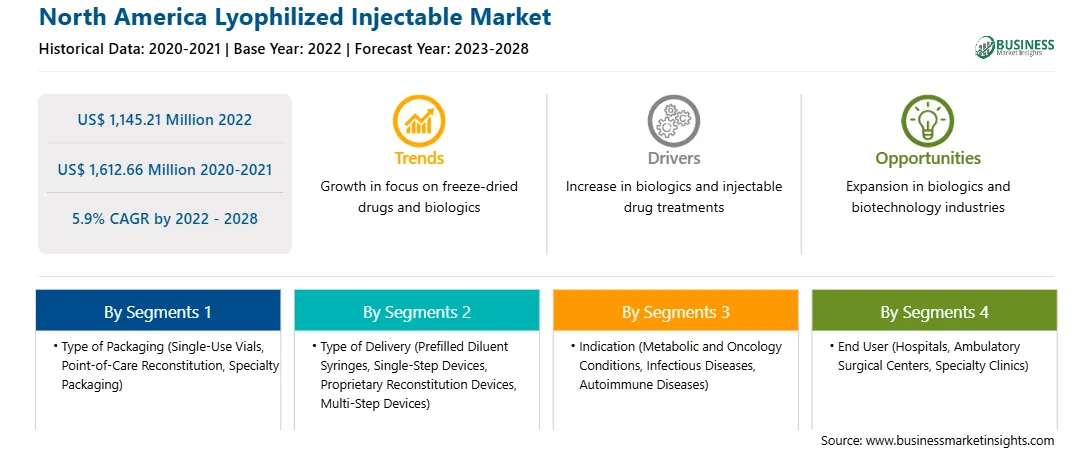

The North America lyophilized injectable market is expected to grow from US$ 1,145.21 million in 2022 to US$ 1,612.66 million by 2028. It is estimated to grow at a CAGR of 5.9% from 2022 to 2028.

Increasing Demand for Biologics

The supply of numerous biologics in a liquid form is not possible. Pharmaceutical organizations may also have concerns that the pharmacodynamic and pharmacokinetic properties of certain biologics in a liquid stable format may diminish over time. The supply of biologics and other drugs is done in a lyophilized or powder form requiring reconstitution at the point of delivery, which is the only feasible pathway for the product's commercial launch. A significant boom has been witnessed in the contract manufacturing of biologics. This can be attributed to difficulties in the production of large-scale biologics in-house. There is a need to scale up the production once novel technologies get approved—for instance, the manufacturing of CAR-T therapy. With more biological products and biosimilars entering the market, the competition within the biopharmaceutical sector is becoming fierce. Biologics manufacturers strive to reduce manufacturing costs, deliver high-quality drugs, improve process efficiency, and accelerate market entry. CMOs can adapt as per requirement, help in process innovation, and improve operational efficiency. As the pharmaceutical industry is shifting from large-scale production to more niche and targeted therapies (personalized medicine), the demand for flexible operational capabilities, production scales, and multiple-product operations is offering significant advantages to CMOs. Moreover, many companies are opting for CMO services to speed up the development process and lower production costs. Thus, the importance of lyophilization in the successful delivery of biologics boosts the use of lyophilized injectables, thereby driving the market across the region.

Market Overview

The North America lyophilized injectable market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022. The market's growth is attributed to growing healthcare expenditure, increasing production of generic pharmaceuticals, and growing government support to enhance pharmaceutical and biopharmaceutical industries. In addition, the growing incidence of chronic and acute diseases has led to the growth of the market indirectly. The supportive environment backs the development and commercialization of pharmaceutical and biopharmaceutical products. As per the International Trade Administration (ITA), the US is the biggest biopharmaceutical market, accounting for about a third of the global market, and is the dominant country in biopharmaceutical R&D. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), the US firms conduct over half the world's R&D in pharmaceuticals (US$ 75 billion) and hold the intellectual property rights on most new medicines. Market players are adopting strategies such as partnerships, collaborations, and mergers & acquisitions to expand the market. For instance, in August 2022, Curia announced that it had completed the transaction to acquire Integrity Bio, Inc., a privately held formulation and fill-finish organization headquartered in Camarillo, California. Similarly, in October 2020, Credence MedSystems and SCHOTT AG collaborated on the application of Credence Companion technology with SCHOTT's pre-fillable syriQ glass and SCHOTT TOPPAC polymer syringe systems. The two companies will work together to integrate the technologies and provide the pharmaceutical industry with an innovative and differentiated offering for the delivery of injectable medications via prefilled syringes. Thus, the growing pharmaceutical and biopharmaceutical industries has broadened the market's growth opportunities. The changing health conditions and requirements are the factors that continually demand newer products.

North America Lyophilized Injectable Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Lyophilized Injectable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Lyophilized Injectable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Lyophilized Injectable Strategic Insights

North America Lyophilized Injectable Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,145.21 Million

Market Size by 2028

US$ 1,612.66 Million

Global CAGR (2022 - 2028)

5.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type of Packaging

By Type of Delivery

By Indication

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Lyophilized Injectable Regional Insights

North America Lyophilized Injectable Market Segmentation

The North America lyophilized injectable market is segmented based on type of packaging, type of delivery, indication, end user, and country.

Aristopharma Ltd.; Baxter; CordenPharma International; Credence MedSystems, Inc.; Curia Global, Inc.; Jubilant HollisterStier (Jubilant Pharma Limited); Nipro; Recipharm AB; S.G. Biopharm Pvt. Ltd.; and Vetter Pharma are among the leading companies operating in the North America lyophilized injectable market.

The North America Lyophilized Injectable Market is valued at US$ 1,145.21 Million in 2022, it is projected to reach US$ 1,612.66 Million by 2028.

As per our report North America Lyophilized Injectable Market, the market size is valued at US$ 1,145.21 Million in 2022, projecting it to reach US$ 1,612.66 Million by 2028. This translates to a CAGR of approximately 5.9% during the forecast period.

The North America Lyophilized Injectable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Lyophilized Injectable Market report:

The North America Lyophilized Injectable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Lyophilized Injectable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Lyophilized Injectable Market value chain can benefit from the information contained in a comprehensive market report.