The North America medical aesthetics market is analyzed on the basis of three major countries: the US, Canada, and Mexico. The US holds the largest share of the North American skin aesthetic devices market. The US is expected to be the largest market for the medical aesthetics market owing to several factors such as rising aesthetic procedures, and growing development of non-invasive aesthetic devices. In Canada, the growth of the market is expected to grow due to factors such as rising strategic investments by international players, increasing the number of aesthetic clinics, and growing numbers of medical device players. On the other hand, Mexico is expected to be the fastest-growing market for the medical aesthetic devices market owing to factors such as growing medical tourism and the aesthetic market. The medical aesthetic market in the US is expected to be the largest in the North American region. The growth of the market in the country is defined by various factors, such as the rise in the development of non-invasive medical aesthetic devices, the exponential rise in the aesthetic procedures. In the US, the number of aesthetic procedures has increased significantly over the last ten years. Also, the development of technology has increased the number of minimally and non-invasive procedures. For instance, according to the American Society for Aesthetic Plastic Surgery (ASAPS), in 2008, there were 10.2 million treatments performed in the US. Among these, nearly 80% of the procedures were performed with minimally invasive procedures. In addition, according to ASAPS latest statistics published in 2018, less famous procedures such as thigh lifts, chin augmentation, and breast reduction has increased significantly in past years, they have increased with 24%, 20%, and 18% respectively. Moreover, according to the ASAPS, 2018 statistics, below is the number of top five surgical and non-surgical procedures performed in 2018.

In the US, healthcare professionals and leading organizations are distracting the flow of healthcare resources from research & development to primary care due to an increasing number of COVID-19 patients. This scenario is slowing down the process of innovation. Moreover, the cosmetic surgeons having a unique perspective of working with patients and their teams create difficulties and challenges in the time of distress. Due to the ongoing COVID-19 pandemic, in May 2020, the American Society of Plastic Surgeons (ASPS) released a statement to urge the suspension of elective and nonessential procedures of cosmetic and laser surgeries in the US.

Strategic insights for the North America Medical Aesthetics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

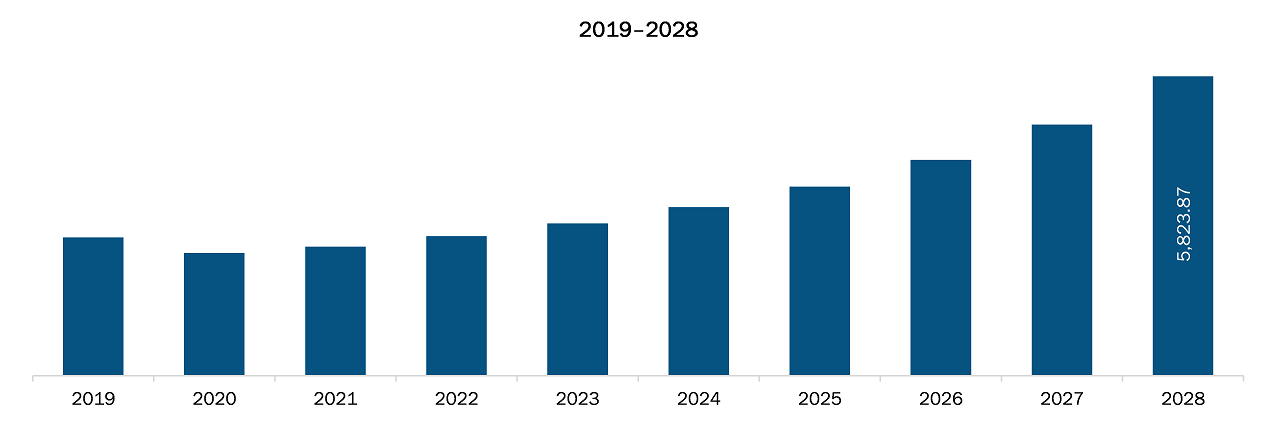

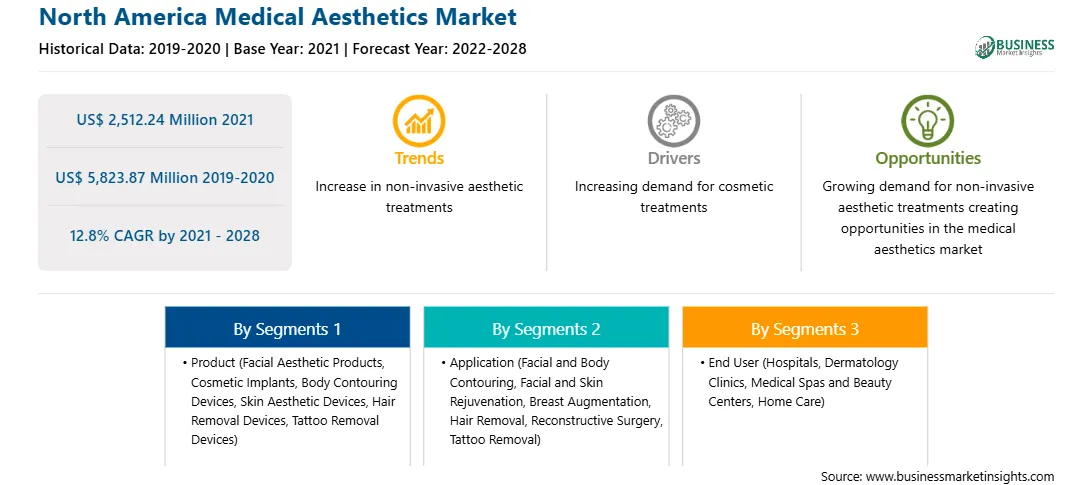

| Market size in 2021 | US$ 2,512.24 Million |

| Market Size by 2028 | US$ 5,823.87 Million |

| Global CAGR (2021 - 2028) | 12.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Medical Aesthetics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The medical aesthetics market in North America is expected to grow from US$ 2,512.24 million in 2021 to US$ 5,823.87 million by 2028; it is estimated to grow at a CAGR of 12.8% from 2021 to 2028. Technological advancements associated with medical aesthetic devices; all medical devices used for various cosmetic procedures, including plastic surgery, unwanted hair removal, excess fat removal, anti-aging, aesthetic implants, skin tightening, etc., are categorized under the medical aesthetic products umbrella. Technological advancements in devices, increasing awareness about aesthetic procedures, growing acceptance of minimally invasive devices, and surge in obese population are the main forces boosting the medical aesthetics market growth. With the establishment of the advanced, high-speed internet infrastructure and the growing trend of social media, information is becoming more accessible to everyone, and people are becoming more aware of aesthetic procedures. An increasing number of social media users and the sensitization of the masses to medical aesthetic procedures are being correlated with the improved sales of medical aesthetic devices. The aesthetic outcome in patient demand for cosmetic treatments was influenced by several parameters, such as clinical improvement after surgery, risks and potential complications, and downtime. These parameters could validate plasma technology as a new regenerative modality. The plasma skin regeneration (PSR) technology has great potential in dermatology; it helps treat facial arrhythmias, sun keratosis, seborrheic keratosis, and warts. A few studies have examined the clinical effects of PSR technology on periorbital rejuvenation. With conventional blepharoplasty, more than 90% improvement and with PSR ~20% and 30% improvement in the tightening of the upper eyelid and the periorbital folds, respectively, were achieved. After six months, ~40% improvement in acne scars on the face was achieved after the single PSR treatment. PSR has also been explored for the rejuvenation of the skin of chest, neck, and back of the hands. In addition, it can be used to treat traumatic scars, benign familial pemphigus, and porokeratosis. Understanding the impact of the PSR technology on aesthetic medicine requires the basic knowledge of the physics and histopathological aspects of plasma. Recent advancements in the technology are likely to bring dramatic improvements in the aesthetic treatment of the skin. The emergence of laser and light-based technologies are very promising among skin rejuvenation therapies. New laser resurfacing techniques for skin rejuvenation offer significant advantages over conventional ablative lasers such as the CO2 and erbium-YAG laser systems. Non-ablative and fractional lasers, although not as effective as ablative therapies, are associated with significantly lower complication rates and shorter recovery periods. New devices combining ablative and fractional technologies are available in the medical aesthetics market, and they are showing remarkable results. This is bolstering the growth of the medical aesthetics market.

Based on product market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices and others. In 2020, the facial aesthetic products segment held the largest share of the market, by product. Based on the application market was segmented into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal and others. In 2020, the facial and body contouring segment held the largest share of the market, by application. Based on the end user market was segmented into hospitals, dermatology clinics, medical spas and beauty centers and home care. In 2020, the hospitals segment held the largest share of the market, by end user.

A few major primary and secondary sources referred to for preparing this report on the medical aesthetics market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allergan Plc, Alma Lasers, Cutera Inc, Galderma, Hologic, Inc., Mentor Worldwide, LLC, Sientra, and Solta Medical among others.

The North America Medical Aesthetics Market is valued at US$ 2,512.24 Million in 2021, it is projected to reach US$ 5,823.87 Million by 2028.

As per our report North America Medical Aesthetics Market, the market size is valued at US$ 2,512.24 Million in 2021, projecting it to reach US$ 5,823.87 Million by 2028. This translates to a CAGR of approximately 12.8% during the forecast period.

The North America Medical Aesthetics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Medical Aesthetics Market report:

The North America Medical Aesthetics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Medical Aesthetics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Medical Aesthetics Market value chain can benefit from the information contained in a comprehensive market report.