The InGaAs cameras are increasingly being used in the military & defense sector to see through unfavorable conditions such as fog, smoke, haze, and water vapor. Their ability to aid in a clear vision makes them suitable for marine intelligence, surveillance, and vision enhancement. Military expenditure of the US was US$ 734.34 billion in 2019, which grew to US$ 778.23 billion in 2020. A rise of 5.63% in military spending signifies a massive scope for the adoption of InGaAs cameras. According to the World Bank collection of development indicators, Canada's military expenditure was 1.41% of its GDP in 2020. The country's military expenses reached US$ 22.75 billion in 2020 from US$ 22.20 billion in 2019. At present, the whole world’s is undergoing the fourth industrial revolution, characterized by rapid advancements in multiple next-generation technologies, including artificial intelligence (AI). The potential of weaker nuclear-armed states can be increased by integrating AI into their military platforms. In January 2021, Lockheed Martin Corp. announced three new next-generation infrared spacecraft to help detect the launch of enemy ballistic missiles. In 2021, Elbit Systems launched its next-generation advanced multi-sensor payload system—AMPS NG. Thus, technological advancements in the military and defense systems are driving the InGaAs market.

Further, increasing partnerships between government bodies and tech giants is creating attractive opportunities in the InGaAs market. Sensors Unlimited is leading provider of short-wave infrared InGaAs cameras, photodiodes, and arrays (for night vision technology). It works with the Department of Defense of the US on various projects through the Defense Advanced Research Projects Agency (DARPA) and the Night Vision Laboratory (NVL) of the US Army. Sensors Unlimited Inc. and a few other companies have introduced a military-hardened uncooled, indium gallium arsenide short-wave infrared (SWIR) video camera for military applications.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America InGaAs camera market at a substantial CAGR during the forecast period.

North America InGaAs Camera Market Segmentation

The North America InGaAs camera market is segmented on the basis of camera cooling technology, scanning type, application, and country. Based on camera cooling technology, the market is segmented into area scan camera and line scan camera. In 2020, the scan camera segment held a larger share of the market, and the same segment is expected to register a higher CAGR during the forecast period. Based on scanning type, the North America InGaAs camera market is segmented into uncooled camera and cooled camera. In 2020, the uncooled camera segment held a larger market share; further, the cooled segment is expected to register a higher CAGR in the market during the forecast period. Based on application, the North America InGaAs camera market is segmented into military and defense, industrial automation, and scientific research. In 2020, the industrial automation segment held the largest share of the market. However, the military and defense segment is expected to register the highest CAGR during the forecast period. Further, based on country, the North America InGaAs camera market is segmented into the US, Canada, and Mexico. In 2020, the US held the largest market share, and it is further expected to register the fastest CAGR during the forecast period.

Allied Vision Technologies GmbH; Hamamatsu Photonics K.K.; Polytec GmbH; Raptor Photonics Limited; Xenics nv.; SWIR Vision Systems; Seiwa Optical America Inc.; New Imaging Technologies (NIT); Pembroke Instruments, LLC; and Sensors Unlimited, (Collins Aerospace Company) are among the leading companies in the North America InGaAs camera market.

Strategic insights for the North America InGaAs Camera provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

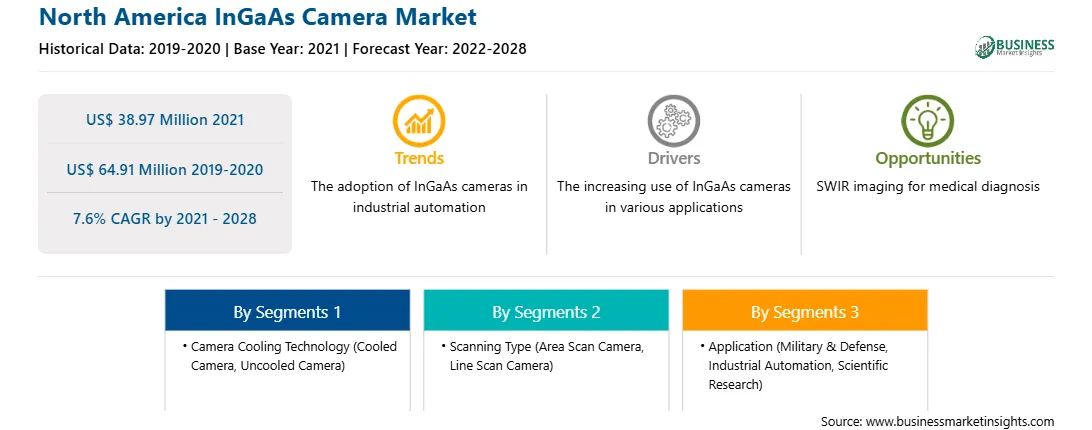

| Market size in 2021 | US$ 38.97 Million |

| Market Size by 2028 | US$ 64.91 Million |

| Global CAGR (2021 - 2028) | 7.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Camera Cooling Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America InGaAs Camera refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America InGaAs Camera Market is valued at US$ 38.97 Million in 2021, it is projected to reach US$ 64.91 Million by 2028.

As per our report North America InGaAs Camera Market, the market size is valued at US$ 38.97 Million in 2021, projecting it to reach US$ 64.91 Million by 2028. This translates to a CAGR of approximately 7.6% during the forecast period.

The North America InGaAs Camera Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America InGaAs Camera Market report:

The North America InGaAs Camera Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America InGaAs Camera Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America InGaAs Camera Market value chain can benefit from the information contained in a comprehensive market report.