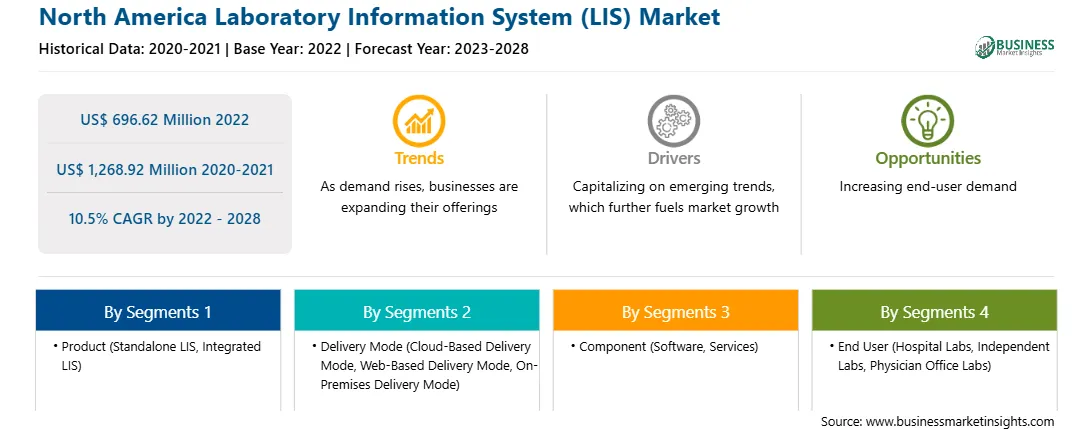

The laboratory information system (LIS) market in North America is expected to grow from US$ 696.62 million in 2022 to US$ 1,268.92 million by 2028. It is estimated to grow at a CAGR of 10.5% from 2022 to 2028.

Rising Adoption of Automation in Laboratories

Laboratory automation is emerging as an approach to minimize human involvement in laboratory processes. The automation of routine laboratory procedures with the help of dedicated workstations and system software helps to increase laboratory efficiency and enables researchers to concentrate on important tasks along with avoiding human errors. Laboratories are increasingly adopting laboratory information system (LIS) to maintain stringent regulatory compliance, uplift efficiency and productivity, and drive data security and integrity. According to a study published in the Journal of Lab Automation, the error incidences in fully automated, semi-automated, and manual operations are 1–5%, 1–10%, and 10–30%, respectively. The growing use of digital workstations, automated analyzers, and total laboratory automation (TLA) allows laboratory personnel to reassign activities and contribute a greater value to operations. Moreover, high volumes of data generated by laboratory systems is triggering the demand for effective data processing, analysis, and sharing methods, thereby highlighting the need of efficient and cost-effective solutions such as the LIS.

Laboratory management departments are facing many challenges with a rising population submitting larger number of samples to laboratories and a lack of personnel to process those samples. These challenges are compelling them to maintain their laboratory operations, as laboratories have to maintain control over the influx of samples as well as find the way to improve workflow to deliver patient results in a timely manner. According to the 2018 Vacancy Survey of Medical Laboratories by the American Society for Clinical Pathology (ASCP), the field has been experiencing a significant shortage of qualified and certified laboratory professionals.

Further, growing demand for data integration is another factor contributing to the laboratory information system (LIS) market growth. With pharmaceutical and biotechnological industries spending huge amounts on research and development activities, the scientific communities are generating huge volumes of data. The appropriate processing and interpretation of the collected data requires data integration solutions. For instance, in 2000, Quest Diagnostics, a prominent independent testing laboratory, started providing their consumers with a direct access to test results through the TheDailyApple.com website owned and managed by Caresoft Inc. It offers direct-to-consumer test result, thereby ensuring confidentiality and anonymity of patients. Manual processes and paper records may allow unauthorized access to data, which increases the chances of data manipulation, and hence, managing data integrity is a big challenge faced by laboratories dependent on manual operations. Increasing adoption of electronic health record (EHR) systems in outpatient clinics and hospitals, to mitigate the risks associated with manual operations, would fuel the demand for LIS. The systems also allow the use of laboratory data to offer safe and high-quality patient care. Thus, the growing focus on effective clinical workflow management, leading to the rise in automation if laboratory processes, is driving the laboratory information system (LIS) market growth.

Market Overview

North American market consists of the US, Canada, and Mexico. The US is the largest market for global laboratory information system, followed by Canada and Mexico. The leading position of North America in the LIS market is primarily attributed to the high regulatory standards followed by the pharmaceutical industry. The software helps store data, including information regarding sample management, instrument and application integration, electronic data exchange, and others. In biotechnology, LIS is used in genetic analysis, as it involves a large volume of sample data to be managed. Various players have been offering LIS solutions specifically for next-generation sequencing (NGS) experiments and other genomic tests. For instance, Illumina, Inc. offers BaseSpace Clarity LIS is designed for genomics labs and optimized for next-generation sequencing (NGS) studies. Also, the rising number of biobanks and the region is attributed to offering significant growth opportunities for market growth during the forecast period.

North America Laboratory Information System (LIS)

Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Laboratory Information System (LIS) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 696.62 Million |

| Market Size by 2028 | US$ 1,268.92 Million |

| Global CAGR (2022 - 2028) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Laboratory Information System (LIS) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Laboratory Information System (LIS) Market Segmentation

The North America laboratory information system (LIS) market is segmented into product, delivery mode, component, end user, and country.

Based on product, the market is bifurcated into standalone LIS and integrated LIS. The standalone LIS segment held the larger market share in 2022.

Based on delivery mode, the market is segmented into cloud-based delivery mode, web-based delivery mode, and on-premises delivery mode. Cloud-based delivery mode segment held the largest market share in 2022.

Based on component, the market is segmented into software and services. Software segment held the larger market share in 2022.

Based on end user, the market is segmented into hospital labs, independent labs, and physician office labs. The hospital labs segment held the largest market share in 2022.

Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

CompuGroup Medical; Francisco Partners; Hex Labs; Illumina, Inc.; LabLynx, Inc.; LabVantage Solutions, Inc.; LABWORKS; McKESSON CORPORATION; and Thermo Fisher Scientific Inc. are the leading companies operating in the laboratory information system (LIS) market in the region.

The North America Laboratory Information System (LIS) Market is valued at US$ 696.62 Million in 2022, it is projected to reach US$ 1,268.92 Million by 2028.

As per our report North America Laboratory Information System (LIS) Market, the market size is valued at US$ 696.62 Million in 2022, projecting it to reach US$ 1,268.92 Million by 2028. This translates to a CAGR of approximately 10.5% during the forecast period.

The North America Laboratory Information System (LIS) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Laboratory Information System (LIS) Market report:

The North America Laboratory Information System (LIS) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Laboratory Information System (LIS) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Laboratory Information System (LIS) Market value chain can benefit from the information contained in a comprehensive market report.