Point-of-care testing (POCT) has become critical to patient-centric healthcare due to the need for rapid diagnostic results to determine accurate and faster treatments. A shift from centralized point-of-care testing to decentralized testing has resulted in easy access to these diagnostics. Immunoassay testing helps monitor chronic conditions and detect pathogens, such as bacteria and viruses. Advanced point-of-care devices enable rapid screening of up to three components from a single sample. Also, the point-of-care diagnostics (POCD) inclined toward mobile healthcare (mH) smart devices could revolutionize personalized healthcare monitoring and management, paving the way for next-generation POCTs. The management of infectious diseases can be significantly improved by POCTs, particularly in developing countries where access to timely medical care is challenging and healthcare infrastructure is outdated and sparse. Additionally, the technologically developed diagnostic kits leading to fewer manual errors propel the immunodiagnostics market. Several market players are developing innovative immunodiagnostics products. For instance, Thermo Fisher Scientific has developed immunodiagnostics products such as enzyme-linked immunoassay (ELISA) reagents and buffers, antibodies and detection probes, linking mechanisms, blocking buffers and detergents, detection substrates, and capture surfaces, as well as services such as bioconjugation and detection. Further, in September 2020, Roche launched the SARS-CoV-2 Rapid Antigen Test, which is used in POC settings to help healthcare professionals identify the infection within 15 minutes in people suspected of carrying the virus.

In April 2021, DiaSorin introduced the LIAISON IQ, a new immunodiagnostics Point-of-Care (POC) reader, and the LIAISON QuickDetect COVID TrimericS Ab test, developed with Lumos Diagnostics for countries accepting the CE Mark. Using a fingerstick of human capillary blood, this test for the LIAISON IQ identifies specific IgG antibodies against SARS-CoV-2 Spike Protein in 10 minutes.

In April 2021, Chembio Diagnostics, Inc. launched an FDA Emergency Use Authorization-approved, in-licensed rapid point-of-care COVID-19/Flu A&B test for use in traditional and decentralized testing settings. The rapid immunoassay test requires no instrumentation and produces results in 15 minutes.

WHO applauded the test kit developers for efforts taken to innovate and respond to the masses’ requirements during the COVID-19 crisis. According to the American Society for Clinical Pathology, in March 2020, the Cepheid Xpert Xpress SARS-CoV-2 test became the first POC COVID-19 detection assay to receive Emergency Use Authorization (EUA) from the US Food and Drug Administration (FDA).

Likewise, the use of immunodiagnostics in cancer treatment is increasing. In oncology, an immunodiagnostics test can confirm the presence of a solid tumor by detecting known tumor-associated antigens or antibodies. These advantages and indications are driving the immunodiagnostics market.

The prevalence of cancer is increasing in the country at an alarming rate, leading to the rising demand for cancer diagnoses. According to the American Cancer Society’s (ASC) cancer facts & figures estimates for 2023, nearly 1.9 million new cancer cases were registered in the US. It is further projected that in 2023, the country will register 609,360 deaths from cancer, which is ~1,670 deaths a day. However, the increased diagnostics have reduced the number of cancer-linked deaths. As per the ASC, in the past 28 years, the death rate from cancer in men and women has fallen 32% from its peak in 1991 to 2019. The fall in death rates was found to be because of early and advanced cancer diagnoses. The awareness of the advancements in diagnostic technology has grown among people. Therefore, it has resulted in the significant growth of the immunoassay market in the US. Similarly, diabetes is prevailing at a high rate in the geriatric population in the US. Many companies are providing immunoassay kits for diabetes. For instance, Bio-Rad Laboratories, Inc. offers Bio-Plex Pro human diabetes immunoassays, which are reliable and convenient for studying human diabetes and obesity markers. They help in managing and treating diabetes in diabetic patients. The market is expected to witness significant growth due to the rising prevalence of diabetes among US citizens. According to the data published by the Centers for Disease Control and Prevention (CDC) in the 2023 National Diabetes Statistics Report, 37.3 million people have diabetes in the US, which accounts for 11.3% of the total US population. Also, the reports state that 96 million people aged 18 years or above are prediabetic, accounting for 38% of the US population. Thus, considering the prevalence of diabetes in the country, an increased demand for immunodiagnostics is anticipated, leading to market growth. There has been unprecedented growth in innovative and improved medical technologies in recent years. As a result, there have been developments in advanced diagnostics and the overall healthcare industry. Moreover, the US houses various companies developing cutting-edge products for point-of-care diagnosis, paving the way for the growth of the immunodiagnostics market. In April 2020, Bio-Rad Laboratories launched a blood-based immunoassay kit to identify antibodies to the SARS-CoV-2.

Strategic insights for the North America Immunodiagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Immunodiagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Immunodiagnostics Strategic Insights

North America Immunodiagnostics Report Scope

Report Attribute

Details

Market size in 2023

US$ 10,463.48 Million

Market Size by 2030

US$ 17,399.10 Million

Global CAGR (2023 - 2030)

7.5%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Product

By Clinical Indication

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Immunodiagnostics Regional Insights

North America Immunodiagnostics Market Segmentation

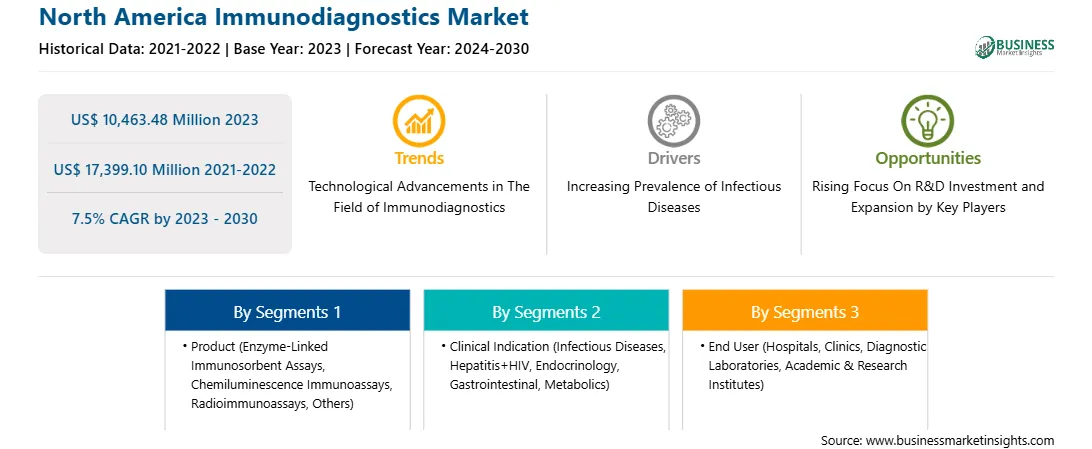

The North America immunodiagnostics market is segmented into product, clinical indication, end user, and country.

Based on product, the North America immunodiagnostics market is segmented into enzyme-linked immunosorbent assays (ELISA), chemiluminescence immunoassays (CLIA), radioimmunoassays (RIA), and others. In 2023, the enzyme-linked immunosorbent assays (ELISA) segment registered the largest share in the North America immunodiagnostics market. The chemiluminescence immunoassays (CLIA) segment is further segmented into vitamin D assay market, HIV detection market, HIV ag/ab combo assay market, and other tests.

Based on clinical indication, the North America immunodiagnostics market is segmented into infectious diseases, hepatitis+HIV, endocrinology, gastrointestinal, metabolics, and others. In 2023, the infectious diseases segment registered the largest share in the North America immunodiagnostics market. The infectious diseases segment is further segmented into COVID-19, tuberculosis, lyme, infection management, zika, treponema, torch, measles and mumps, VZV, and EBV. The endocrinology segment is further segmented into hypertension, growth, diabetes, thyroid, and reproductive endocrinology.

Based on end user, the North America immunodiagnostics market is segmented into hospitals, clinics, diagnostic laboratories, academic & research institutes, and others. In 2023, the hospitals segment registered the largest share in the North America immunodiagnostics market.

Based on country, the North America immunodiagnostics market is segmented into the US, Canada, Mexico. In 2023, the US registered the largest share in the North America immunodiagnostics market.

Abbott Laboratories; bioMerieux SA; Danaher Corp; DiaSorin SpA; F. Hoffmann-La Roche Ltd; PerkinElmer Inc; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Siemens Healthcare GmbH; Svar Life Science AB; and Thermo Fisher Scientific Inc are some of the leading companies operating in the North America immunodiagnostics market.

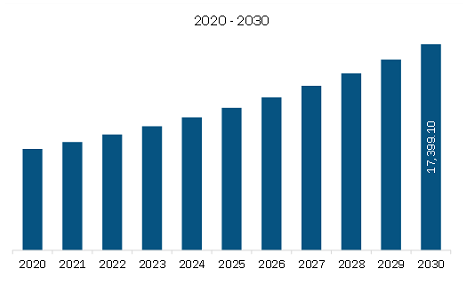

The North America Immunodiagnostics Market is valued at US$ 10,463.48 Million in 2023, it is projected to reach US$ 17,399.10 Million by 2030.

As per our report North America Immunodiagnostics Market, the market size is valued at US$ 10,463.48 Million in 2023, projecting it to reach US$ 17,399.10 Million by 2030. This translates to a CAGR of approximately 7.5% during the forecast period.

The North America Immunodiagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Immunodiagnostics Market report:

The North America Immunodiagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Immunodiagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Immunodiagnostics Market value chain can benefit from the information contained in a comprehensive market report.