North America Land Survey Equipment Market

No. of Pages: 137 | Report Code: BMIRE00027690 | Category: Electronics and Semiconductor

No. of Pages: 137 | Report Code: BMIRE00027690 | Category: Electronics and Semiconductor

Use of Unmanned Aerial Vehicles (UAVs) and Remote-Control Drones

The use of unmanned aerial vehicles (UAVs) and remote-control drones is increasing in the mapping and surveying professions. These technologies have many potential applications within several sectors related to land surveys, agriculture, and environmental monitoring. With the help of drones and UAVs, surveyors can get their data precisely and quickly. UAVs and drones are safer as it eliminates the requirement of manpower to enter dangerous environments for measurements. With the help of these technologies, surveyors can access areas that are inaccessible to humans. UAVs combines photogrammetry, 3D mapping, land surveys, topographic surveying, etc. However, legal permission must be taken from the respective authority before using UAVs and drones by the surveyors. There are a few challenges associated with using drones and UAVs for a survey, such as pilot training for the operator and its assessment, keeping up with regulations for the operation, and providing professional output to the customer. If surveyors overcome these challenges, the use of UAVs and drones is expected to become a trend in the land survey equipment market across the region.

Market Overview

The North America land survey equipment market is bifurcated into the US and Mexico. According to the US Census Bureau and the Department of Housing and Urban Development, in 2021, ~762,000 new homes were sold in the US, most of which were single-family houses. The land survey equipment market growth in North America depends on several factors, such as the growing real estate business in the US and Mexico, the usage of advanced construction software, the dependency on agriculture, and the development of automobiles that increased traffic and led to new road developments. For instance, according to a report published by World Highways in June 2022, a highway is under construction in Mexico, which is expected to be completed by December 2022. This highway will connect Guadalupe y Calvo with Badiraguato and provide a link between Chihuahua State and Sinaloa State. Due to the presence of mountainous topography, the 140km highway construction was challenging and will cost ~US$ 117 million until its completion. Out of 140 km, ~13km of highway construction is still pending. Such infrastructure development requires land survey equipment to calculate area, route, location, site planning, etc. Further, the US is one of the leading countries in the land survey equipment market due to the high consumption of land survey equipment that led to increased production by several leading market players such as Allenbuild Instruments. Moreover, rising technological advancements leading to increased production and research & development activities are a few factors supporting the land survey equipment market growth. With the growing demand for land survey equipment in North America, the land survey equipment market is expected to grow during the forecast period.

Strategic insights for the North America Land Survey Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Land Survey Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Land Survey Equipment Strategic Insights

North America Land Survey Equipment Report Scope

Report Attribute

Details

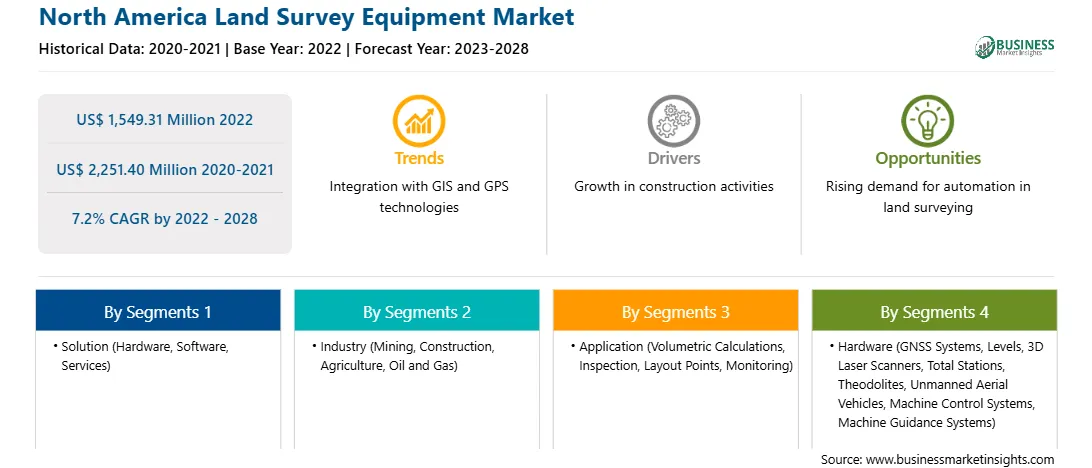

Market size in 2022

US$ 1,549.31 Million

Market Size by 2028

US$ 2,251.40 Million

Global CAGR (2022 - 2028)

7.2%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Solution

By Industry

By Application

By Hardware

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Land Survey Equipment Regional Insights

North America Land Survey Equipment Market Segmentation

The North America land survey equipment market is segmented based on solution, industry, application, hardware, and country.

Hexagon AB; Hi-Target; PENTAX Surveying; Robert Bosch Tool Corporation; Shanghai Huace Navigation Technology Ltd.; South Surveying & Mapping Technology CO., LTD.; Suzhou FOIF Co., Ltd.; Topcon Corporation; and Trimble Inc. are the leading companies operating in the North America land survey equipment market.

The North America Land Survey Equipment Market is valued at US$ 1,549.31 Million in 2022, it is projected to reach US$ 2,251.40 Million by 2028.

As per our report North America Land Survey Equipment Market, the market size is valued at US$ 1,549.31 Million in 2022, projecting it to reach US$ 2,251.40 Million by 2028. This translates to a CAGR of approximately 7.2% during the forecast period.

The North America Land Survey Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Land Survey Equipment Market report:

The North America Land Survey Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Land Survey Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Land Survey Equipment Market value chain can benefit from the information contained in a comprehensive market report.