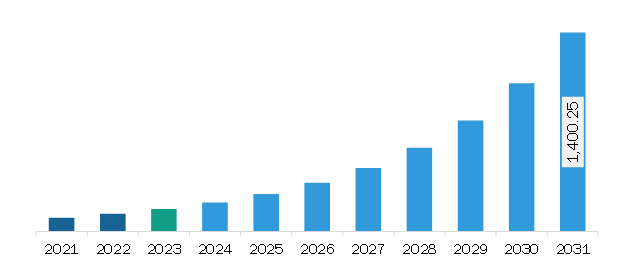

The North America medical exoskeleton market was valued at US$ 159.30 million in 2023 and is expected to reach US$ 1,400.25 million by 2031; it is estimated to register a CAGR of 31.2% from 2023 to 2031.

Small and big companies operating in the medical exoskeleton market adopt various strategies such as geographic expansion, new product launches, and technological advancements to boost their revenues. A few recent developments in the medical exoskeleton market are mentioned below; In July 2022, Ekso Bionics Holdings Inc. received approval from the US Food and Drug Administration (FDA) to market its EksoNR robotic exoskeleton for patients suffering from multiple sclerosis. It was cleared for stroke and spinal cord injury (SCI) rehabilitation in 2016 and acquired brain injury in 2020. It has also received CE certification and is available in Europe.

Samsung Electronics has received the US FDA for its assistive robot "GEMS Hip," a wearable device that acts as an exoskeleton for users with mobility issues using an active assist algorithm to improve gait and muscle movement. In December 2021, German Bionic launched the fifth generation of the Cray X exoskeleton. The fifth-generation Cray X underscores technology leadership in the massively growing international exoskeleton market. The company's innovations are paving the way for more people and businesses worldwide to benefit across a wider range of use cases and industries. In November 2021, Ottobock acquired Bay Area-based exoskeleton startup SuitX. SuitX is a spinout of UC Berkeley’s Robotics and Human Engineering Lab. Both companies effectively operate in the same category, producing robotic exoskeletons designed for two distinct purposes—work assistance and healthcare. In May 2021, Roam Robotics launched “Ascend,” a smart knee orthosis that helps wearers reduce knee pain and regain mobility. It senses the body’s movement, automatically adjusts to the wearer’s needs, and provides precise support at the right moment for target muscle groups. It is a registered Class I device with FDA approval available for purchase directly and through private and Medicare insurance, radically expanding public accessibility to wearable robotic devices. Therefore, the active participation of market players in product launches, expansions, partnerships, and mergers & acquisitions boosts the growth of the medical exoskeleton market.

Market players are receiving product approvals in the US to enhance the exoskeleton business. For instance, in July 2022, Ekso Bionics Holdings Inc. received marketing approval from the US Food and Drug Administration for its EksoNR robotic exoskeleton to use in patients with multiple sclerosis. Thus, the growing developments by various medical device giants in the US healthcare industry will further boost the market for medical exoskeletons in the country in the upcoming years.

Strategic insights for the North America Medical Exoskeleton provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Medical Exoskeleton refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Medical Exoskeleton Strategic Insights

North America Medical Exoskeleton Report Scope

Report Attribute

Details

Market size in 2023

US$ 159.30 Million

Market Size by 2031

US$ 1,400.25 Million

Global CAGR (2023 - 2031)

31.2%

Historical Data

2020-2021

Forecast period

2023-2031

Segments Covered

By Component

By Type

By Extremity

By Application

By Mobility

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Medical Exoskeleton Regional Insights

The North America medical exoskeleton market is categorized into component, type, extremity, application, mobility, end users, and country.

By component, the North America medical exoskeleton market is segmented into hardware and software. The hardware segment held a larger share of the North America medical exoskeleton market share in 2023.

In terms of type, the North America medical exoskeleton market is segmented into powered exoskeleton and passive exoskeleton. The powered exoskeleton segment held a larger share of the North America medical exoskeleton market share in 2023.

Based on extremity, the North America medical exoskeleton market is segmented into lower body exoskeleton, upper body exoskeleton, and full body exoskeleton. The lower body exoskeleton segment held the largest share of the North America medical exoskeleton market share in 2023.

By application, the North America medical exoskeleton market is segmented into spinal cord injury, multiple sclerosis, stroke, cerebral palsy, Parkinson’s disease, and others. The spinal cord injury segment held the largest share of the North America medical exoskeleton market share in 2023.

In terms of mobility, the North America medical exoskeleton market is segmented into mobile exoskeleton and stationary exoskeleton. The powered exoskeleton segment held a larger share of the North America medical exoskeleton market share in 2023.

By end users, the North America medical exoskeleton market is segmented into rehabilitation centers, physiotherapy centers, long term care centers, homecare settings, and others. The rehabilitation centers segment held the largest share of the North America medical exoskeleton market share in 2023.

Based on country, the North America medical exoskeleton market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America medical exoskeleton market in 2023.

BIONIK; B-Temia Inc; Cyberdyne Inc; Ekso Bionics Holdings Inc; ExoAtlet; Hocoma AG; Lifeward, Inc; Myomo Inc; and Rex Bionics Ltd. are some of the leading companies operating in the North America medical exoskeleton market.

The North America Medical Exoskeleton Market is valued at US$ 159.30 Million in 2023, it is projected to reach US$ 1,400.25 Million by 2031.

As per our report North America Medical Exoskeleton Market, the market size is valued at US$ 159.30 Million in 2023, projecting it to reach US$ 1,400.25 Million by 2031. This translates to a CAGR of approximately 31.2% during the forecast period.

The North America Medical Exoskeleton Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Medical Exoskeleton Market report:

The North America Medical Exoskeleton Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Medical Exoskeleton Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Medical Exoskeleton Market value chain can benefit from the information contained in a comprehensive market report.