North America Label Free Detection Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Product (Instruments and Consumables), Technology (Surface Plasmon Resonance, Bio-Layer Interferometry, Isothermal Titration Calorimetry, Differential Scanning Calorimetry, and Other LFD Technologies), Application (Binding Kinetics, Binding Thermodynamics, Endogenous Receptor Detection, Hit Confirmation, Lead Generation, and Other Applications), and End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations, and Other End Users)

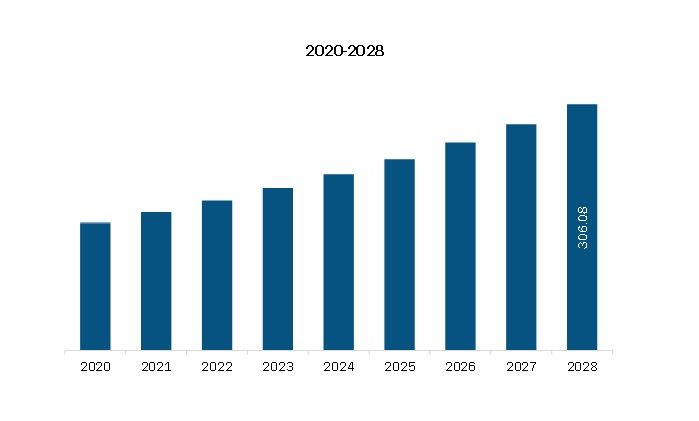

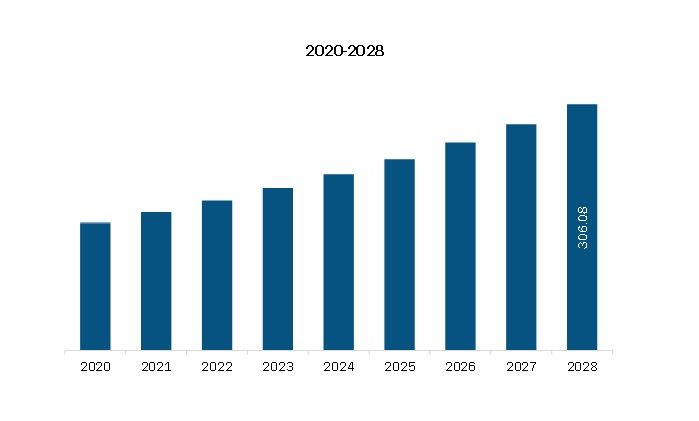

The North America label free detection market is expected to reach US$ 306.08 million by 2028 from US$ 171.84 million in 2021; it is estimated to grow at a CAGR of 8.6% from 2021 to 2028.

The growth of the market is attributed to the rapid proliferation of the pharmaceuticals and biotechnology industries, increasing adoption of innovative approaches in drug discovery, and rising government initiatives and funding for R&D. However, the lack of skilled professionals restricts the market growth.

Label free technologies are relatively new in the well-established high-throughput screening (HTS) field. The technologies probe biomolecular interactions without getting affected by spatial interference, or auto-fluorescence or quenching repercussions of labels. On average, a new drug takes at least a decade to complete the journey from initial discovery to commercial launch. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), the average cost of research & development for every successful drug is ~ US$ 2.6 billion. With the rising costs of drug development to treat increasingly complex diseases, improving productivity in early drug discovery processes has been challenging.

Initially, low throughput was a significant challenge associated with label free technologies. However, the introduction of surface plasmon resonance-based (SPR-based) label free systems with higher throughput has increased the overall operational efficiency of these systems while providing valuable data to make informed decisions.

• The latest innovation in differential scanning calorimetry (DSC) by Spectris is designed specifically for regulated environments, and the innovative technique delivers essential data to guide biopharmaceutical development. In 2017, Spectris introduced the MicroCal PEAQ-DSC microcalorimeter, which offers 24-hour operations, streamlined workflows, and automated data analysis to produce results in hours, driving productivity and efficiency gains in research and production.

• In 2018, Danaher introduced Biacore 8K+, an eight-needle, high-sensitivity SPR system. The system automates over 4,500 experiments focused on binding between drug candidates and specific disease targets. It can be connected with the Biacore Insight Evaluation Software to translate high-quality data into actionable insights.

• In 2019, Agilent Technologies introduced a unique multimode real-time cell analyzer (RTCA), which blends the best of noninvasive biosensor measurements with live-cell imaging. These advancements provide label-free, real-time biosensor measurements and kinetic imaging of the same live cell populations, independently or simultaneously. This revolutionizes cell analysis in life science research.

• In 2020, Nicoya launched Alto, a fully automated, high-throughput benchtop SPR system. It uses digital microfluidics (DMF) that replaces physical pumps, valves, or tubes with low-cost disposable cartridges. This lowers the time and cost of drug discovery, enabling scientists to understand better and fasten the process of obtaining the cure for human diseases.

Therefore, due to technological advancements, pharmaceutical and biopharmaceutical companies and academic research institutes adopt label-free technologies for biomolecular analysis during drug discovery, which fuels the growth of the label-free detection market.

North America Label Free Detection Market Revenue and Forecast to 2028 (US$ Mn)

Get more information on this report :

NORTH AMERICA LABEL FREE DETECTION MARKET SEGMENTATION

The North America label free detection market based on the product is segmented into instruments and consumables. Based on technology, the North America label free detection market is segmented into surface plasmon resonance, bio-layer interferometry, isothermal titration calorimetry, differential scanning calorimetry, and other LFD technologies. The North America label free detection market, based on application is segmented into binding kinetics, binding thermodynamics, endogenous receptor detection, hit confirmation, lead generation, and other applications. The North America label free detection market, based on end user is segmented into pharmaceutical and biotechnology companies, academic and research institutes, contract research organizations and other end users. Geographically, the North America label free detection market can be divided into US, Canada, and Mexico.

General Electric, Perkin Elmer, Inc., AMETEK Inc., F. HOFFMANN-LA ROCHE LTD., Spectris, METTLER TOLEDO, Agilent Technologies, Inc., Waters Corporation, Sartorius AG and Corning Incorporated are among the leading companies operating in the North America label free detection market.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Label Free Detection Market – By Product

1.3.2 North America Label Free Detection Market – By Technology

1.3.3 North America Label Free Detection Market – By Application

1.3.4 North America Label Free Detection Market – By End User

1.3.5 North America Label Free Detection Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Label Free Detection Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.3 Experts Opinion

5. Label Free Detection Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Introduction of High-Tech Products

5.1.2 Growing Number of Drug Discovery Programs Through Academic–Industrial Partnerships

5.2 Market Restraints

5.2.1 High Cost of LFD Instruments

5.3 Future Trends

5.3.1 Rising Pharmaceutical Outsourcing

5.4 Impact Analysis

6. Label Free Detection Market–North America Analysis

6.1 North America Label Free Detection Market Revenue Forecast and Analysis

7. North America Label Free Detection Market Revenue and Forecasts To 2028– by Product

7.1 Overview

7.2 Label Free Detection Market Share by Product 2021 & 2028 (%)

7.3 Instruments

7.3.1 Overview

7.3.2 Instruments: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

7.4 Consumables

7.4.1 Overview

7.4.2 Consumables: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

8. North America Label Free Detection Market Analysis – By Technology

8.1 Overview

8.2 Label Free Detection Market Share, by Technology, 2021 and 2028 (%)

8.3 Surface Plasmon Resonance

8.3.1 Overview

8.3.2 Surface Plasmon Resonance: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

8.4 Bio-Layer Interferometry

8.4.1 Overview

8.4.2 Bio-Layer Interferometry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

8.5 Isothermal Titration Calorimetry

8.5.1 Overview

8.5.2 Isothermal Titration Calorimetry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

8.6 Differential Scanning Calorimetry

8.6.1 Overview

8.6.2 Differential Scanning Calorimetry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

8.7 Other LFD Technologies

8.7.1 Overview

8.7.2 Other LFD Technologies: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9. Label Free Detection Market Revenue and Forecasts To 2028 – Application

9.1 Overview

9.2 Label Free Detection Market Share by Application - 2021 & 2028 (%)

9.3 Binding Kinetics

9.3.1 Overview

9.3.2 Binding Kinetics: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9.4 Binding Thermodynamics

9.4.1 Overview

9.4.2 Binding Thermodynamics: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9.5 Endogenous Receptor Detection

9.5.1 Overview

9.5.2 Endogenous Receptor Detection: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9.6 Hit Confirmation

9.6.1 Overview

9.6.2 Hit Confirmation: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9.7 Lead Generation

9.7.1 Overview

9.7.2 Lead Generation: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

9.8 Other Applications

9.8.1 Overview

9.8.2 Other Applications: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

10. North America Label Free Detection Market Revenue and Forecasts To 2028 – End User

10.1 Overview

10.2 Label Free Detection Market Share by End User - 2021 & 2028 (%)

10.3 Pharmaceutical and Biotechnology Companies

10.3.1 Overview

10.3.2 Pharmaceutical and Biotechnology Companies: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

10.4 Academic and Research Institutes

10.4.1 Overview

10.4.2 Academic and Research Institutes: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

10.5 Contract Research Organizations (CROs)

10.5.1 Overview

10.5.2 CROs: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

10.6 Other End Users

10.6.1 Overview

10.6.2 Other End Users: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

11. Label Free Detection Market Revenue and Forecasts to 2028 –Country Analysis

11.1 North America: Label Free Detection Market

11.1.1 North America: Label Free Detection Market - Revenue and Forecast to 2028 (USD Million)

11.1.2 North America Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

11.1.3 North America Label Free Detection Market, by Technology– Revenue and Forecast to 2028 (USD Million)

11.1.4 North America Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.1.5 North America Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

11.1.6 North America: Label Free Detection Market, by Country, 2021 & 2028 (%)

11.1.6.1 US: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.1.1 U.S. Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.1.2 US Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

11.1.6.1.3 US Label Free Detection Market, by Technology – Revenue and Forecast to 2028 (USD Million)

11.1.6.1.4 US Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.1.6.1.5 US Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

11.1.6.2 Canada: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.2.1 Canada: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.2.2 Canada Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

11.1.6.2.3 Canada Label Free Detection Market, by Technology – Revenue and Forecast to 2028 (USD Million)

11.1.6.2.4 Canada Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.1.6.2.5 Canada Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

11.1.6.3 Mexico: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.3.1 Mexico: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

11.1.6.3.2 Mexico Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

11.1.6.3.3 Mexico Label Free Detection Market, by Technology – Revenue and Forecast to 2028 (USD Million)

11.1.6.3.4 Mexico Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.1.6.3.5 Mexico Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

12. Impact Of COVID-19 Pandemic on Label Free Detection Market

12.1 North America: Impact Assessment of COVID-19 Pandemic

13. Label Free Detection Market–Industry Landscape

13.1 Overview

13.2 Organic Developments

13.2.1 Overview

13.3 Inorganic Developments

13.3.1 Overview

14. Company Profiles

14.1 General Electric

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Financial Overview

14.1.4 SWOT Analysis

14.1.5 Key Developments

14.2 Perkin Elmer, Inc.

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 AMETEK Inc.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 F. HOFFMANN-LA ROCHE LTD.

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Spectris

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 METTLER TOLEDO

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Agilent Technologies, Inc.

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Waters Corporation

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Sartorius AG

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Corning Incorporated

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Label Free Detection Market, by Product– Revenue and Forecast to 2028 (USD Million)

Table 2. North America Label Free Detection Market, by Technology– Revenue and Forecast to 2028 (USD Million)

Table 3. North America Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 4. North America Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 5. US Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 6. US Label Free Detection Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 7. US Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 8. US Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 9. Canada Label Free Detection Market, by Product - Revenue and Forecast to 2028 (USD Million)

Table 10. Canada Label Free Detection Market, by Technology -Revenue and Forecast to 2028 (USD Million)

Table 11. Canada Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 12. Canada Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 13. Mexico Label Free Detection Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 14. Mexico Label Free Detection Market, by Technology -Revenue and Forecast to 2028 (USD Million)

Table 15. Mexico Label Free Detection Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 16. Mexico Label Free Detection Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 17. Organic Developments Done by Companies

Table 18. Inorganic Developments Done by Companies

Table 19. Glossary of Terms

LIST OF FIGURES

Figure 1. Label Free Detection Market Segmentation

Figure 2. Label Free Detection Market, By Country

Figure 3. North America Label Free Detection Market Overview

Figure 4. Surface Plasmon Resonance Segment Held Largest Share of Technology Segment in Label Free Detection Market

Figure 5. North America Label Free Detection Market- Leading Country Markets (US$ Million)

Figure 6. North America: PEST Analysis

Figure 7. Experts Opinion

Figure 8. Label Free Detection Market: Impact Analysis of Drivers and Restraints

Figure 9. North America Label Free Detection Market– Revenue Forecast and Analysis – 2021 - 2028

Figure 10. Label Free Detection Market Share by Product 2021 & 2028 (%)

Figure 11. Instruments: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 12. Consumables: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 13. Label Free Detection Market Share, by Technology, 2021 and 2028 (%)

Figure 14. Surface Plasmon Resonance: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 15. Bio-Layer Interferometry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 16. Isothermal Titration Calorimetry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 17. Differential Scanning Calorimetry: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 18. Other LFD Technologies: Label Free Detection Market– Revenue and Forecast to 2028 (US$ Million)

Figure 19. Label Free Detection Market Share by Application - 2021 & 2028 (%)

Figure 20. Binding Kinetics: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 21. Binding Thermodynamics: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 22. Endogenous Receptor Detection: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 23. Hit Confirmation: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 24. Lead Generation: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 25. Other Applications: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 26. Label Free Detection Market Share by End User - 2021 & 2028 (%)

Figure 27. Pharmaceutical and Biotechnology Companies: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 28. Academic and Research Institutes: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 29. CROs: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 30. Other End Users: Label Free Detection Market– Revenue and Forecasts To 2028 (US$ Million)

Figure 31. North America: Label Free Detection Market, by Key Country – Revenue (2021) (USD Million)

Figure 32. North America Label Free Detection Market Revenue and Forecast to 2028 (USD Million)

Figure 33. North America: Label Free Detection Market, by Country, 2021 & 2028 (%)

Figure 34. US: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

Figure 35. Canada: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

Figure 36. Mexico: Label Free Detection Market – Revenue and Forecast to 2028 (USD Million)

Figure 37. Impact of COVID-19 Pandemic in North American Country Markets

- General Electric

- Perkin Elmer, Inc.

- AMETEK Inc.

- F. HOFFMANN-LA ROCHE LTD.

- Spectris

- METTLER TOLEDO

- Agilent Technologies, Inc.

- Waters Corporation

- Sartorius AG

- Corning Incorporated

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America label free detection market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America label free detection market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.