type

North America Metabolomics Services Market –By Application

North America Metabolomics Services Market -By Country

North America Metabolomics Services Market -

Company Profiles

The North America Metabolomics Services Market is valued at US$ 178.89 Million in 2021, it is projected to reach US$ 685.85 Million by 2028.

As per our report North America Metabolomics Services Market, the market size is valued at US$ 178.89 Million in 2021, projecting it to reach US$ 685.85 Million by 2028. This translates to a CAGR of approximately 21.2% during the forecast period.

The North America Metabolomics Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Metabolomics Services Market report:

The North America Metabolomics Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Metabolomics Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Metabolomics Services Market value chain can benefit from the information contained in a comprehensive market report.