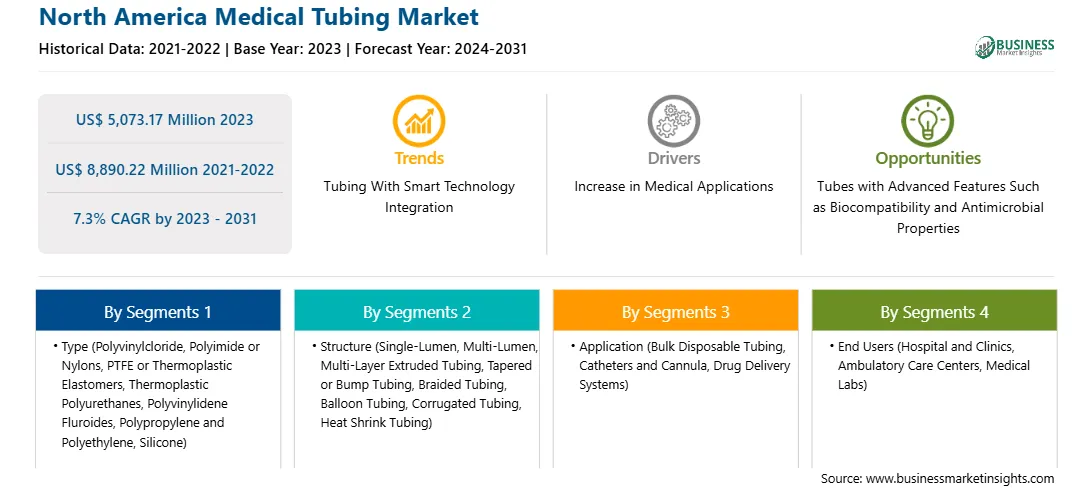

The North America medical tubing market was valued at US$ 5,073.17 million in 2023 and is expected to reach US$ 8,890.22 million by 2031; it is estimated to register a CAGR of 7.3% from 2023 to 2031.

Medical tubing is utilized in various medical and pharmaceutical applications, including fluid management, drainage, anesthesiology, respiratory equipment, intravenous (IV) administration, catheters, peristaltic pumps, dialysis, feeding tubes, and biopharmaceutical laboratory equipment. Medical interventions that involve specialized medical tubing are often needed in the management of chronic diseases, such as diabetes, cardiovascular diseases, and cancer. In 2022, the American Cancer Society estimated 26,380 new cases of stomach cancer (gastric cancer) in the US. According to the Global Cancer Statistics published in 2022 by GLOBOCAN, the category of trachea, bronchus, and lung cancer was the most common cancer condition worldwide, followed by breast cancer and colorectal cancer, respectively. As per the International Agency for Research on Cancer (IARC), nearly 1 in 5 people would develop cancer during their lifetime, and ~ 1 in 9 men and ~1 in 12 women succumb to the disease. With the rising prevalence of chronic diseases, healthcare systems continuously seek medical devices such as infusion devices, catheters, and IV administration systems using tubing to effectively manage these conditions. Companies such as RAUMEDIC AG and Saint-Gobain offer a wide range of medical tubing systems for drug delivery devices, infusion devices, internal feeding systems, and peristaltic pumps. RAUMEDIC's silicone tubing is ideal for use in medical pump devices. Patients suffering from chronic diseases often require hospitalization, wherein treatment processes such as catheterization, drainage, and infusion involve the use of medical tubing. Patients with serious chronic conditions may also need surgical interventions, making medical tubing products invincible. Reliable and effective medical tubing solutions significantly contribute to patient safety and the success of treatments.

Crohn's disease (a gastrointestinal disease associated with trauma), bowel obstruction, microscopic colitis, short bowel syndrome, and ulcerative colitis are a few of the common gastrointestinal disorders. Patients suffering from these conditions are provided with enteral nutrition, which utilizes feeding tubes, as consuming food orally is not feasible. In September 2023, Cardinal Health launched a novel Kangaroo OMNI enteral feeding pump with a Kangaroo feeding tube featuring IRIS Technology. The pump is equipped with a camera to assist in the placement of small-bore feeding tubes. Developed with a focus on patient safety and innovation, this advanced pump delivers nutrition and hydration for individuals from different age groups, whether in hospitals, at home, or elsewhere. Therefore, an increase in the medical applications of tubing, coupled with a surge in the number of chronic disease cases, drives the medical tubing market toward growth.

Investors are increasingly focusing on companies that produce high-quality medical tubing, a critical requirement for healthcare applications such as anesthesia delivery and fluid management. Innovative materials such as specialty polymers and biocompatible plastics drive medical device performance and safety. For instance, in June 2020, Nordson Corporation acquired Fluortek, Inc., an Easton, Pennsylvania-based precision plastic extrusion manufacturer that serves the medical device industry with custom-dimensioned tubing. As Nordson MEDICAL continues expanding differentiated product offerings, the acquisition of Fluortek enhances the ability to deliver critical components that make customers' most complex medical device innovations possible. This offering further deepens Nordson MEDICAL's position as a component and device manufacturing capability provider for OEMs throughout the interventional, minimally invasive, and surgical medical device landscape. The higher rate of early adoption of emerging medical technology advancements in the future, coupled with the rising prevalence of chronic diseases, is likely to increase the demand for medical tubing solutions. As healthcare delivery continues to focus on efficiency and patient safety, investing in this area is expected to reap good returns and form an attractive channel of investing for growth-driven investors across the US.

Strategic insights for the North America Medical Tubing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Medical Tubing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Medical Tubing Strategic Insights

North America Medical Tubing Report Scope

Report Attribute

Details

Market size in 2023

US$ 5,073.17 Million

Market Size by 2031

US$ 8,890.22 Million

Global CAGR (2023 - 2031)

7.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Structure

By Application

By End Users

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Medical Tubing Regional Insights

The North America medical tubing market is categorized into type, structure, application, end users, and country.

By type, the North America medical tubing market is segmented into polyvinyl chloride (PVC), polyimide or nylons, PTFE or thermoplastic elastomers (TPES), thermoplastic polyurethanes (TPUS), polyvinylidene fluoride (PVDF), polypropylene and polyethylene, silicone, and others. The polyvinyl chloride (PVC) segment held the largest share of the North America medical tubing market share in 2023.

In terms of structure, the North America medical tubing market is segmented into single-lumen, multi-lumen, multi-layer extruded tubing, tapered or bump tubing, braided tubing, ballon tubing, corrugated tubing, heat shrink tubing, and others. The single-lumen segment held the largest share of the North America medical tubing market share in 2023.

Based on application, the North America medical tubing market is segmented into bulk disposable tubing, catheters and cannula, drug delivery systems, and others. The bulk disposable tubing segment held the largest share of the North America medical tubing market share in 2023.

By end users, the North America medical tubing market is segmented into hospital and clinics, ambulatory care centers, medical labs, and others. The hospital and clinics segment held the largest share of the North America medical tubing market share in 2023.

Based on country, the North America medical tubing market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America medical tubing market in 2023.

Air Liquide Medical Systems; Armstrong Medical Ltd; Besmed Health Business Corp; BMC Medical Co Ltd; DeVilbiss Healthcare LLC; Dimar S.P.A.; Dragerwerk AG & Co KGaA; Fisher & Paykel Healthcare Corp Ltd; Hamilton Medical AG; Hangzhou Formed Medical Devices Co., Ltd; Intersurgical Ltd; Koninklijke Philips NV; Medline Industries LP; ResMed Inc; Sleepnet Corporation; SunMed Group Holdings LLC ( AirLife); and SURU INTERNATIONAL PVT. LTD. are some of the leading companies operating in the North America medical tubing market.

The North America Medical Tubing Market is valued at US$ 5,073.17 Million in 2023, it is projected to reach US$ 8,890.22 Million by 2031.

As per our report North America Medical Tubing Market, the market size is valued at US$ 5,073.17 Million in 2023, projecting it to reach US$ 8,890.22 Million by 2031. This translates to a CAGR of approximately 7.3% during the forecast period.

The North America Medical Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Medical Tubing Market report:

The North America Medical Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Medical Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Medical Tubing Market value chain can benefit from the information contained in a comprehensive market report.