The North America medical packaging market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Manufacturing giant Siemens has also adopted a substance transparency policy as part of their broader "Product Eco Excellence" program. These declarations allow one to see not just the elements in these products but also their quantity. Further, Roche Diabetes Care offers services to help recycle their product packaging. The Swiss company's insulin pump tubing comes in Tyvek plastic, which needs specialists to recycle correctly. By providing customers the means to send their packaging to a recycling center, they can make sure that the packaging does not end up in a landfill. In addition, medical device manufacturers are fostering eco-friendly consumers by promoting sustainable practices. Conferences like CleanMed showcase the ways healthcare companies are going green, inspiring other businesses and individuals to take similar steps in their work and lives. Rising awareness about environmental issues and increasing government regulations are pressurizing the pharmaceutical companies to move toward sustainable processes. These developments by the medical devices and pharmaceutical vendors provide scope for the expansion of the medical packaging market.

In case of COVID-19, in North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of medical packaging manufacturing activities. Downfall of other healthcare products manufacturing sectors has negatively impacted the demand for medical packaging during the early months of 2020. Moreover, decline in the overall packaging materials manufacturing activities has led to discontinuation of medical packaging manufacturing projects, thereby reducing the demand for medical packaging. Similar trend was witnessed in other North America countries, i.e., Mexico, Canada, Panama and Costa Rica. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the North America Medical Packaging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

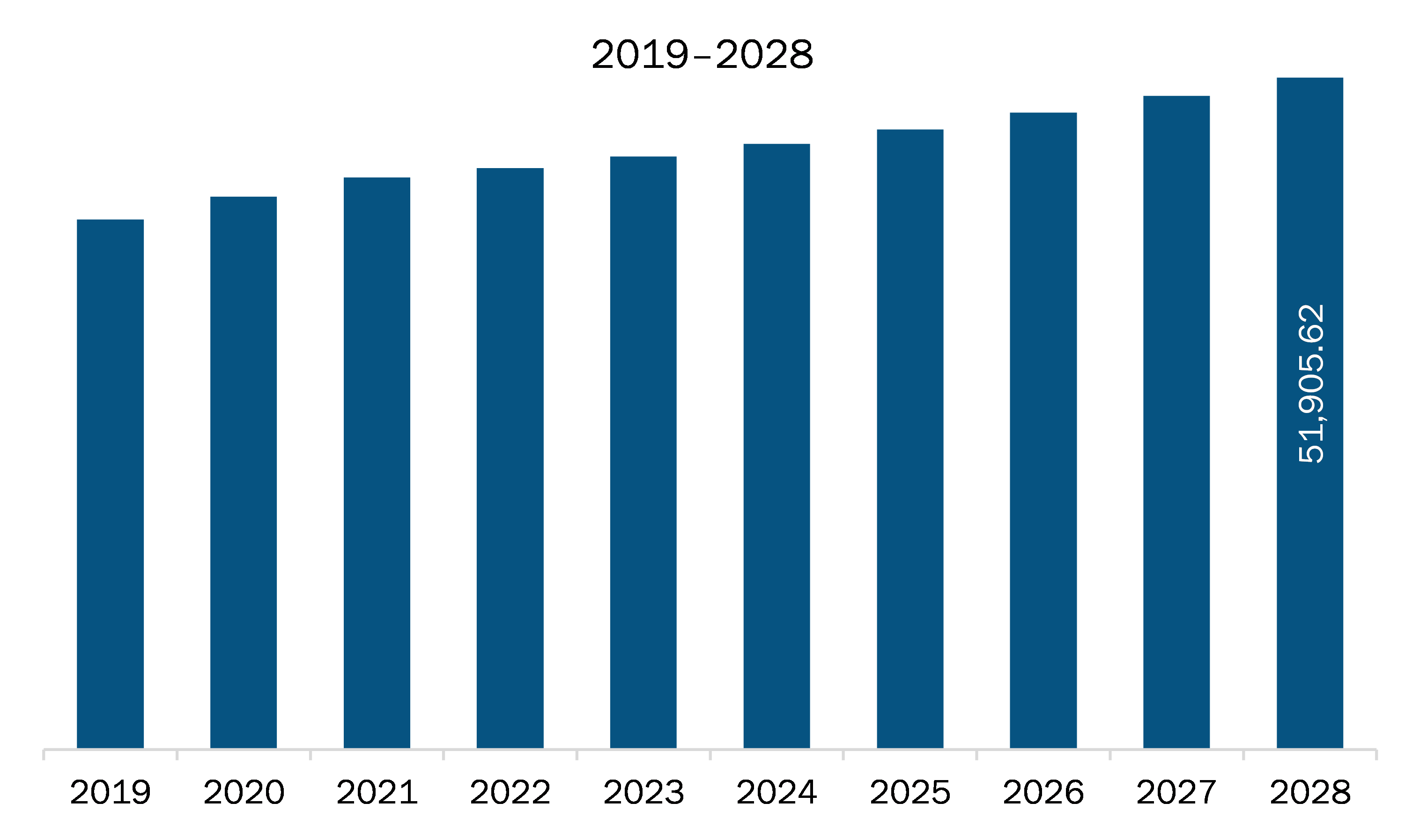

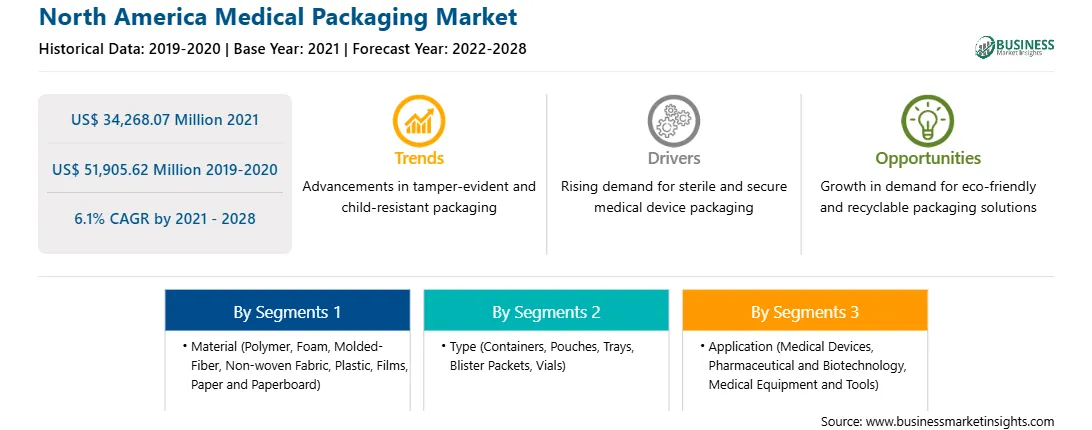

| Market size in 2021 | US$ 34,268.07 Million |

| Market Size by 2028 | US$ 51,905.62 Million |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Medical Packaging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The medical packaging market in North America is expected to grow from US$ 34,268.07 million in 2021 to US$ 51,905.62 million by 2028; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028. The Internet of Things (IoT) is revolutionizing the healthcare packaging industry as it enables many possibilities to essential aspects such as tracking of shipments and missed medications, which, in turn, will enhance not only the clinical workflow but also the quality of life. Like any other domain (or industry) that hitchhikes onto the latest technological innovations, IoT in packaging also offers many features previously unseen, such as bi-directional communications, tracking, and status display mechanisms. Considering the crucial aspect of timely administering of medication, the prominent role of IoT in healthcare packaging may be in ensuring the frequency and dosage, thereby ensuring efficacy. It is now possible to replace the medicine container with IoT solutions to link to a cloud-based application. A patient and their doctor can input the information and use audio-visual indicators to remind the patient to take medication at a particular time. A smart medicine box with innovative pharmaceutical packaging can revolutionize in-home healthcare services. IoT smart packaging can help control the entry of substances in healthcare environments, which may be linked with security measures and to the right patient, ensuring traceability. This is of great importance in emerging markets to tackle counterfeiting challenges and illegal recycling. In India, examples of illicit recycling could be the reuse of syringes and medical waste cotton. IoT in packaging could introduce the relevant electronic circuitry in a chip or printed electronic element the provides a unique signature.

Based on material, the polymer segment accounted for the largest share of the North America medical packaging market in 2021. Based on type, the containers segment accounted for the largest share of the North America medical packaging market in 2021. Based on application, the pharmaceutical & biotechnology segment accounted for the largest share of the North America medical packaging market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America medical packaging market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Amcor Plc.; DuPont de Nemours, Inc.; Mitsubishi Chemical Corporation; SGD Pharma; 3M; West Pharmaceutical Services, Inc.; Avery Dennison Corporation; Sonoco Products Company; CCL Industries Inc. and WestRock Company.

The North America Medical Packaging Market is valued at US$ 34,268.07 Million in 2021, it is projected to reach US$ 51,905.62 Million by 2028.

As per our report North America Medical Packaging Market, the market size is valued at US$ 34,268.07 Million in 2021, projecting it to reach US$ 51,905.62 Million by 2028. This translates to a CAGR of approximately 6.1% during the forecast period.

The North America Medical Packaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Medical Packaging Market report:

The North America Medical Packaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Medical Packaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Medical Packaging Market value chain can benefit from the information contained in a comprehensive market report.