Ball valves have a simple construction that features a ball mounted within a pipe. The ball valves are majorly known for their high durability, damage resistance, and low service requirements. They can be repaired easily without the need for intense workmanship. Furthermore, these valves do not require lubrication while offering a bubble-tight seal with low torque. Ball valves are also affordable and easy to use. In addition, they can handle and regulate high volume, pressure, and flow at elevated temperatures, which makes them suitable for operations involving various gasses and liquids. Thus, these factors are propelling the adoption of ball valves in industries such as oil & gas, water & wastewater, and chemicals & petrochemicals. For instance, in November 2023, FITOK Group announced the launch of its new BGP series ball valves for specialty gas, semiconductor, and chemical industry applications.

Butterfly valves are also among the most used valves in the industrial sector. The body of the valve is lightweight and available in disc and wafer form; it requires significantly less structural assistance than other types of valves such as ball valves. Further, they are cost-efficient and easier to install. Butterfly valves are well-known for their ability to effectively handle slurries and corrosive liquids. Thus, with rising urbanization, coupled with increasing deployment of wastewater treatment plants, the industrial valve market players are witnessing huge demand for butterfly valves. Hence, the rising use of ball valves and butterfly valves are fueling the industrial valve market growth.

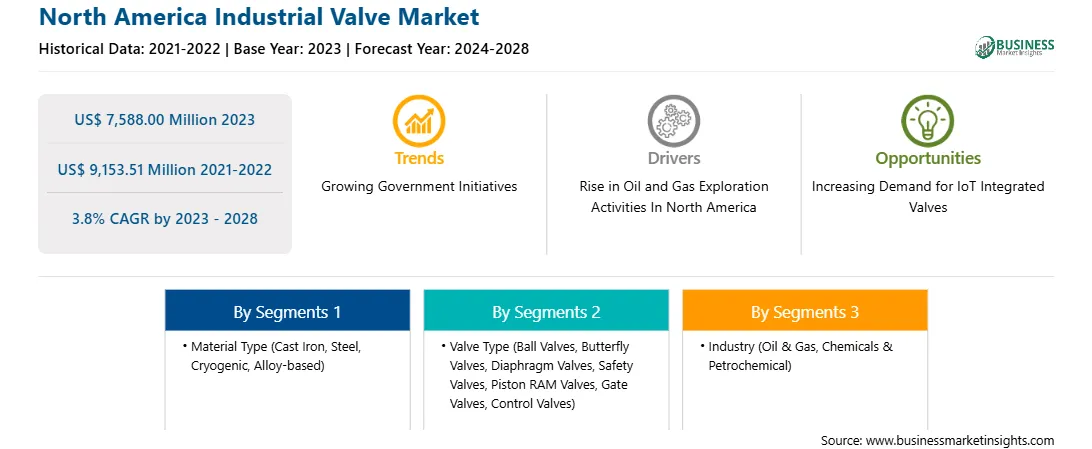

The North America industrial valves market, based on country, is segmented into the US, Canada, and Mexico. North America is an important market for industrial valves since it is home to a few top multinational firms, including Emerson, Cameron-Schlumberger, Flowserve Corporation, and Crane Company. Increasing R&D activities in the region related to actuator usage in valves for automation and the rising need for safety applications are driving the market growth in North America. In the US, R&D at the industry level is expanding the application areas of industrial valves in industries such as energy & power and chemicals. Control valves are used in oil & gas, energy & electricity, and water & wastewater treatment industries to regulate media flow; start, stop, or throttle flow; and assure safe and effective process automation.

Petroleum has been a major industry in the US since 1859, when oil was discovered in the Oil Creek area of Titusville, Pennsylvania. Exploration, production, processing, transportation, and marketing of natural gas and petroleum products are major activities carried out across the country by the pol & gas companies. In 2018, the US surpassed Russia and Saudi Arabia in oil production and became the world's top crude oil producer, generating 15% of global crude oil.

Strategic insights for the North America Industrial Valve provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Industrial Valve refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Industrial Valve Strategic Insights

North America Industrial Valve Report Scope

Report Attribute

Details

Market size in 2023

US$ 7,588.00 Million

Market Size by 2028

US$ 9,153.51 Million

Global CAGR (2023 - 2028)

3.8%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Material Type

By Valve Type

By Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Industrial Valve Regional Insights

North America Industrial Valve Market Segmentation

The North America industrial valve market is segmented based on material type, valve type, industry, and country. Based on material type, the North America industrial valve market is segmented into cast iron, steel, cryogenic, alloy-based, and others. The steel segment held the largest market share in 2023.

Based on valve type, the North America industrial valve market is segmented into ball valves, butterfly valves, diaphragm valves, safety valves, piston ram valves, gate valves, and control valves. The ball valves segment held the largest market share in 2023.

Based on industry, the North America industrial valve market is bifurcated into oil & gas and chemicals & petrochemical. The oil & gas segment held a larger market share in 2023.

Based on country, the North America industrial valve market is segmented into the US, Canada, and Mexico. The US dominated the North America industrial valve market share in 2023.

Velan Inc.; Crane Co.; Circor International Inc.; Flowserve Corp; Emerson Electric Co.; KITZ Corporation; Neway Valve (Suzhou) Co., Ltd; Spirax Sarco Engineering Plc; Schlumberger Ltd; and Weir Group PLC are the leading companies operating in the North America industrial valve market.

The North America Industrial Valve Market is valued at US$ 7,588.00 Million in 2023, it is projected to reach US$ 9,153.51 Million by 2028.

As per our report North America Industrial Valve Market, the market size is valued at US$ 7,588.00 Million in 2023, projecting it to reach US$ 9,153.51 Million by 2028. This translates to a CAGR of approximately 3.8% during the forecast period.

The North America Industrial Valve Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Valve Market report:

The North America Industrial Valve Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Valve Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Valve Market value chain can benefit from the information contained in a comprehensive market report.