North America is one of the significant markets for LNG storage tank providers, owing to the presence of major liquefied natural gas manufacturers such as Cheniere Energy, Royal Dutch Shell, and Total. Countries in North America have gradually boosted their LNG export capability. For instance, the United States of America's LNG export capacity expanded from less than 1 billion cubic feet per day (Bcf/d) in 2016 to ~9 billion cubic feet per day (Bcf/d) by the end of 2019. In 2019, U.S. LNG shipments to 38 nations set a new high of around 1,819 Bcf, accounting for 39% of total US natural gas exports. LNG storage tank producers such as Lockheed Martin, McDermott, and Bechtel Corporation are benefiting from the increasing trade of LNG across the continent.

Further, the shipping sector has already begun investing in the LNG market and expects to do so in the future owing to increasing availability of natural gas in the US. Domestic shipyards have developed or are amid developing LNG-transporting assets. For instance, Conrad Shipyard in Orange, Texas, built the first LNG bunker barge in North America in 2018. In addition, VT Halter is also working on a 4,000 cubic meter LNG Articulated Tug And Barge (ATB) and has signed a letter of intent to build an 8,000 cubic meter version of the vessel. LNG technology, which is currently in use at American shipyards, has been scaled up to meet customer requests, resulting in a burgeoning market for LNG storage tanks.

Owing to favorable government policies to boost innovation and reinforce infrastructure capabilities, North America have the highest acceptance and development rate of emerging technologies. Any impact on industries is therefore projected to have a negative influence on the region's economic development. Currently, due to the COVID-19 outbreak, the US is the world's worst affected country, thus affecting the sudden stands still across all the industries present in the region. In North America, especially the US, witnessed an unprecedented rise in number of COVID cases, which disrupted its LNG trade activities in the oil & gas sector and subsequently impacted the demand for LNG storage tank in 2020 and is expected to continue in 2021. Additionally, as per the US Energy Information Administration (EIA) due to COVID-19, ~175 US LNG cargoes were cancelled in October 2020, out of which around 80% of the LNG cargoes cancelled, which are scheduled for the summer months. The EIA anticipated that demand of LNG will slowly increase by the end of 2021. Moreover, the considerable decline in overall global gas prices further restricted the oil & gas related projects and other activities that negatively influenced the demand for LNG storage tank. Similar trend was witnessed in other North American countries such as Canada and Mexico. However, the countries are expected to overcome the swift drop in demand as the countries continue to open their economic activities especially in the recent months for revival of business activities. However, the demand for the same could not be catered by the country due to the temporary shutdown of transportation facilities across the region, which has negatively hindered the LNG trade cross-border. Thus, owing to the above-mentioned factors, LNG storage tank market is said to be negatively affected owing to the outbreak of the COVID-19 across the region.

Strategic insights for the North America LNG Storage Tank provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

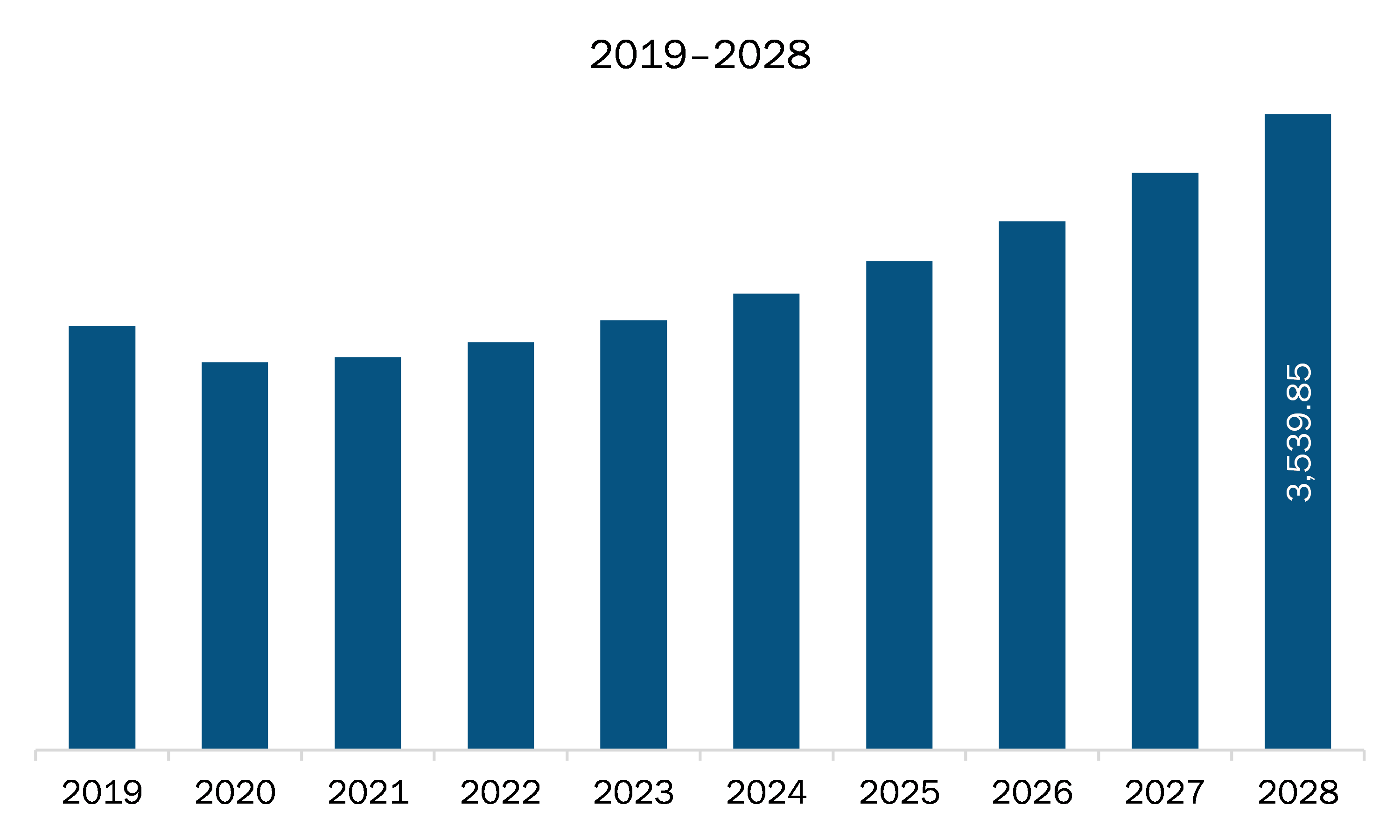

| Market size in 2021 | US$ 2,816.14 Million |

| Market Size by 2028 | US$ 3,539.85 Million |

| Global CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Configuration

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America LNG Storage Tank refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The LNG storage tank market in North America is expected to grow from US$ 2,816.14 million in 2021 to US$ 3,539.85 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. The mounting readiness of liquefied natural gas (LNG) offers access to least carbon-intensive hydrocarbon The floating storage and regasification units (FSRU) terminal plays a significant role in the LNG value chain, developing the interface between the local gas supply infrastructure and the LNG carriers. The FSRU is convenient, adaptable, and avails natural gas to the market faster than land-based installations. The FSRU vessels are installed on ships or offshore, depending upon the design they integrate. The FSRUs are being equipped in two different ways: it is fitted either as an old gas carrier that can easily be converted into an independent unit placed in an offshore installation or installed as a separate unit aboard the LNG carrier itself. When the FSRU unit is installed in the ship, its construction is like other LNG ships undergoing LNG trading operation with regular dry-docking and complying with all the required international marine safety standards. The significant advantage of such installation is that the heating and liquefaction process is carried out within the vessel rather than unloading the fuel in its semi-frozen slushy state. Thus, the increasing application of FSRU is creating a massive opportunity for the growth of the LNG storage tanks market.

The North America LNG storage tank market is segmented on the bases of configuration, type, material, and country. Based on configuration the North America LNG storage tank market is segmented into self-supporting tank and non-self-supporting tank. The self-supporting tank segment is the most used configuration in the LNG storage tanks market in 2020. Based on type, the market is segmented into LNG carrier, and LNG fuelled vessel. LNG carrier segment held the largest market share in 2020. Similarly, based on materials, the market is segmented into stainless steel, aluminum alloy, 9% nickel steel, invar alloy, C-MN steel, others. Stainless steel segment held the largest market share in 2020. Based on country the North America LNG storage tank market is segmented Into US, Canada, and Mexico.

A few major primary and secondary sources referred to for preparing this report on the LNG storage tank market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Air Water Inc.; Chart Industries, Inc.; CIMC Enric Holding Ltd.; Cryolor; IHI Corporation; India Inox Pvt. Ltd.; ISISAN AS; Linde Plc; and Wartsila Corporation.

The North America LNG Storage Tank Market is valued at US$ 2,816.14 Million in 2021, it is projected to reach US$ 3,539.85 Million by 2028.

As per our report North America LNG Storage Tank Market, the market size is valued at US$ 2,816.14 Million in 2021, projecting it to reach US$ 3,539.85 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The North America LNG Storage Tank Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America LNG Storage Tank Market report:

The North America LNG Storage Tank Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America LNG Storage Tank Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America LNG Storage Tank Market value chain can benefit from the information contained in a comprehensive market report.