North America Manufacturing Execution System Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Software and Services), Deployment (Cloud and On-Premise), and Industry Type (Process Industry and Discrete Industry)

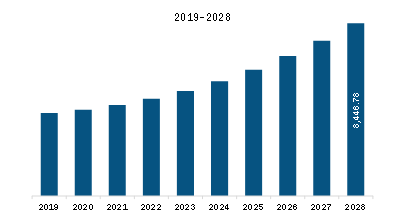

The North America manufacturing execution system market is expected to grow from US$ 4451.91 million in 2021 to US$ 8446.78 million by 2028; it is estimated to grow at a CAGR of 9.6% from 2021 to 2028.

The end-to-end industrial and manufacturing environment is intelligent, smart, and connected in recent business settings. New types of discrete and process manufacturing of sensors, connected objects, and smart machines have emerged and changed the ecosystem through the exchanges and collaborations among people, machines, data, and technologies. The modern digitalized plants helping smart manufacturing rely heavily on collecting, sorting, and analyzing data and information by extracting business values from the data. The manufacturing execution system (MES) provides a sustainable competitive benefit by assisting in the shifting production process in real-time on the basis of changes in the markets they serve. It encourages users to prepare a proactive strategic plan of the maintenance processes that decrease downtime. Efficient MES solutions decrease waste and overages, optimize inventory, lower manufacturing cycle time, improve customer service, and reduce setup costs. The growing adoption of Industry 4.0 has further underlined the need for advanced MES solutions. Industry 4.0 creates an interoperability platform for operations and information technology, enabling many equipment, products, and materials to communicate through embedded electronics. The MES manages and monitors work progress in a manufacturing facility. It delivers a strong base to build Industry 4.0 applications. Therefore, the growing usage of technology and automation in the manufacturing sector and the widespread adoption of Industry 4.0 are fueling the manufacturing execution system market growth.

With the latest features and technologies, vendors attract new customers to grow their footprints in emerging markets. This factor is likely to drive the weather monitoring system market. The North America manufacturing execution system market is expected to grow at a substantial CAGR during the forecast period.

North America Manufacturing Execution System Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

North America Manufacturing Execution System Market Segmentation

The North America manufacturing execution system market is segmented based on component, deployment, industry type, and country. Based on component, the North America manufacturing execution system market is segmented into software and services. The software segment dominated the market in 2020 and services segment is expected to be the fastest growing during the forecast period. Based on deployment, the North America manufacturing execution system market is segmented into cloud and on-premise. The on-premise segment dominated the market in 2020 and cloud segment is expected to be the fastest growing during the forecast period. Based on industry type, the North America manufacturing execution system market is segmented into process industry and discrete industry. The discrete industry segment dominated the market in 2020 and process industry is expected to be the fastest growing during the forecast period. Further process industry is segmented into food & beverages market, pulp & paper market, chemical market, energy & power market, pharmaceutical & life sciences market, and others. Likewise discrete industry is segmented into automotive market, aerospace & defense market, consumer packaged goods market, medical devices market, electronics & semiconductors market, and others. Based on country, the North America manufacturing execution system market is segmented into the US, Canada, and Mexico. 42Q; AVEVA Group plc; Dassault Systemes SE; Eazyworks Inc.; Emerson Electric Co.; General Electric Company; Honeywell International Inc.; Oracle Corporation; Rockwell Automation, Inc.; and SAP SE are among the leading companies in the North America manufacturing execution system market.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Manufacturing Execution System Market – By Component

1.3.2 North America Manufacturing Execution System Market – By Deployment Type

1.3.3 North America Manufacturing Execution System Market – By Industry Type

1.3.4 North America Manufacturing Execution System Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Manufacturing Execution System Market Landscape

4.1 Market Overview

4.2 Ecosystem Analysis

4.3 North America PEST Analysis

5. North America Manufacturing Execution System Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increasing Implementation of Technology and Automation in Manufacturing Sector

5.1.2 Rising Need for Adherence with Stringent Regulatory Compliances

5.2 Key Market Restraints

5.2.1 Expensive Implementation and Upgrading

5.3 Key Market Opportunities

5.3.1 High Degree of Integration with Other Solutions

5.4 Future Trends

5.4.1 Combination of Artificial Intelligence in MES Solutions

5.5 Impact Analysis of Drivers and Restraints

6. Manufacturing Execution System Market – North America Analysis

6.1 North America Manufacturing Execution System Market Overview

6.2 North America Manufacturing Execution System Market Forecast and Analysis

7. North America Manufacturing Execution System Market Analysis – By Component

7.1 Overview

7.2 North America Manufacturing Execution System Market Breakdown, By Component, 2020 & 2028

7.3 Software

7.3.1 Overview

7.3.2 Software Market Revenue and Forecasts to 2028 (US$ Mn)

7.4 Services

7.4.1 Overview

7.4.2 Services Market Revenue and Forecasts to 2028 (US$ Mn)

8. North America Manufacturing Execution System Market Analysis – By Deployment

8.1 Overview

8.2 North America Manufacturing Execution System Market Breakdown, By Deployment, 2020 & 2028

8.3 Cloud

8.3.1 Overview

8.3.2 Cloud Market Revenue and Forecasts to 2028 (US$ Mn)

8.4 On-Premise

8.4.1 Overview

8.4.2 On-Premise Market Revenue and Forecasts to 2028 (US$ Mn)

9. North America Manufacturing Execution System Market Analysis – By Industry Type

9.1 Overview

9.2 North America Manufacturing Execution System Market Breakdown, By Industry Type, 2020 & 2028

9.3 Process Industry

9.3.1 Overview

9.3.2 Process Industry Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.3 Food & Beverages

9.3.3.1 Overview

9.3.3.2 Food & Beverages Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.4 Pulp & Paper

9.3.4.1 Overview

9.3.4.2 Pulp & Paper Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.5 Chemical

9.3.5.1 Overview

9.3.5.2 Chemical Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.6 Energy & Power

9.3.6.1 Overview

9.3.6.2 Energy & Power Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.7 Pharmaceutical and Life Sciences

9.3.7.1 Overview

9.3.7.2 Pharmaceutical and Life Sciences Market Revenue and Forecasts to 2028 (US$ Mn)

9.3.8 Others

9.3.8.1 Overview

9.3.8.2 Others Market Revenue and Forecasts to 2028 (US$ Mn)

9.4 Discrete Industry

9.4.1 Overview

9.4.2 Discrete Industry Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.3 Automotive

9.4.3.1 Overview

9.4.3.2 Automotive Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.4 Aerospace & Defense

9.4.4.1 Overview

9.4.4.2 Aerospace & Defense Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.5 Consumer Packaged Goods

9.4.5.1 Overview

9.4.5.2 Consumer Packaged Goods Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.6 Medical Devices

9.4.6.1 Overview

9.4.6.2 Medical Devices Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.7 Electronics & Semiconductors

9.4.7.1 Overview

9.4.7.2 Electronics & Semiconductors Market Revenue and Forecasts to 2028 (US$ Mn)

9.4.7.3 Others

9.4.8 Overview

9.4.8.1 Others Market Revenue and Forecasts to 2028 (US$ Mn)

10. North America Manufacturing Execution System Market – Country Analysis

10.1 Overview

10.1.1 North America: Manufacturing Execution System Market, by Country

10.1.1.1 US Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

10.1.1.1.1 US: Manufacturing Execution System Market, by Component

10.1.1.1.2 US: Manufacturing Execution System Market, by Deployment

10.1.1.1.3 US: Manufacturing Execution System Market, by Industry Type

10.1.1.2 Canada Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

10.1.1.2.1 Canada: Manufacturing Execution System Market, by Component

10.1.1.2.2 Canada: Manufacturing Execution System Market, by Deployment

10.1.1.2.3 Canada: Manufacturing Execution System Market, by Industry Type

10.1.1.3 Mexico Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

10.1.1.3.1 Mexico: Manufacturing Execution System Market, by Component

10.1.1.3.2 Mexico: Manufacturing Execution System Market, by Deployment

10.1.1.3.3 Mexico: Manufacturing Execution System Market, by Industry Type

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 Merger and Acquisition

11.4 New Product Launches

12. Company Profiles

12.1Q

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 AVEVA Group plc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Dassault Systèmes SE

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Eazyworks Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Emerson Electric Co.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 General Electric Company

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Honeywell International Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Oracle Corporation

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 SAP SE

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Rockwell Automation, Inc.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Manufacturing Execution System Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. US: Manufacturing Execution System Market, by Component –Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Manufacturing Execution System Market, by Deployment –Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Manufacturing Execution System Market, by Industry Type –Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Manufacturing Execution System Market, by Component –Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Manufacturing Execution System Market, by Deployment –Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Manufacturing Execution System Market, by Industry Type –Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico: Manufacturing Execution System Market, by Component –Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico: Manufacturing Execution System Market, by Deployment –Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico: Manufacturing Execution System Market, by Industry Type –Revenue and Forecast to 2028 (US$ Million)

Table 11. Glossary of Term

LIST OF FIGURES

Figure 1. North America Manufacturing Execution System Market Segmentation

Figure 2. North America Manufacturing Execution System Market Segmentation – By Country

Figure 3. North America Manufacturing Execution System Market Overview

Figure 4. Software Segment Held the Largest Market Share of the Market in 2020

Figure 5. The US Held the Largest Market Share of the Market in 2020

Figure 6. North America Manufacturing Execution System Market Ecosystem Analysis

Figure 7. North America PEST Analysis

Figure 8. North America Manufacturing Execution System Market Impact Analysis of Drivers and Restraints

Figure 9. North America Manufacturing execution system Market Forecast and Analysis, (US$ Mn)

Figure 10. North America Manufacturing Execution System Market Breakdown by Component, 2020 & 2028 (%)

Figure 11. North America Software Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 12. North America Services Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 13. North America Manufacturing execution system Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 14. North America Cloud Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 15. North America On-Premise Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 16. North America Manufacturing execution system Market Breakdown, By Industry Type, 2020 & 2028 (%)

Figure 17. North America Process Industry Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 18. North America Food & Beverages Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 19. North America Pulp & Paper Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 20. North America Chemical Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 21. North America Energy & Power Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 22. North America Pharmaceutical and Life Sciences Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 23. North America Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 24. North America Discrete Industry Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 25. North America Automotive Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 26. North America Aerospace & Defense Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 27. North America Consumer Packaged Goods Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 28. North America Medical Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 29. North America Electronics & Semiconductors Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 30. North America Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 31. North America Manufacturing Execution System Market, by Key Country – Revenue (2020) (US$ Million)

Figure 32. North America: Manufacturing Execution System Market Revenue Share, by Country (2020 and 2028)

Figure 33. US Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

Figure 34. Canada Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

Figure 35. Mexico Manufacturing Execution System Market Revenue and Forecast To 2028 (US$ Mn)

- 42Q

- AVEVA Group plc

- Dassault Systemes SE

- Eazyworks Inc.

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Oracle Corporation

- Rockwell Automation, Inc.

- SAP SE

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America manufacturing execution system market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America manufacturing execution system market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving manufacturing execution system market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution