Market Introduction

North American market for inspection machine consists of the US, Canada, and Mexico. The US inspection machine market is estimated to be the largest in the region and is likely to continue its dominance during forecast years. The market across the country is expected to grow due to the well-established pharmaceutical and biotechnology market. The growth is also attributed due to the growing research and development, rising number of inspection checkpoints in the production line, and highly regulated inspection standards & obligatory compliance in the region. In addition, the United States is the largest pharmaceutical and biotechnology market. Therefore, drug development activities have increased drastically across the country which results in growth in manufacturing facilities in the region. With rise in manufacturing facilities there has been a steep rise in inspection processes for high quality products with zero error. Thus, several market players are based in the US, resulting to which the US is a center for innovation in the inspection machines market.

In the North American region, the US was highly affected by the outbreak of the COVID-19 pandemic. The pandemic has created a panic situation across the country that impacted all other economies across the world. The COVID-19 pandemic had severely impacted the pharmaceutical and Medtech R&D in the North American region. Similar to most organizations around the region, the FDA and other regulatory agencies has also experienced unprecedented and unique challenges during the COVID-19 pandemic. The FDA announced in March 2020 that all domestic and foreign routine surveillance facility inspections postponed temporarily, while mission critical inspections continuing when possible. The FDA began working on resuming prioritized domestic inspections using its COVID-19 Advisory Rating system the week of July 20, 2020. In particular, the inspection, surveillance and compliance activities were significantly impacted. However, on March 2021, the US Food and Drug Administration released a new report titled "Resiliency Roadmap for FDA Inspectional Oversight," which details the agency's inspectional activities during the COVID-19 pandemic and its detailed plan to move toward a more consistent state of operations, as well as the FDA's priorities for this work in the future. Moreover, the current scenario owing to the well-established treatment procedure and stability in the healthcare system has helped the associated business gain pace. The inspection systems have gained importance and demand. With increasing research and diagnostic testing the demand of inspection systems have increased at slower rate and is expected to increase in the forecasted period.

Strategic insights for the North America Inspection Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Inspection Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Inspection Machine Strategic Insights

North America Inspection Machine Report Scope

Report Attribute

Details

Market size in 2021

US$ 289.24 Million

Market Size by 2028

US$ 419.71 Million

Global CAGR (2021 - 2028)

5.5%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Product

By Type

By Packaging

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Inspection Machine Regional Insights

Market Overview and Dynamics

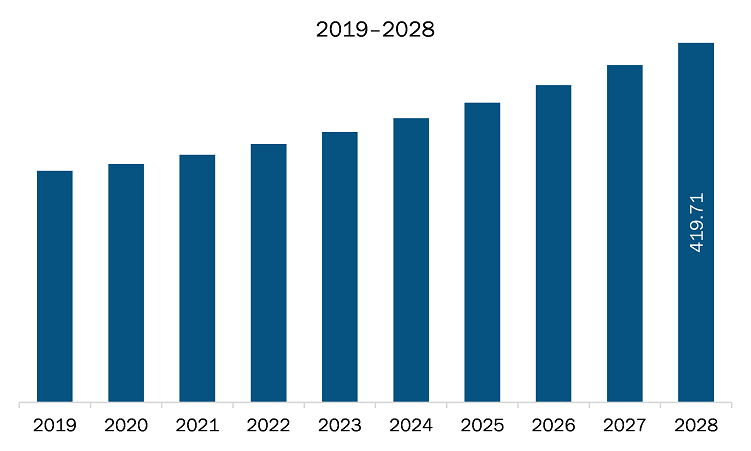

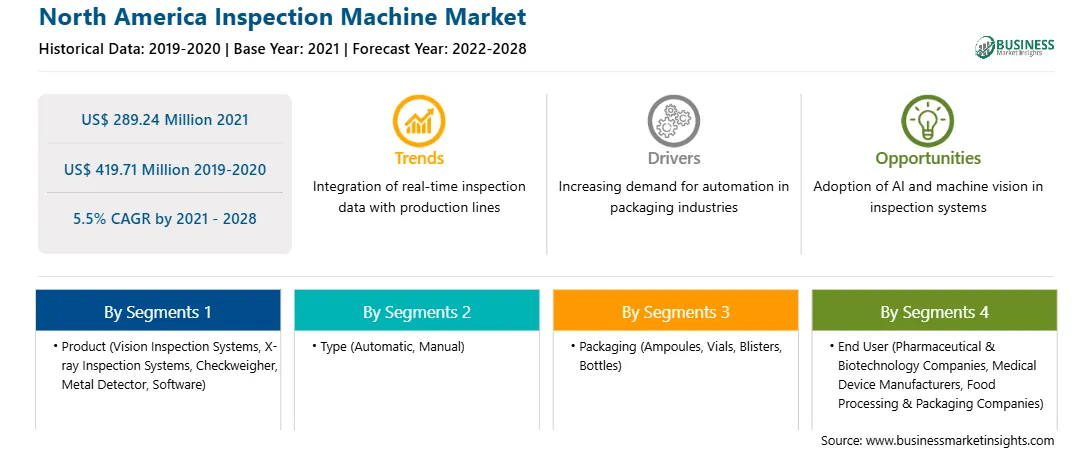

The inspection machine market in North America is expected to grow US$ 289.24 million in 2021 to US$ 419.71 million by 2028; it is estimated to grow at a CAGR of 5.5% from 2021 to 2028. Technological advancements in inspection machines, with increasing investments from market players, are likely to result in several significant trends in the inspection machine market in future. The market players have adopted various strategies such as new products launch, advancements, collaborations, partnerships, and expansions to accelerate their proliferation. The incorporation of artificial intelligence (AI) in inspection systems has been a boon to manufacturers. For instance, in Feb 2021, Syntegon Technology installed the first fully validated visual inspection system utilizing Artificial Intelligence (AI) in an automated inspection machine. The installation constitutes a significant step in the company’s sustained effort to introduce AI to pharmaceutical visual inspection that will help to explore large uncharted territory in the industry. Similarly, in September 2021, Mettler Toledo launched a next-generation series of metal detection systems M30 R-Series GC, that deliver a fresh dimension to the food inspection market. The smart, digital inspection for small and medium-size manufacturers and co-packers who value high performance. The M30 R-Series, built around the leading-edge SENSE software technology, brings new intelligence and sophistication levels to the mid-market metal detection field. Also, FT System’s ROBO QCS offers a fully automated in-line inspection without causing product damage or loss. These inspection devices inspect caps and bottles before they reach the filler or capper to remove any defects, which could impact line efficiencies. Furthermore, many companies are coming up with innovative inspection systems and equipment to keep up its pace with demand. For instance, the TapTone PRO Series Pouch Inspector system finds and rejects leaking and damaged pouches at production line speeds up to 200 feet per minute. Because of these factors, technical improvements in inspection machines are predicted to generate growth chances for the aforementioned market in the coming years. Owing to the above-mentioned factors, the technological advancement of inspection machines likely to create growth opportunities for the inspection machines market in the coming years.

Key Market Segments

In terms of product the vision inspection systems segment accounted for the largest share of the North America inspection machine market in 2021. In terms of type the automatic segment accounted for the largest share of the North America inspection machine market in 2021. In terms of packaging the ampoules segment accounted for the largest share of the North America inspection machine market in 2021. In term of end user, pharmaceutical & biotechnology companies segment held a larger market share of the inspection machine market in 2021.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the inspection machine market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are OMRON Corporation; Thermo Fisher Scientific, Inc.; Cognex Corporation; Syntegon Technology GmbH; METTLER TOLEDO; Teledyne Technologies, Inc.; General Inspection LLC; BREVETTI CEA S.P.A; and Minebea Intec GmbH among others.

Reasons to buy report

North America Inspection Machine Market Segmentation

North America Inspection Machine Market – By Product

North America Inspection Machine Market – By Type

North America Inspection Machine Market – By Packaging

North America Inspection Machine Market – By

End User

North America Inspection Machine Market – By

Country

North America Inspection Machine Market – Companies Mentioned

The North America Inspection Machine Market is valued at US$ 289.24 Million in 2021, it is projected to reach US$ 419.71 Million by 2028.

As per our report North America Inspection Machine Market, the market size is valued at US$ 289.24 Million in 2021, projecting it to reach US$ 419.71 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The North America Inspection Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Inspection Machine Market report:

The North America Inspection Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Inspection Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Inspection Machine Market value chain can benefit from the information contained in a comprehensive market report.