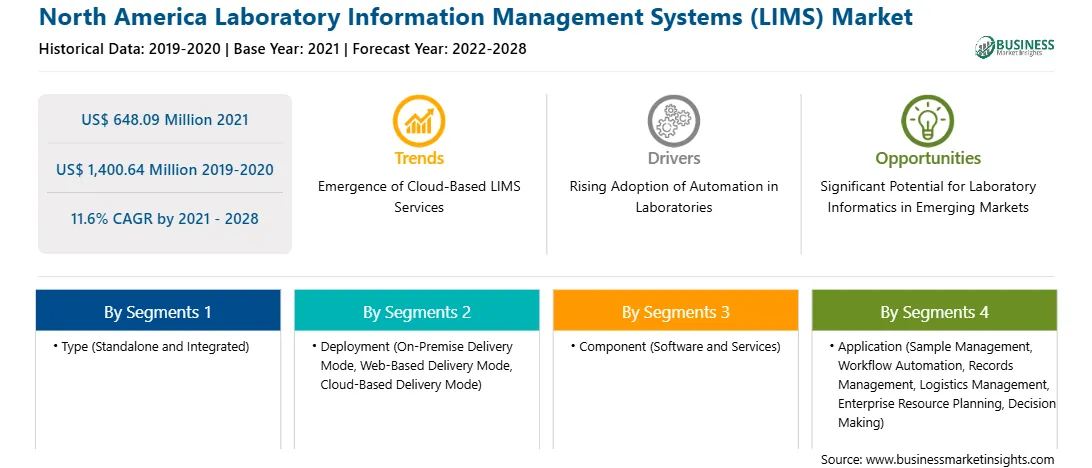

North America Laboratory Information Management Systems (LIMS) Market

No. of Pages: 135 | Report Code: TIPRE00027970 | Category: Technology, Media and Telecommunications

No. of Pages: 135 | Report Code: TIPRE00027970 | Category: Technology, Media and Telecommunications

Informatics platforms save time and money as they help to avoid rework if error occurred, and other technical glitches persists. The LIMS solutions ensure that samples are only sent or assigned to instruments that are regularly monitored as well as accurately calibrated and maintained as per schedule. Due to technological developments and far exceeding complexities in laboratory process, the scope of LIMS has gone beyond data, process, and product management. Moreover, mobility is one of the driving forces of the new technological era, wherein the remote management of laboratories are likely to be indispensable. Cloud-based LIMS are also been considered to meet the problem of limited geographic coverage associated with the traditional LIMS systems. These systems eliminate the need of heavy capital investments in infrastructure and enables fast and safe data transfer within the organizations. The laboratory information management systems market players are coming up with innovative solutions to sustain their presence in the highly competitive market. For instance, in February 2019, LabVantage Solutions launched LabVantage 8.4, the newest version of its LIMS. The LabVantage 8.4 has novel and updated features that enable laboratory managements and staffs to improve the efficiency and effectiveness of laboratory processes. The product is likely to assist them in planning work and managing resource capacity and availability, simultaneously ensuring data privacy. Autoscribe Informatics launched an updated version of its Regulated Manufacturing LIMS, in March 2021; it is a configured solution based on the Matrix Gemini LIMS solution. The product is ideal for all manufacturing organizations, including the highly regulated industries such as medical devices and pharmaceuticals. Moreover, the companies are also upgrading their original automation platforms to meet the escalating demands of researchers and laboratory personnel. In July 2021, LabVantage Solutions, Inc. announced the launch of a new edition of its flagship LabVantage LIMS. The LabVantage LIMS 8.7 portal features systems that manage the laboratory’s data security, along with offering self-service access to external customers. It also allows laboratories to go live faster and at a lower total cost. Thus, the developments and innovations by the market players are boosting the growth of laboratory information management systems market.

North America has been witnessing a growing number of COVID-19 cases since its outbreak. The chaotic situation was created in the medical industry across the countries, increased demand for clinical diagnostics and therapeutic systems have dramatically increased in the hospitals. Due to COVID-19 the increasing infection rate among the healthcare workers and patients demand for medications across the region has been increased. Therefore, the healthcare facilities and clinical laboratories as well as pharmaceutical and Biotech companies have been preferring automated systems to handle the burden of COVID 19. There has also been an increasing demand for centralized laboratory information and data reporting systems that has been increasing rapidly which has created an opportunity to adapt the laboratory information management systems to deal with massive number of clinical examinations and research for development of new therapeutics. Moreover, escalating demand for rapid and quality diagnosis of coronavirus infections with minimum error has resulted in increased adoption of laboratory information systems in North America region. For instance, in March 2020, Cloud LIMS a US based market player has launched COVID-19 LIMS, a free LIMS solution for COVID-19 research and testing laboratories and biobanks. CloudLIMS has already helped supported many laboratories in US for COVID-19 research and diagnostic testing. CloudLIMS is preconfigured with COVID-19 specific tests, such as RT-PCR, serological tests for the detection of IgG/IgM antibodies, Enzyme-linked Immunosorbent Assay (ELISA), neutralization test, and Rapid Diagnostic Test (RDT).

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America laboratory information management systems (LIMS) market. The North America laboratory information management systems (LIMS) market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the North America Laboratory Information Management Systems (LIMS) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 648.09 Million |

| Market Size by 2028 | US$ 1,400.64 Million |

| Global CAGR (2021 - 2028) | 11.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Laboratory Information Management Systems (LIMS) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Laboratory Information Management Systems (LIMS) Market is valued at US$ 648.09 Million in 2021, it is projected to reach US$ 1,400.64 Million by 2028.

As per our report North America Laboratory Information Management Systems (LIMS) Market, the market size is valued at US$ 648.09 Million in 2021, projecting it to reach US$ 1,400.64 Million by 2028. This translates to a CAGR of approximately 11.6% during the forecast period.

The North America Laboratory Information Management Systems (LIMS) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Laboratory Information Management Systems (LIMS) Market report:

The North America Laboratory Information Management Systems (LIMS) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Laboratory Information Management Systems (LIMS) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Laboratory Information Management Systems (LIMS) Market value chain can benefit from the information contained in a comprehensive market report.