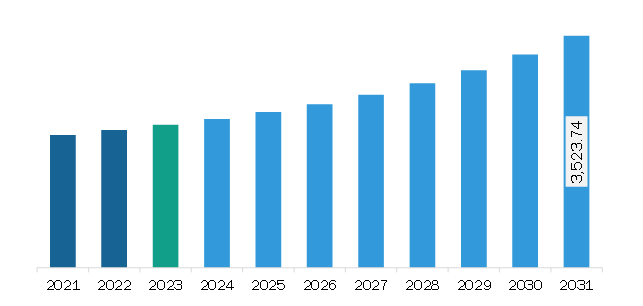

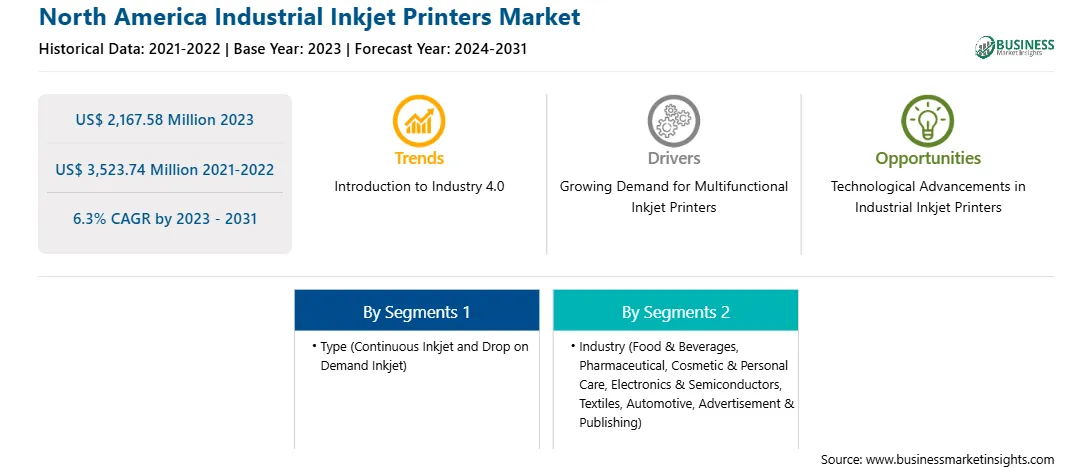

The North America industrial inkjet printers market was valued at US$ 2,167.58 million in 2023 and is expected to reach US$ 3,523.74 million by 2031; it is estimated to register a CAGR of 6.3% from 2023 to 2031.

Multifunctional inkjet printers offer features such as printing, scanning, copying, and faxing, making them an attractive option in industrial settings. In sectors such as packaging, textiles, and electronics, multifunctional inkjet printers integrate printing with scanning or labeling tasks, which reduces the need for separate machines. For instance, in September 2024, Mimaki announced the launch of four new versatile inkjet printers for the signage, textile, and industrial printing sectors. These solutions offer enhanced performance, particularly in terms of print speed and quality, while meeting the needs of professionals seeking to diversify their activities.

Multifunctional inkjet printers enable manufacturers to quickly adapt to custom designs, varying print materials, and different ink types. This flexibility is essential in industries that rely heavily on branding and personalization, such as food and beverage packaging and promotional products. For example, the use of custom product labeling has proliferated in the food and beverages industry, where companies want to personalize packaging for seasonal promotions or limited editions. Multifunctional inkjet printers can easily switch between different label designs and materials, which reduces setup times and costs.

Several companies are launching new multifunctional inkjet printers, offering various benefits. Therefore, the increasing demand for multifunctional inkjet printers fuels the growth of the North America industrial inkjet printers market.

The US industrial inkjet printer market is gaining traction owing to factors such as the increasing demand for efficient printing solutions, growing e-commerce sales, and rising requirements from the manufacturing industry. E-commerce and manufacturing industries are widely using industrial inkjet printers as they can print at high speeds, making them suitable for production environments where time is critical. They are used for printing date codes, batch codes, manufacturer and expiration dates, and other information. Moreover, government investment in sustainable packaging solutions is expected to create the opportunity for market growth. For example, in September 2024, the US Department of Commerce's Economic Development Administration (EDA) awarded a US$ 500,000 grant to the University of Wisconsin-Stevens Point in Stevens Point, Wisconsin, to support the expansion of the environmental sustainability of the packaging industry in Wisconsin. In September 2023, sustainable materials company Paptic announced that it had raised US$ 25 million in equity financing, aimed at growing the company's development of packaging materials and scaling up its ability to serve global customers. Such investment drives the demand for industrial inkjet printers that can utilize water-based inks or other eco-friendly formulations. This aligns with sustainability goals, allowing manufacturers to produce packaging without harmful solvents, thus reducing their carbon footprint.

Strategic insights for the North America Industrial Inkjet Printers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Industrial Inkjet Printers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Industrial Inkjet Printers Strategic Insights

North America Industrial Inkjet Printers Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,167.58 Million

Market Size by 2031

US$ 3,523.74 Million

Global CAGR (2023 - 2031)

6.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Industrial Inkjet Printers Regional Insights

The North America industrial inkjet printers market is categorized into type, industry, and country.

By type, the North America industrial inkjet printers market is bifurcated into continuous inkjet and drop on demand inkjet. The drop on demand inkjet segment held a larger share of the North America industrial inkjet printers market share in 2023.

In terms of industry, the North America industrial inkjet printers market is segmented into food & beverages, pharmaceutical, cosmetic & personal care, electronics & semiconductors, textiles, automotive, advertisement & publishing, and others. The food & beverages segment held the largest share of the North America industrial inkjet printers market share in 2023.

Based on country, the North America industrial inkjet printers market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America industrial inkjet printers market in 2023.

Brother Industries Ltd; Canon Inc; CTC Japan Inc; Docod Precision Group Limited; FUJIFILM Holdings America Corporation; Hitachi Industrial Equipment & Solutions America, LLC; HP Development Company L.P; Industrial Inkjet Ltd.; InkJet, Inc; KYOCERA Corporation; Lexmark International Inc; Linx Printing Technologies; Markem-Imaje; Pannier Corporation; REA Elektronik GmbH; Seiko Epson Corp; Squid Ink Manufacturing; Videojet Technologies Inc; Weber Marking Systems GmbH; and Xerox Corporation are the among leading companies operating in the North America industrial inkjet printers market.

The North America Industrial Inkjet Printers Market is valued at US$ 2,167.58 Million in 2023, it is projected to reach US$ 3,523.74 Million by 2031.

As per our report North America Industrial Inkjet Printers Market, the market size is valued at US$ 2,167.58 Million in 2023, projecting it to reach US$ 3,523.74 Million by 2031. This translates to a CAGR of approximately 6.3% during the forecast period.

The North America Industrial Inkjet Printers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Inkjet Printers Market report:

The North America Industrial Inkjet Printers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Inkjet Printers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Inkjet Printers Market value chain can benefit from the information contained in a comprehensive market report.