The industrial radiography market in North America consists of the US, Canada, and Mexico. North America is inclined toward the adoption of modern technologies across industries owing to supportive government policies and a positive outlook for advanced technologies. North America has the largest aerospace industry in the world owing to the presence of military and commercial aircraft manufactures and MRO service providers. Positive outlook toward the adoption of new technologies coupled with the presence of skilled workforce, favorable economic policies, and high GDP per capita flourish the aerospace industry in the region. A few of the leading aircraft manufacturers operating in the region are Northrop Grumman, Gulfstream Aerospace, Boing, Textron, Bombardier, and Lockheed Martin. These aircraft OEMs have their manufacturing facilities across North America, and each manufacturing facility produces noteworthy volumes of aircraft models. Moreover, MRO contracts secured by StandardAero, Westjet, Collins Aerospace, and ST Engineering coupled with the inclination toward procuring military aircraft and helicopters in North America drive the growth of the industrial radiology market in this region. Further, North America has leveraged the automotive industry. Therefore, the region is one of the most significant passenger and commercial vehicle production and sales nations across the world. In 2018, 2019, and 2020, the production of passenger and commercial vehicles were 17,436,070, 16,783,398, and 13,375,622 units, respectively. Moreover, North America has a presence of major automotive manufacturers, such as Ford Motor Company, General Motors Company, Tesla, BMW, Porsche, Fiat Chrysler Automobiles, Daimler, Toyota, Honda, Nissan, Renault, RAM, VW, and Hyundai. Also, the governments in the region are taking initiatives for the development of the automotive sector. The Department of Energy administered the Advanced Technology Vehicle Manufacturing Loan Program worth US$ 25 billion. The growing automotive industry is driving the industrial radiology market in North America. Moreover, the region is characterized for developing and manufacturing high-quality industrial products. These products undergo numerous quality checks, which is one of the major contributors propelling the demand for industrial radiology across North America. Meanwhile, the region generates the majority of its energy from coal, gas, nuclear, and oil power plants, which is also fuelling the growth of the market in the region.

In North America, the US recorded the largest number of COVID-19 cases, with more than 20 million cases. In addition, California, Texas, Florida, and New York are among the majorly affected areas in the country. The federal government in the country did not impose nationwide lockdown in 2020. However, the governors of a few states decided to impose lockdown in their respective states. The lockdown hindered the operations of various industries, including manufacturing and aerospace. However, essential industries, such as fast-moving consumer goods (FMCG) and pharmaceutical, had to continue their operations. North America dominated the industrial radiography market owing to the presence of the world's largest aerospace sector in the US and the large automotive industry in Mexico, where radiography is widely used. Companies are increasingly focusing on decreasing radiation-related dangers and favoring portable solutions, prompting them to rethink their product line. The impact of the COVID-19 pandemic on the market was not only from the demand side but also from the supply side. Since manufacturing facilities in the region were not operational for months, supply chain was disrupted as well as the procurement of raw material was interrupted. Due to this, OEMs saw prominent challenge in keeping up with the quarterly revenue. Therefore, the COVID-19 pandemic has a negative impact on the industrial radiography market in the major North American countries.

Strategic insights for the North America Industrial Radiography provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

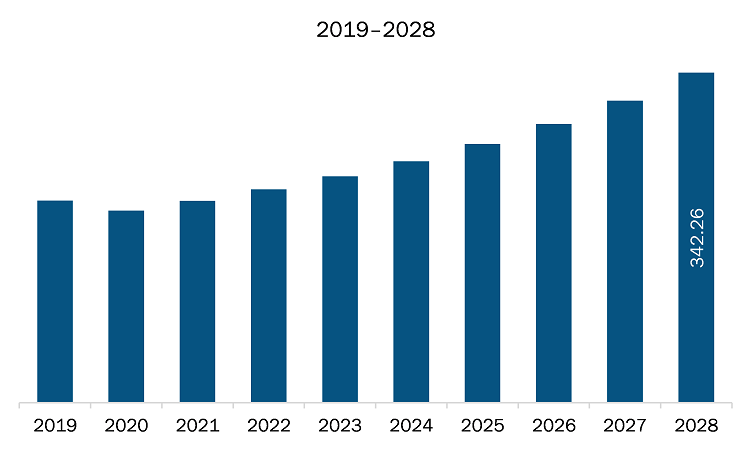

| Market size in 2021 | US$ 209.43 Million |

| Market Size by 2028 | US$ 342.26 Million |

| Global CAGR (2021 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technique

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Industrial Radiography refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The industrial radiography market in North America is expected to grow from US$ 209.43 million in 2021 to US$ 342.26 million by 2028; it is estimated to grow at a CAGR of 7.3% from 2021 to 2028. Growing MRO operation; from the past few years, the rising aviation industry has been propelling the demand for aircraft maintenance, repair, and overhaul (MRO) services. A few of the aircraft MRO businesses are Guangzhou Aircraft Maintenance Engineering Co., Ltd. (GAMECO), China; MTU Maintenance; and ExecuJet Haite Aviation Services China Co., Ltd. Huge spending on aviation infrastructure, economic growth, and increasing passenger count are among the factors propelling the adoption of aircraft MRO services. Moreover, the increasing number of middle-class travelers, is the main factor contributing to the growth of air travel, which is consequently increasing the need for aircraft MRO services in the region. The radiography technique is one of the most used techniques for inspecting aircraft components as it reduces overall downtime and cost subsequently. MRO companies across the region are engaged in the rapid adoption of radiography systems to ensure efficient and time-saving MRO procedures. With a rising fleet of wide-body and narrow-body aircraft, the airlines are demanding reliable and versatile systems for inspecting aircraft. Thus, it would create lucrative business opportunities for the players in the industrial radiography market in the coming years. This is bolstering the growth of the industrial radiography market.

Based on technique, the market is bifurcated into digital radiography and film-based radiography. In 2020, the digital radiography segment held the largest share North America industrial radiography market. By end-user industry, the market is segmented into petrochemical and gas, power generation, manufacturing, aerospace, automotive & transportation, and others. In 2020, the automotive & transportation segment held the largest share North America industrial radiography market.

A few major primary and secondary sources referred to for preparing this report on the industrial radiography market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Anritsu, Comet Group, Fujifilm Corporation, GENERAL ELECTRIC, METTLER TOLEDO, Nikon Corporation, SHIMADZU CORPORATION, and ZEISS International among others.

The North America Industrial Radiography Market is valued at US$ 209.43 Million in 2021, it is projected to reach US$ 342.26 Million by 2028.

As per our report North America Industrial Radiography Market, the market size is valued at US$ 209.43 Million in 2021, projecting it to reach US$ 342.26 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The North America Industrial Radiography Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Radiography Market report:

The North America Industrial Radiography Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Radiography Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Radiography Market value chain can benefit from the information contained in a comprehensive market report.