North America Manufacturing Execution System (MES) In Life Sciences Market

No. of Pages: 137 | Report Code: BMIRE00028424 | Category: Technology, Media and Telecommunications

No. of Pages: 137 | Report Code: BMIRE00028424 | Category: Technology, Media and Telecommunications

The pharmaceutical & medical device manufacturing industry is highly regulated, and non-compliance can lead to severe ramifications. In January 2023, the US District Court for the Southern District of Florida entered a consent decree of permanent injunction against LGM Pharma LLC, an importer and distributor of active pharmaceutical ingredients (API) used by the company’s customers to manufacture and/or compound finished drug products. The consent decree set a strict timetable for the firm to comply with current good manufacturing practice (cGMP) requirements under the Federal Food, Drug, and Cosmetics Act (FD&C Act). The decree allows the US Food and Drugs Administration (FDA) to take appropriate action, including ordering the company to cease receiving, labelling, holding, and/or distributing any or all drug substances, in the event the FD&C Act, its implementing regulations, or the consent decree is further violated. Again, in January 2023, the FDA issued a letter to Mohawk Laboratories (Division of NCH Corporation) stating that the consumer hand sanitizer manufactured at its Irving, Texas facility had impurities of acetaldehyde and acetal at unacceptable levels and hence violated Current Good Manufacturing Practice (cGMP) requirements. The FDA recommended engaging a consultant qualified as outlined in 21 CFR 211.34 to assist the company in meeting CGMP requirements. It further recommended that the consultant perform a comprehensive audit of the firm’s operation for CGMP compliance and evaluate the completion and efficacy of their corrective actions and preventive actions (CAPA) before the company pursues a resolution of compliance status with the FDA.

Manufacturing execution systems (MES) are solutions that aid pharmaceutical and medical device manufacturers to easily comply with such regulations while capturing details on each step of the manufacturing process. The FDA requires every medical device manufacturer to maintain Design History File (DHF) and Device History Records (DHR) to ensure that DHRs for each batch, lot, or unit can further help demonstrate that the device is manufactured as per the Device Master Record (DMR) and the requirements of this devices. DHR includes all the details pertinent to manufacturing a medical device, while DHF demonstrates the history of how the product was designed. The data was traditionally recorded on paper, which consisted of production travellers and other documentation. However, these paper-oriented processes expose companies to unnecessary risks, including in-process deviations and non-conformances, which can lead to product quality issues in the field. Modern MES have built-in features that enforce production processes and capture information associated with production records. Such integrations of features into the MES that ensure compliance with the regulatory framework boost the demand for MES in the pharmaceutical & medical device manufacturing industry.

The North America manufacturing execution system (MES) in life sciences market has been segmented into the US, Canada, and Mexico. North America is one of the developed regions. Pharmaceuticals, biotechnology, and many other industries in the region are known for the adoption of highly advanced technologies and automated operations. Pharmaceutical, medical device manufacturing, and biotechnology companies are implementing MES to improve the productivity and management of their production units. Companies such as Abbot, Baxter International, Genitope Corporation, and Merck & Co. Merck have implemented Elan’s MES software for improving the functionality of their production units, as well as for supporting factory automation. 10 years back, Terumo Americas implemented the MES—Camstar Medical Device Suite—in its cardiovascular division located in Ashland, Massachusetts. The aim was to streamline the overall quality and manufacturing process, improve productivity, and reduce nonconformance reports (NCRs) and complaints by 40–60%. In 2018, the company took a digital transformation initiative for the management of business logistics and manufacturing operations; under this, it selected SAP S/4HANA as an enterprise resource planning (ERP) system. Additionally, Terumo Americas selected Siemens as its strategic partner for manufacturing operations management (MOM), implementing Siemens Opcenter Execution, an evolved version of the Camstar solution. Moreover, MES solutions in the pharmaceuticals industry replace the conventional paper-based execution process, along with controlling, monitoring, and documenting the manufacturing process digitally in real time through the entire production cycle. MES maintains the effective flow of information between manufacturing systems and other departments, as well as facilitates the execution of production orders, quality check, machine status, and much more.

Strategic insights for the North America Manufacturing Execution System (MES) In Life Sciences provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Manufacturing Execution System (MES) In Life Sciences refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Manufacturing Execution System (MES) In Life Sciences Strategic Insights

North America Manufacturing Execution System (MES) In Life Sciences Report Scope

Report Attribute

Details

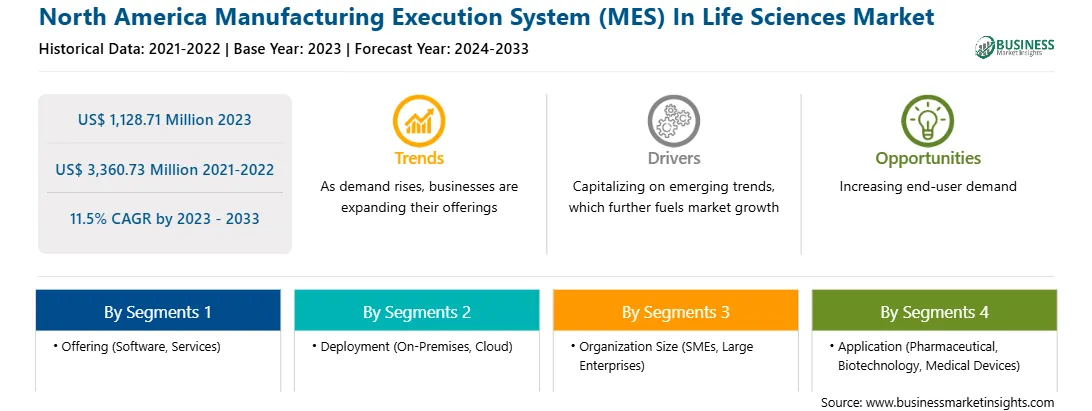

Market size in 2023

US$ 1,128.71 Million

Market Size by 2033

US$ 3,360.73 Million

Global CAGR (2023 - 2033)

11.5%

Historical Data

2021-2022

Forecast period

2024-2033

Segments Covered

By Offering

By Deployment

By Organization Size

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Manufacturing Execution System (MES) In Life Sciences Regional Insights

The North America manufacturing execution system in life sciences market is segmented into offering, deployment, organization size, application, and country.

Based on offering, the North America manufacturing execution system in life sciences market is segmented into software and services. The services segment held a larger share of the North America manufacturing execution system in life sciences market in 2023.

Based on deployment, the North America manufacturing execution system in life sciences market is segmented into on-premises and cloud. The cloud segment held a larger share of the North America manufacturing execution system in life sciences market in 2023.

Based on organization size, the North America manufacturing execution system in life sciences market is segmented into SMEs and large enterprises. The large enterprises segment held the largest share of the North America manufacturing execution system in life sciences market in 2023.

Based on application, the North America manufacturing execution system in life sciences market is segmented into pharmaceutical, biotechnology, and medical devices. The medical devices segment held the largest share of the North America manufacturing execution system in life sciences market in 2023.

Based on country, the North America manufacturing execution system in life sciences market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America manufacturing execution system in life sciences market in 2023.

Apprentice FS Inc; Atachi Systems; ATS Global B.V.; Emerson Electric Co; LZ Lifescience Limited; POMS Corporation; Rockwell Automation Inc; Schneider Electric SE; and Siemens AG are the leading companies operating in the North America manufacturing execution system in life sciences market.

The North America Manufacturing Execution System (MES) In Life Sciences Market is valued at US$ 1,128.71 Million in 2023, it is projected to reach US$ 3,360.73 Million by 2033.

As per our report North America Manufacturing Execution System (MES) In Life Sciences Market, the market size is valued at US$ 1,128.71 Million in 2023, projecting it to reach US$ 3,360.73 Million by 2033. This translates to a CAGR of approximately 11.5% during the forecast period.

The North America Manufacturing Execution System (MES) In Life Sciences Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Manufacturing Execution System (MES) In Life Sciences Market report:

The North America Manufacturing Execution System (MES) In Life Sciences Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Manufacturing Execution System (MES) In Life Sciences Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Manufacturing Execution System (MES) In Life Sciences Market value chain can benefit from the information contained in a comprehensive market report.