North America Luxury Vinyl Tiles (LVT) Flooring Market

No. of Pages: 120 | Report Code: BMIRE00030927 | Category: Chemicals and Materials

No. of Pages: 120 | Report Code: BMIRE00030927 | Category: Chemicals and Materials

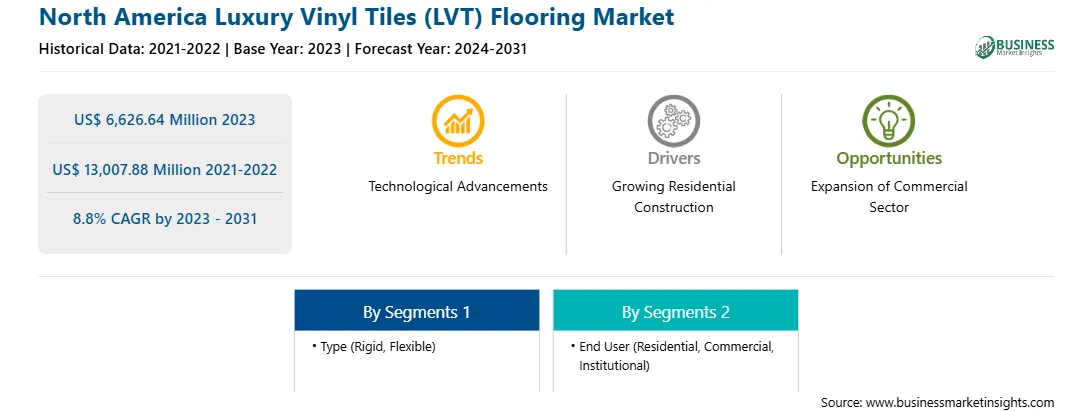

The North America luxury vinyl tiles (LVT) flooring market was valued at US$ 6,626.64 million in 2023 and is expected to reach US$ 13,007.88 million by 2031; it is estimated to register at a CAGR of 8.8% from 2023 to 2031.

Improved printing technologies have allowed for more realistic and intricate designs, enhancing the aesthetic appeal and making luxury vinyl tiles (LVT) flooring a more attractive option for consumers seeking the look of natural materials such as wood or stone. This innovation opens up new market segments, such as high-end residential properties and design-conscious commercial spaces, where the visual impact of flooring plays a crucial role.

The integration of enhanced performance features such as waterproofing and scratch resistance significantly broadens the applications of luxury vinyl tiles (LVT) flooring. Waterproof luxury vinyl tiles (LVT) allow for installation in moisture-prone areas such as kitchens, bathrooms, and basements, where traditional flooring options, including hardwood or laminate, may not be suitable. This expansion into previously untapped segments of the market increases the versatility and appeal of luxury vinyl tiles (LVT), further driving its demand in both residential and commercial sectors.

The incorporation of scratch-resistant properties enhances the durability and longevity of luxury vinyl tiles (LVT) flooring, making it ideal for high-traffic areas in commercial settings such as retail stores, restaurants, and healthcare facilities. This enhanced durability not only reduces maintenance costs but also extends the lifespan of the flooring, providing long-term value to customers.

Luxury vinyl tiles (LVT) flooring market in North America is segmented into the US, Canada, and Mexico. The luxury vinyl tiles (LVT) flooring market in North America has experienced significant growth and evolution in recent years, driven by factors including growing residential construction and renovation, technological advancements, changing consumer preferences, and the growing demand for durable, aesthetically pleasing flooring solutions. For instance, according to the US Census Bureau and HUD, ~1,470,000 building permits were issued for privately owned construction, which is 8.6% above the January 2023 number of permits issued. LVT flooring has emerged as a popular choice among homeowners, architects, and interior designers due to its numerous advantages over traditional flooring options.

The key driver behind the growth of the LVT flooring market in North America is its ability to replicate the look and feel of natural materials such as hardwood, stone, and ceramic tiles at a fraction of the cost. This has made LVT flooring an attractive option for budget-conscious consumers who economically desire the elegance and sophistication of high-end flooring materials. Additionally, advancements in manufacturing technologies have led to the development of LVT flooring products that offer superior durability, water resistance, and easy maintenance, making them ideal for use in high-traffic areas such as kitchens, bathrooms, and commercial spaces. This has further fueled the demand for LVT flooring in North America, particularly among homeowners and businesses seeking long-lasting, low-maintenance flooring solutions. For instance, the value of new residential construction projects in the US was an estimated US$ 986.72 billion in 2023, a 12% increase from 2023. Furthermore, the increasing focus on sustainability and environmental consciousness has prompted manufacturers to produce LVT flooring using eco-friendly materials and processes. Many LVT flooring products now feature recycled content and are certified as low emission, contributing to their appeal among environmentally conscious consumers.

Strategic insights for the North America Luxury Vinyl Tiles (LVT) Flooring provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Luxury Vinyl Tiles (LVT) Flooring refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.-flooring-market-img1.png)

North America Luxury Vinyl Tiles (LVT) Flooring Strategic Insights

North America Luxury Vinyl Tiles (LVT) Flooring Report Scope

Report Attribute

Details

Market size in 2023

US$ 6,626.64 Million

Market Size by 2031

US$ 13,007.88 Million

Global CAGR (2023 - 2031)

8.8%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Luxury Vinyl Tiles (LVT) Flooring Regional Insights

The North America luxury vinyl tiles (LVT) flooring market is segmented based on type, end user, and country.

Based on type, the North America luxury vinyl tiles (LVT) flooring market is bifurcated into rigid and flexible. The rigid segment held a larger share in 2023.

In terms of end user, the North America luxury vinyl tiles (LVT) flooring market is segmented into residential, commercial, and institutional. The residential segment held the largest share in 2023.

Based on country, the North America luxury vinyl tiles (LVT) flooring market is categorized into the US, Canada, and Mexico. The US dominated the North America luxury vinyl tiles (LVT) flooring market in 2023.

Wedge Industries Ltd; Mohawk Industries, Inc.; Tarkett; Shaw Industries Group, Inc.; Interface Inc; AWI Licensing, LLC; Gerflor Group; Congoleum; Mannington Mills, Inc.; and Forbo Holding AG are some of the leading companies operating in the North America luxury vinyl tiles (LVT) flooring market.

The North America Luxury Vinyl Tiles (LVT) Flooring Market is valued at US$ 6,626.64 Million in 2023, it is projected to reach US$ 13,007.88 Million by 2031.

As per our report North America Luxury Vinyl Tiles (LVT) Flooring Market, the market size is valued at US$ 6,626.64 Million in 2023, projecting it to reach US$ 13,007.88 Million by 2031. This translates to a CAGR of approximately 8.8% during the forecast period.

The North America Luxury Vinyl Tiles (LVT) Flooring Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Luxury Vinyl Tiles (LVT) Flooring Market report:

The North America Luxury Vinyl Tiles (LVT) Flooring Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Luxury Vinyl Tiles (LVT) Flooring Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Luxury Vinyl Tiles (LVT) Flooring Market value chain can benefit from the information contained in a comprehensive market report.