Surge in Sea Trade and Increasing Maritime Budgets is Driving the North America Maritime Information Market

Terrorist invasions, ecological disturbances, and unauthorized immigration via sea have emerged as major maritime concerns with increased trade. The number of ships traveling the oceans has increased due to the liberalization of trade. Maritime information is essential for such economic growth. Several Governments are expanding their maritime budgets due to ongoing business growth. For instance, in August 2021, the Federal Emergency Management Agency of the US Department of Homeland Security allocated over US$ 30 million from the total grant of US$ 100 million for port authorities. The money was distributed among 44 port administrations, several terminal operators, municipalities, and law enforcement agencies to improve the security of the vital port infrastructure. Thus, the surge in sea trade has increased the maritime budget which drives the North America maritime information market growth.

Market Overview

The US, Canada, and Mexico are the key contributors to the North America maritime information market. In North America, the US is one of the major economies for maritime information market vendors. The maritime economy accounted for 1.7% or US$ 361.4 billion of current-dollar US gross domestic product (GDP) in 2020 and 1.7% or US$ 610.3 billion of current-dollar gross output. The US merchant navy, shipbuilding and repair facilities, port system, and supporting industries (collectively, the US maritime industry) integrate the economy into one vast global system, transferring more than 90% of the world's trade tonnage, including energy, consumer goods, agricultural products, and raw materials. As a result, the maritime information systems are highly serviceable across the region, anticipating lucrative opportunities for the North America maritime information market vendors over the forecast period. Furthermore, according to the TSB report, in 2020, 18 deaths at sea were reported, up from 17 deaths reported in 2019 and above the annual average of 15.4 from 2010 to 2019. Of the 18 deaths in 2020, 12 resulted from four marine accidents, while the remaining six resulted from five accidents on board. In context, 12 marine accident deaths in 2020 involved commercial fishing vessels, and four out of six shipboard accident deaths occurred on commercial fishing vessels. Since maritime information solutions play an important role in ensuring the security of the marine industry, they are widely used by government agencies across the region. These solutions help countries reduce maritime threats such as human trafficking, terrorist attacks, environmental destruction, and illegal immigration by sea. Therefore, with the rising marine incidents, coupled with growing awareness of the benefits of maritime information solutions, the region's maritime information market is anticipated to boom over the forecast period. Furthermore, the growing collaboration between marine industry players and software vendors is propelling the market growth. For instance, in February 2021, Spire Global partnered with Zero North, ship optimization software vendor. Spire Global captures precise temperature, humidity, and pressure information for the entire planet, including the vast oceans, and integrates it with optimization software to derive optimization results. The weather forecasting data benefit the global shipping industry and global forecasting models, leading to market growth.

Strategic insights for the North America Maritime Information provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Maritime Information refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Maritime Information Strategic Insights

North America Maritime Information Report Scope

Report Attribute

Details

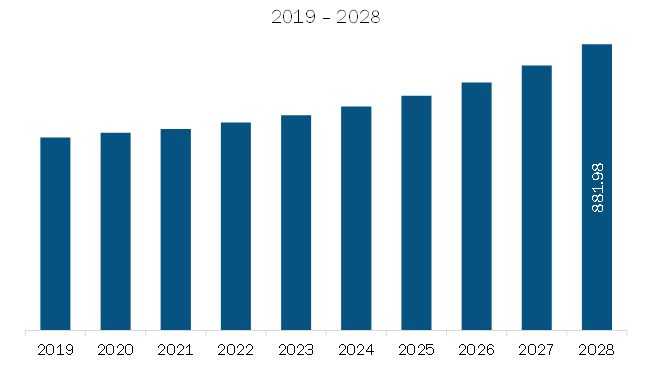

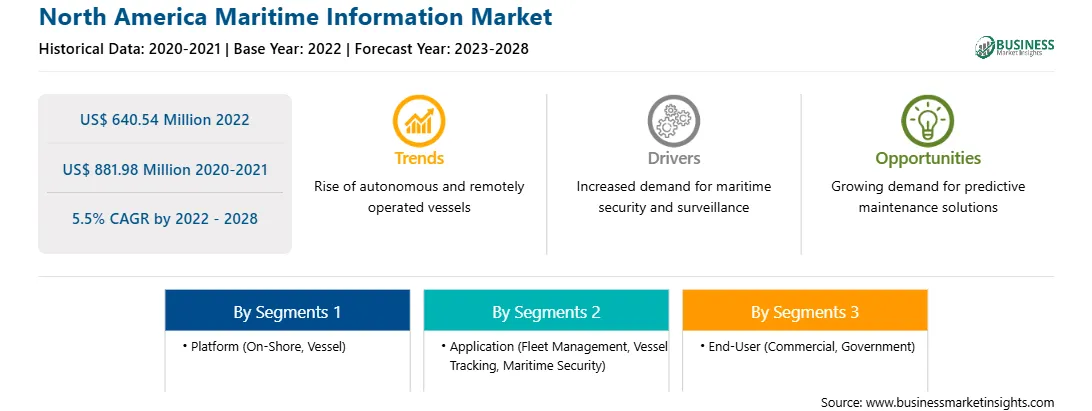

Market size in 2022

US$ 640.54 Million

Market Size by 2028

US$ 881.98 Million

Global CAGR (2022 - 2028)

5.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Platform

By Application

By End-User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Maritime Information Regional Insights

North America Maritime Information Market Segmentation

The North America maritime information market is segmented into platform, application, end-user, and country.

Based on platform, the North America maritime information market is bifurcated into on-shore and vessel. The vessel segment registered the larger market share in 2022.

Based on application, the North America maritime information market is segmented into fleet management, vessel tracking, and maritime security. The fleet management segment held the largest market share in 2022.

Based on end user, the North America maritime information market is bifurcated into commercial and government. The commercial segment held the larger market share in 2022.

Based on country, the North America maritime information market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

BAE Systems Plc; Fujitsu Limited; Iridium Communications Inc.; L3Harris Technologies Inc.; Lockheed Martin Corp; Northrop Grumman Corp; ONEOCEAN; ORBCOMM Inc.; Polestar; Saab AB; Siemens AG; Spire Global; Thales Group; and Windward Ltd are the leading companies operating in the North America maritime information market.

The North America Maritime Information Market is valued at US$ 640.54 Million in 2022, it is projected to reach US$ 881.98 Million by 2028.

As per our report North America Maritime Information Market, the market size is valued at US$ 640.54 Million in 2022, projecting it to reach US$ 881.98 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The North America Maritime Information Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Maritime Information Market report:

The North America Maritime Information Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Maritime Information Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Maritime Information Market value chain can benefit from the information contained in a comprehensive market report.