Lyophilization is a freeze-drying method that removes water from the material to extend its shelf life and stability. The products processed under lyophilization are frozen under high vacuum and are majorly used in pharmaceutical industries to manufacture high-quality and affordable products. Many new parenteral products, including biotechnology-derived products, in-vitro diagnostics, and anti-infectives, are manufactured as lyophilized products. The lyophilization process makes antibiotics such as cephalosporins, semi-synthetic penicillin, erythromycin salts, chloramphenicol, and doxycycline. Low bioburden is expected when batching antibiotics formulations, which can be attained using lyophilization. Similarly, a few other dosage forms such as methylprednisolone sodium succinate, hydrocortisone sodium succinate, and many biotechnology-derived products are lyophilized.

Over 10 novel biologics have been approved annually by the US Food and Drug Administration (FDA) in the last few years. According to the data published by FDA in February 2022, biologics continue to account for slightly more than 25% of all drugs accepted by the FDA. Most of these products are not stable as aqueous formulations, making it challenging to preserve them for longer durations. Thus, lyophilization is preferred for making dry biopharmaceutical formulations to achieve longer and commercially viable shelf lives. According to the data published by Lubrizol Life Science, in October 2019, over 60% of biologics production in the market would not be possible without lyophilization, and market demand for lyophilization technology will increase due to the growing biosimilars and novel biologics development. The method proves beneficial when there is a stability issue while providing exact biologics dosage (for instance, very small and highly concentrated doses). Furthermore, it is suitable for biologics sensitive to heat, oxygen, and humidity. Further, lyophilization has become important in the biotech industry, as several suppliers are introducing lyo-ready or pre-lyophilized products to the marketplace. As a result, the demand for lyophilization services is growing rapidly, driving the growth of the lyophilization services for biopharmaceuticals market.

The lyophilization services for biopharmaceuticals market in North America is further segmented into the US, Canada, and Mexico. The US held the largest share of the North America lyophilization services for biopharmaceuticals market in 2022. The market growth in the US is attributed to factors such as extensive research and development activities, advanced manufacturing of innovative biopharmaceutical and pharmaceutical products. Likewise, the significant growth of the biopharmaceutical industry in Canada and increasing investment by international companies are likely to accelerate the market growth at a faster pace. The growing biopharmaceutical industry in the US, Canada, and Mexico is generating job opportunities across the countries.

Strategic insights for the North America Lyophilization Services for Biopharmaceuticals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Lyophilization Services for Biopharmaceuticals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Lyophilization Services for Biopharmaceuticals Strategic Insights

North America Lyophilization Services for Biopharmaceuticals Report Scope

Report Attribute

Details

Market size in 2023

US$ 974.05 Million

Market Size by 2028

US$ 1,587.77 Million

Global CAGR (2023 - 2028)

10.3%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Service Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Lyophilization Services for Biopharmaceuticals Regional Insights

North America Lyophilization Services for Biopharmaceuticals Market Segmentation

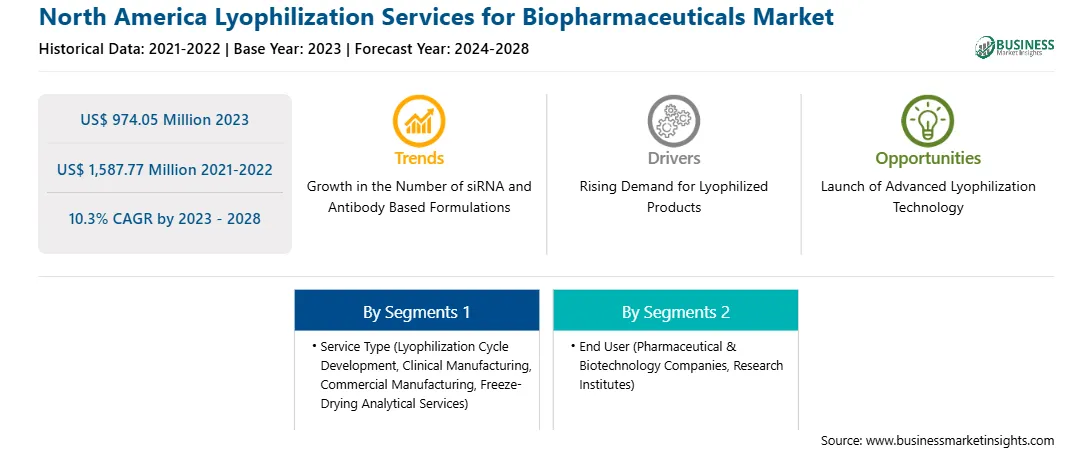

The North America lyophilization services for biopharmaceuticals market is segmented into service type, end user, and country.

Based on service type, the North America lyophilization services for biopharmaceuticals market is segmented into lyophilization cycle development, clinical manufacturing, commercial manufacturing, and freeze drying analytical services. The commercial manufacturing segment held the largest share of the North America lyophilization services for biopharmaceuticals market in 2023.

Based on end user, the North America lyophilization services for biopharmaceuticals market is segmented into pharmaceutical & biotechnology companies, research institutes, and others. The pharmaceutical & biotechnology companies segment held the largest share of the North America lyophilization services for biopharmaceuticals market in 2023.

Based on country, the North America lyophilization services for biopharmaceuticals market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America lyophilization services for biopharmaceuticals market in 2023.

ATTWILL Medical Solutions; Axcellerate Pharma LLC; Berkshire Sterile Manufacturing; Curia Global Inc; Emergent BioSolutions Inc; Jubilant HollisterStier LLC.; Labyrinth BioPharma LLC; Lyophilization Technology, Inc.; and PCI Pharma Services are the leading companies operating in the North America lyophilization services for biopharmaceuticals market.

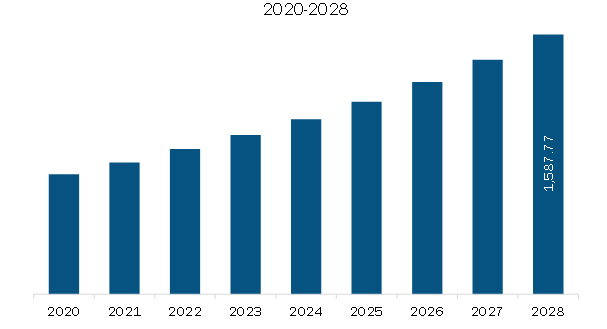

The North America Lyophilization Services for Biopharmaceuticals Market is valued at US$ 974.05 Million in 2023, it is projected to reach US$ 1,587.77 Million by 2028.

As per our report North America Lyophilization Services for Biopharmaceuticals Market, the market size is valued at US$ 974.05 Million in 2023, projecting it to reach US$ 1,587.77 Million by 2028. This translates to a CAGR of approximately 10.3% during the forecast period.

The North America Lyophilization Services for Biopharmaceuticals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Lyophilization Services for Biopharmaceuticals Market report:

The North America Lyophilization Services for Biopharmaceuticals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Lyophilization Services for Biopharmaceuticals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Lyophilization Services for Biopharmaceuticals Market value chain can benefit from the information contained in a comprehensive market report.