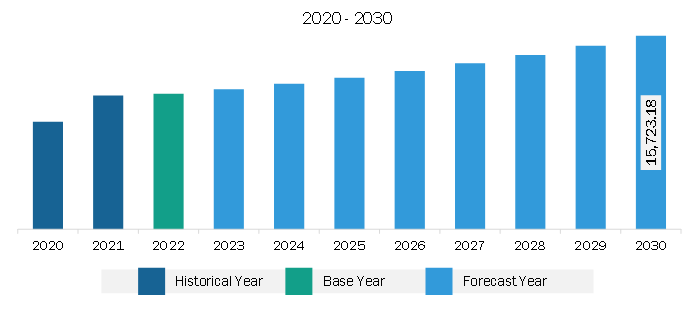

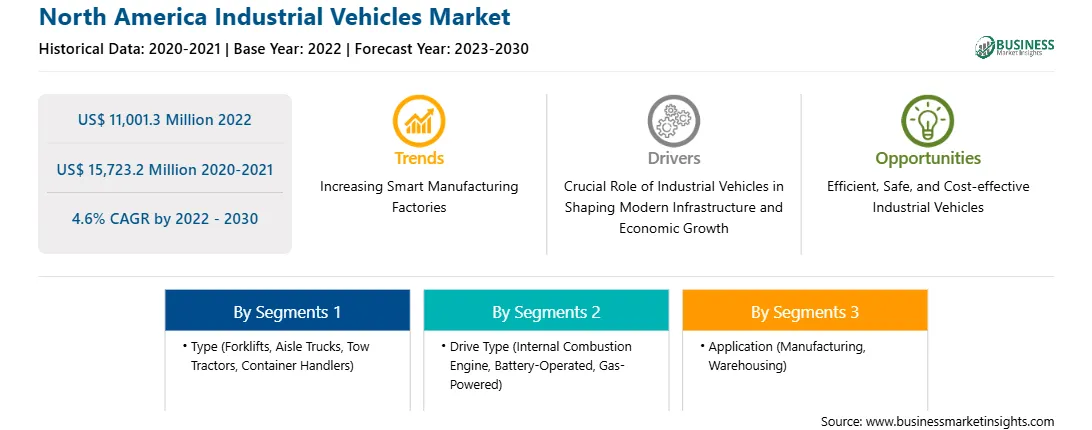

The North America industrial vehicles market was valued at US$ 11,001.3 million in 2022 and is expected to reach US$ 15,723.2 million by 2030; it is estimated to register at a CAGR of 4.6% from 2022 to 2030. Increasing Smart Manufacturing Factories Fuels North America Industrial Vehicles Market

The ongoing digital transformation of production processes and business models in industrial companies presents a significant growth trend for the industrial vehicle market in upcoming years. With the increasing interconnection of machinery and equipment, along with the integration of sensors, there is a wealth of data being generated. By harnessing the power of big data and artificial intelligence, these companies can achieve greater transparency, efficiency, and cost reduction.

Smart manufacturing techniques, which encompass AI, ML, robotics, automation, and IoT, play a crucial role in creating efficient and adaptable production systems. These technologies can be applied across various industries such as automotive, warehouse, logistics, and manufacturing, enabling improvements in multiple processes. For instance, in product design, smart manufacturing techniques can facilitate more innovative and optimized designs. In production planning and scheduling, these technologies can enhance efficiency by optimizing resource allocation and reducing downtime. Quality control can be improved through real-time monitoring and predictive analytics, minimizing defects and ensuring higher product standards. Additionally, supply chain management can be streamlined through enhanced visibility and coordination.

By adopting smart manufacturing techniques, industrial companies can unlock new growth opportunities. The increased efficiency and productivity resulting from these technologies can lead to cost savings and improved competitiveness. Moreover, the ability to leverage data-driven insights enables companies to make more informed decisions, identify optimization opportunities, and respond quickly to market demands. As a result, the industrial vehicle market can benefit from this growth trajectory, as the demand for vehicles used in various industrial processes, such as material handling, transportation, and logistics, is likely to increase over the forecast period. This presents a promising outlook for the industrial vehicle market as it aligns with the evolving needs of digitally transformed industries.North America Industrial Vehicles Market Overview

The rising demand for the material handling equipment and vehicles around the globe across the manufacturing sector drives the North America industrial vehicles market growth. According to the World Industrial Vehicle Statistics Association (WITS), more than 2.34 million material-handling vehicles and equipment sales were recorded during 2021. The material handling industry saw a 43.0% increase in orders in 2021 compared to the previous year, 2020. Among the 2.34 million material handling units, around 68.8%, that is 1.61 million units, were recorded as electric-powered forklifts. Electric forklift demand is increasing at a rapid pace with a surge in consumer popularity. With a surge in the number of orders, the demand for industrial vehicles such as forklifts, aisle trucks, and pallet trucks has increased.

Further, the North American North America industrial vehicles market growth is attributed to the expansion of logistics & transportation, and e-commerce industries. Online shopping in the US has increased in recent years. Total US e-commerce sales hit US$ 1.03 trillion in 2022, an increase from US$ 518.5 billion in 2018. Many logistics giants in the market, such as UPS, FedEx, USPS, XPO Logistics, and Amazon, recognized the increasing demand for industrial vehicles in their warehouses. These companies have made significant investments in warehouse establishment and in automating their logistics operations. For instance, in November 2023, United Parcel Service opened the largest warehouse in Louisville, Kentucky, with an area of around 20 acres. This warehouse is made for storage and package handling, with a significant investment of US$ 79 million for the establishment of over 3,000 automated robots and industrial vehicles. These robots and industrial vehicles will handle several warehouse tasks, such as lifting and transportation of goods from one place to another, by reducing the requirement of manual labor. Rising such investments have created massive opportunities for industrial vehicles in North America.

North America Industrial Vehicles Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Industrial Vehicles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Industrial Vehicles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Industrial Vehicles Strategic Insights

North America Industrial Vehicles Report Scope

Report Attribute

Details

Market size in 2022

US$ 11,001.3 Million

Market Size by 2030

US$ 15,723.2 Million

Global CAGR (2022 - 2030)

4.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Drive Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Industrial Vehicles Regional Insights

North America Industrial Vehicles Market Segmentation

The North America industrial vehicles market is segmented based on type, drive type, level of autonomy, application, and country.

Based on type, the North America industrial vehicles market is segmented into forklifts, aisle trucks, tow tractors, container handlers, and others. The forklifts segment held the largest share in 2022.

In terms of drive type, the North America industrial vehicles market is segmented into internal combustion engine, battery-operated, and gas-powered. The battery-operated segment held the largest share in 2022.

By level of autonomy, the North America industrial vehicles market is bifurcated into non/semi-autonomous and autonomous. The non/semi-autonomous segment held a larger share in 2022.

Based on application, the North America industrial vehicles market is segmented into manufacturing, warehousing, and others. The manufacturing segment held the largest share in 2022.

Based on country, the North America industrial vehicles market is categorized into the US, Canada, and Mexico. The US dominated the North America industrial vehicles market in 2022.

Kion Group AG, Toyota Industries Corp, Mitsubishi Heavy Industries Ltd, Komatsu Ltd, Hyster-Yale Materials Handling Inc, Jungheinrich AG, CLARK Material Handling Co, Crown Equipment Corp, Konecranes Plc, and Anhui Heli Co Ltd are some of the leading companies operating in the North America industrial vehicles market.

1. Kion Group AG

2. Toyota Industries Corp

3. Mitsubishi Heavy Industries Ltd

4. Komatsu Ltd

5. Hyster-Yale Materials Handling Inc

6. Jungheinrich AG

7. CLARK Material Handling Co

8. Crown Equipment Corp

9. Konecranes Plc

10. Anhui Heli Co Ltd

The North America Industrial Vehicles Market is valued at US$ 11,001.3 Million in 2022, it is projected to reach US$ 15,723.2 Million by 2030.

As per our report North America Industrial Vehicles Market, the market size is valued at US$ 11,001.3 Million in 2022, projecting it to reach US$ 15,723.2 Million by 2030. This translates to a CAGR of approximately 4.6% during the forecast period.

The North America Industrial Vehicles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Vehicles Market report:

The North America Industrial Vehicles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Vehicles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Vehicles Market value chain can benefit from the information contained in a comprehensive market report.