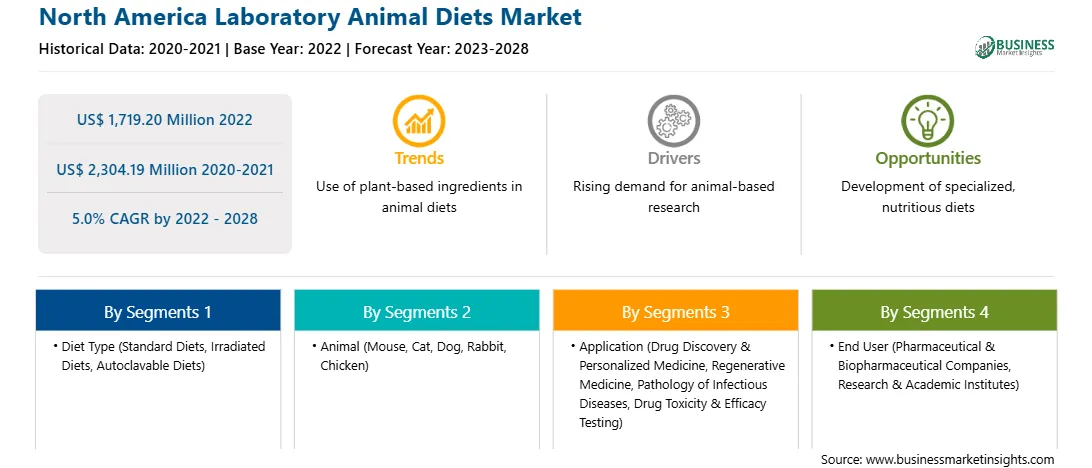

The laboratory animal diets market in North America is expected to grow from US$ 1,719.20 million in 2022 to US$ 2,304.19 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2022 to 2028.

Rising Use of Mice Models in Virology and Infectious Disease Studies Boost North America Laboratory Animal Diets Market Growth

Mice models are essential tools for studying the pathogenesis of infectious diseases and for the preclinical evaluation of vaccines and therapies against various human pathogens. The use of genetically defined inbred mouse strains, humanized mice, and gene knockout mice has enabled the research community to study pathogens that cause diseases and explain the role of specific host genes in controlling or promoting diseases. It also helps determine potential targets for the prevention or identification of treatments for various infectious agents. With the growing incidences of new infectious diseases, the animal model has become a vital tool for studying disease mechanisms and developing therapeutics. Mice with xenografted human immune systems have been used to study the pathogenesis of various infectious agents, including Plasmodium falciparum (malaria), Mycobacterium tuberculosis, dengue virus, and influenza virus. These models have been beneficial in studying HIV, which includes analyzing viral and host factors that promote viral replication and HIV interactions with the host's immune response. They are also helpful as platforms for testing therapeutic approaches to control HIV infection. Mouse models are widely used for preclinical screening of vaccines/therapies because of their reproducibility, low cost, and ease of experimental manipulation. Over the past century, advancements in vaccines, antibiotics/antivirals, and infection control measures have significantly reduced the burden of infectious diseases across the region. However, there has been an increase in contagious viral diseases. Mouse models are considered the best small animal models to be tested for hepatitis B virus (HBV), hepatitis C virus (HCV), Zika virus, SARS-CoV-2, and cytomegalovirus (CMV). According to the WHO, more than 17 million people die from infectious diseases yearly. Over the past two decades, over 30 new infectious diseases have emerged. According to UNAIDS, 38 million people were affected by HIV by the end of 2019. Mouse models have been widely used for various viral studies due to their small size, low cost, ease of use, and high reproducibility. To study the effect of the vaccines and therapies, these mice models are given a particular standardized diet. The prevalence of viral and infectious diseases is driving the demand for mice models; hence, the requirement for a specific diet for mice models has increased. This is driving the growth of the laboratory animal diet market in North America.

Market Overview

The North America laboratory animal diets market is segmented into the US, Canada, and Mexico. North America accounted for the largest share of the global market in 2021, owing to the increasing demand for laboratory animals by a large number of research institutions and well-established players in the industry across developed countries. Additionally, the rising need for animal models is due to the increased use of Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) technique. In addition, the development and introduction of personalized medicine products and services mainly emerged in the US market. Concerns regarding the adverse effects of certain drugs and the desire to increase patient participation in medical decisions have the potential to boost the acceptance of personalized medicine in the US. Moreover, the Precision Medicine Initiative was introduced by the government in the US. Under this initiative, the government intends to increase knowledge related to cancer genetics and biology, discover more effective therapeutics for chronic disorders, and promote the use of precision medicine. Rapid developments in regenerative medicine and tissue engineering have witnessed an increasing inclination toward the clinical translation of breakthrough technologies. Various domesticated and companion animals are used in personalized medicine, regenerative medicine, and tissue engineering studies.

North America Laboratory Animal Diets Market Segmentation

The North America laboratory animal diets market is segmented on the basis of diet type, animal, application, end user, and country.

Based on diet type, the North America laboratory animal diets market is segmented into standard diets, irradiated diets, and autoclavable diets. The standard diets segment is likely to register the largest share of the market in 2022.

Based on animal, the North America laboratory animal diets market is segmented into mouse, cat, dog, rabbit, chicken, and others. The mouse segment is likely to register the largest share of the market in 2022.

Based on application, the North America laboratory animal diets market is segmented into drug discovery and personalized medicines, regenerative medicines, pathology of infectious disease, drug toxicity and efficacy testing, and others. The drug discovery and personalized medicine segment is likely to register the largest share of the market in 2022.

Based on end user, the North America laboratory animal diets market is segmented into pharmaceutical & biopharmaceutical companies, research & academic institutes, and others. The pharmaceutical & biopharmaceutical companies segment is likely to register the largest share of the market in 2022.

Based on country, the North America laboratory animal diets market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

Altromin Spezialfutter GmbH & Co. KG; Bio-Serv; Dyets, Inc.; Envigo; LabDiet; Research Diets Inc.; SAFE; Special Diet Services; and Specialty Feeds are the leading companies operating in the laboratory animal diets market in North America.

Strategic insights for the North America Laboratory Animal Diets provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,719.20 Million |

| Market Size by 2028 | US$ 2,304.19 Million |

| Global CAGR (2022 - 2028) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Diet Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Laboratory Animal Diets refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Laboratory Animal Diets Market is valued at US$ 1,719.20 Million in 2022, it is projected to reach US$ 2,304.19 Million by 2028.

As per our report North America Laboratory Animal Diets Market, the market size is valued at US$ 1,719.20 Million in 2022, projecting it to reach US$ 2,304.19 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The North America Laboratory Animal Diets Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Laboratory Animal Diets Market report:

The North America Laboratory Animal Diets Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Laboratory Animal Diets Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Laboratory Animal Diets Market value chain can benefit from the information contained in a comprehensive market report.