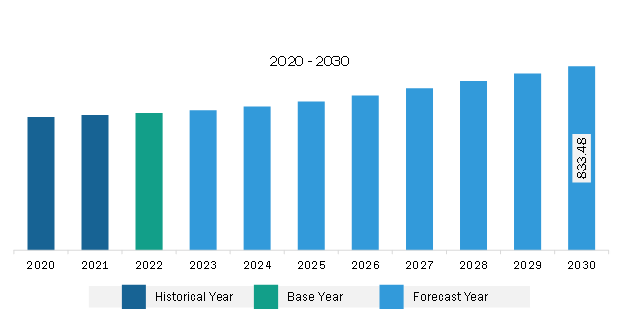

The North America lubricating grease market was valued at US$ 621.87 million in 2022 and is expected to reach US$ 833.48 million by 2030; it is estimated to register a CAGR of 3.7% from 2022 to 2030.

Lubricating grease is an essential component in the automotive sector, serving a multitude of critical applications to ensure the smooth operation and longevity of various vehicle components. The widespread use of lubricating grease in automotive bearings, chassis components, and other moving parts to reduce friction, minimize wear, and enhance overall performance is a significant contributor to the market growth. Additionally, advancements in automotive technologies, such as electric vehicles and sophisticated drivetrain systems, have fueled the demand for specialized lubricating greases. These innovations often involve components that require lubricants to withstand higher temperatures and extreme pressure and offer superior protection. Lubricating grease, formulated to meet these specific requirements, is essential for supporting the evolving needs of the automotive industry.

As the global automotive sector undergoes a transformative shift toward electrification, lubricating grease is becoming crucial for ensuring the optimal functioning and longevity of various components within electric vehicles. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022. In September 2021, Ford, an American multinational automobile manufacturer, announced its plans to invest US$ 11.4 billion in electric vehicle plants. Lubricating grease is essential for the proper functioning of components such as bearings, gears, and sliding surfaces within electric vehicles. They are also used in other electric vehicle components, such as wheel bearings, suspension systems, and other moving parts. The increasing production of electric vehicles has encouraged lubricating grease manufacturers to develop specialized formulations that address the unique requirements of electric drivetrains and associated components. For instance, in June 2021, Castrol announced the launch of the Castrol ON range of e-fluids for electric mobility. The electric drivetrain's high-speed and high-torque characteristics require lubricants capable of handling increased stress and heat generation. Lubricating greases tailored for electric vehicles are formulated to withstand these challenging conditions, providing effective lubrication and heat dissipation to ensure the longevity of critical components.

The continuous growth and technological evolution of the automotive sector drive the demand for specialized greases. The automotive industry is a significant consumer and a catalyst for innovation and advancements in the North America lubricating grease market. As the automotive industry continues to expand and evolve, lubricating grease plays a vital role in supporting the reliability, efficiency, and longevity of vehicles. Thus, all these factors positively influence market growth.

North America holds extensive growth opportunities for lubricating grease manufacturers owing to the increasing demand for grease from end-use industries such as construction, automotive, aerospace, and mining. Lubricating grease is primarily used to enhance performance and increase the life span of engines and machinery. The construction industry is flourishing in North America due to government investments in residential construction projects and increasing renovation activities. Lubricating grease also enhances the performance of machines and components used in the construction industry.

In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022. As the automotive sector expands, there is a parallel increase in the demand for lubricating grease, which are essential for ensuring the smooth functioning and longevity of various automotive components. These greases are extensively used in critical areas such as wheel bearings, chassis, and other moving parts within vehicles. As the automotive industry continues to evolve and innovate, these high-performance materials are increasingly gaining traction, thereby contributing to market growth.

A rise in the number of wind turbine installations owing to the increased demand for renewable energy is expected to create lucrative opportunities for lubricating grease market players. According to the Office of Energy Efficiency & Renewable Energy, the US wind industry installed 13,413 megawatts (MW) of new wind capacity in 2021. Greases are used to protect critical components such as the main shaft, yaw, pitch, and generator bearing from extreme weather conditions and other contaminants in the wind power industry.

Grease are used in aerospace applications for the lubrication of aircraft bearings, engine accessories, slides, and joints to protect them from corrosion and extreme conditions. Governments of countries in North America have significantly invested in technology and research programs in the aerospace sector. The region is a hub for major aircraft manufacturing companies such as Raytheon Technologies Corporation, Boeing, and Lockheed Martin Corporation. Therefore, increasing manufacturing activities in the aerospace industry further boosts the demand for lubricating grease in North America.

Strategic insights for the North America Lubricating Grease provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Lubricating Grease refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Lubricating Grease Strategic Insights

North America Lubricating Grease Report Scope

Report Attribute

Details

Market size in 2022

US$ 621.87 Million

Market Size by 2030

US$ 833.48 Million

Global CAGR (2022 - 2030)

3.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Base Oil

By Thickener Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Lubricating Grease Regional Insights

The North America lubricating grease market is categorized into base oil, thickener type, end-use industry, and country.

Based on base oil, the North America lubricating grease market is segmented mineral oil, synthetic oil, and bio-based. The mineral oil segment held the largest market share in 2022. The synthetic oil segment is further sub segmented into polyalkylene glycol, polyalphaolefin, and esters.

In terms of thickener type, the North America lubricating grease market is categorized into lithium, lithium complex, polyurea, calcium sulfonate, anhydrous calcium, aluminum complex, and others. The lithium segment held the largest market share in 2022.

By end-use industry, the North America lubricating grease market is segmented into conventional vehicles, electric vehicles, building & construction, mining, marine, food, energy & power, and others. The conventional vehicles segment held the largest market share in 2022.

By country, the North America lubricating grease market is bifurcated into the US, Canada, and Mexico. The US dominated the North America lubricating grease market share in 2022.

Exxon Mobil Corp, Fuchs SE, Petroliam Nasional Bhd, Shell Plc, Kluber Lubrication GmbH & Co KG, TotalEnergies SE, BP Plc, Chevron Corp, Valvoline Inc, and Axel Christiernsson AB are some of the leading companies operating in the North America lubricating grease market.

The North America Lubricating Grease Market is valued at US$ 621.87 Million in 2022, it is projected to reach US$ 833.48 Million by 2030.

As per our report North America Lubricating Grease Market, the market size is valued at US$ 621.87 Million in 2022, projecting it to reach US$ 833.48 Million by 2030. This translates to a CAGR of approximately 3.7% during the forecast period.

The North America Lubricating Grease Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Lubricating Grease Market report:

The North America Lubricating Grease Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Lubricating Grease Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Lubricating Grease Market value chain can benefit from the information contained in a comprehensive market report.