Strategic Developments by Manufacturers is Expected to Drive the Markets

Manufacturers in the North America intradermal injection market are adopting strategies such as partnerships, collaborations, product launches, approvals, and mergers and acquisitions to sustain the competition. They are also focused on partnerships to strengthen their presence in the market and to boost clinical research for accelerating the development of new drugs. For instance, in January 2021, Pharmajet partnered with the US Army Medical Research Institute of Infectious Diseases (USAMRIID) with an aim of utilizing the Pharmajet needle-free jet injector to deliver gene therapy developed by USAMRIID for treating small-pox; the therapy is commercially available under the name 4pox. Further, Inviragen and PharmaJet collaboration received an investment of US$ 15.5 million for an investigational dengue vaccine—DENVax—administered via Pharmajet’s needle-free injection device. Further, Crossject and Cenexi partnered in 2016 to develop a needle-free autoinjector named Zeneo. Thus, medical equipment manufacturers in North America are scaling up the production of their devices, along with introducing innovative products and ensuring the easy availability of their products. Moreover, regulatory agencies are providing the required support through timely product approvals and permissions. Such favorable conditions for manufacturers are bolstering the growth of the North America intradermal injection market.

Market Overview

The US, Canada, and Mexico are the key contributors to the intradermal injections market in the North America. The US is the largest contributor to the market in this region, and the market growth in the US is attributed to factors such as increase in incidences of tuberculosis, allergies, etc.; comprehensive clinical research and contract research ongoing in the country; and surging adoption of aesthetic cosmetic procedures. Moreover, the country is well ahead of other developed and emerging countries in terms of technology development and adoption, which has been favoring the development of various innovative intradermal injections and their applications in the healthcare sector. Tuberculosis (TB) is one of the leading bacterial infections in developed countries, including the US. According to the CDC, ~13 million people in the US are living with latent TB, while more than 7,000 cases of tuberculosis are diagnosed newly every year. As the tuberculin skin test is the primary test for the diagnosis of this disease, the demand for intradermal injections continues to grow with the rising cases of TB. The incidences of various allergic reactions are also increasing in the US; various allergies constitute the 6th leading reason for chronic illness in the country. According to the Asthma and Allergy Foundation of America, more than 50 million Americans experience allergic reactions. Moreover, ~30,000 people experienced anaphylaxis due to food every year, while ~7.7% of the adult population and 7.2% of children experience hay fever every year. The annual cost incurred by the healthcare sector due to allergies is also rising in the US. With a surge in the cases of skin allergies, the demand for intradermal injections has also increased in North America, which is bolstering the intradermal injection market growth.

Strategic insights for the North America Intradermal Injections provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

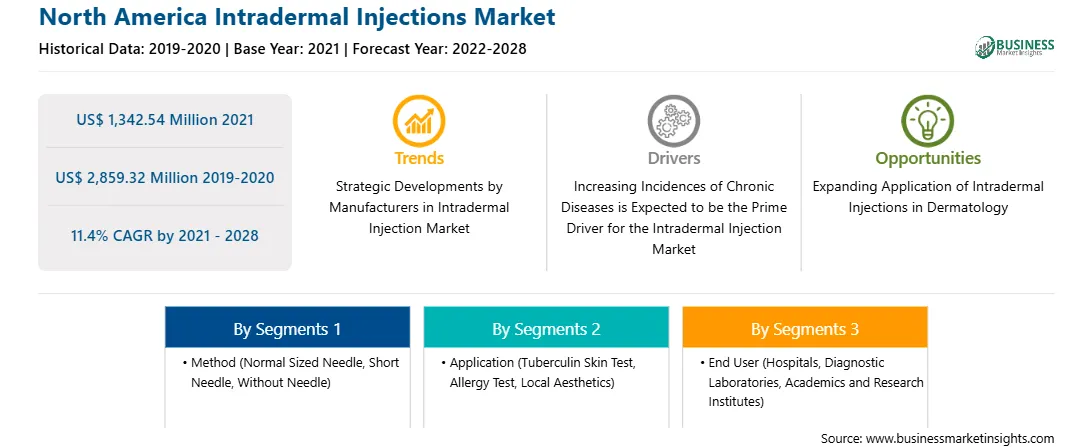

| Market size in 2021 | US$ 1,342.54 Million |

| Market Size by 2028 | US$ 2,859.32 Million |

| Global CAGR (2021 - 2028) | 11.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Method

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Intradermal Injections refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Intradermal Injections Market Segmentation

The North America intradermal injections market is segmented on the basis of method, application, end user, and country. Based on method, the market is segmented into normal sized needle, short needle, and without needle. The normal sized needles segment registered the largest market share in 2021. The normal sized needles segment is further subsegmented into intradermal microinjections, microneedle arrays, and tattoo devices. The short needle segment is bifurcated into intradermal liquid jet injectors and ballistic intradermal injectors. In terms of application, the North America intradermal injections market is segmented into tuberculin skin test, allergy test, local aesthetics, and others. The tuberculin skin test segment held the largest market share in 2021. The North America intradermal injections market, by end user, is segmented into hospitals, diagnostic laboratories, academics and research institutes, and others. The hospitals segment held the largest market share in 2021. Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2021.

BD; West Pharmaceutical Services, Inc; Terumo Corporation; Nanopass; PharmaJet; Idevax; EUNSUNG GLOBAL; Crossject; Cardinal Health Inc; and Hindustan Syringes and Medical Devices Ltd are the leading companies operating in intradermal injections market in North America."

The North America Intradermal Injections Market is valued at US$ 1,342.54 Million in 2021, it is projected to reach US$ 2,859.32 Million by 2028.

As per our report North America Intradermal Injections Market, the market size is valued at US$ 1,342.54 Million in 2021, projecting it to reach US$ 2,859.32 Million by 2028. This translates to a CAGR of approximately 11.4% during the forecast period.

The North America Intradermal Injections Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Intradermal Injections Market report:

The North America Intradermal Injections Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Intradermal Injections Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Intradermal Injections Market value chain can benefit from the information contained in a comprehensive market report.