Market Introduction

The safety needles market is anticipated to grow in the forecast period owing to driving factors such as high prevalence of blood-borne disease, active government participation to implement stringent regulations, increase in demand for injectable drugs & vaccines and untapped potential in the emerging economies. Nevertheless, high cost of safety needles and alternative drug delivery options are expected to hamper the market growth during the forecast period.

Moreover, the surge in demand for vaccines is expected to bolster the market growth during the forecast period.

The COVID-19 pandemic has resulted in many hospital admissions. These hospital admissions are followed by various tests using blood samples and various medications, which is expected to further fuel the market growth. Also, the rise in COVID-19 vaccinations has been observed, which will lead to increased demand for syringes and needles. The vaccine campaign has placed the spotlight on syringes and needles. Companies in the hypodermic needles are capitalizing on business opportunities with unprecedented demand for single-use needles. The COVID-19 pandemic has necessitated rapid vaccine development for the control of the disease. Most vaccinations, including those currently approved for COVID-19, are administered intramuscularly and subcutaneously using hypodermic needles. Manufacturers in the hypodermic needles market are maintaining robust supply chains to meet requirements for vaccine campaigns and ongoing COVID-19 cases of patients in hospitals.

Market Overview and Dynamics

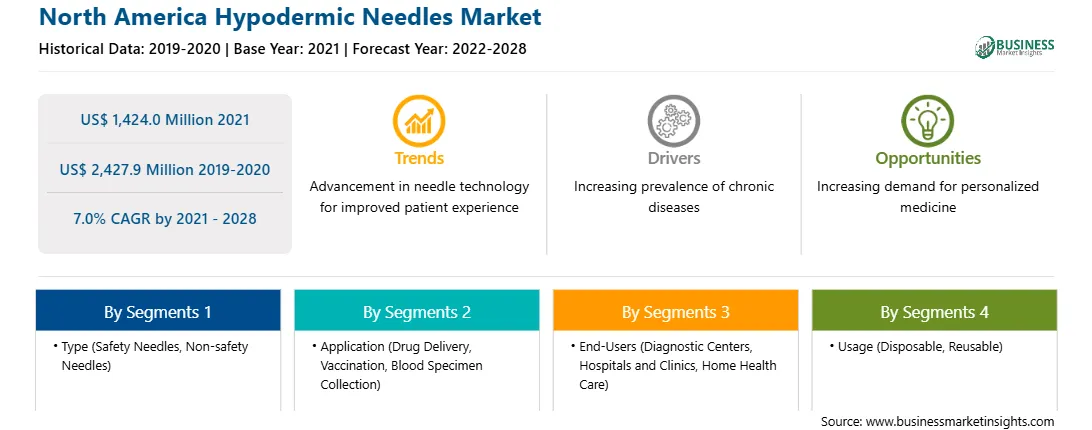

The North America hypodermic needles market is expected to reach US$ 2,427.9 million by 2028 from US$ 1,424.0 million in 2021. The market is estimated to grow at a CAGR of 7.0% from 2021–2028. As per the CDC, direct costs for testing and treatment can range from US$ 500 to US$ 3,000 per injury. Safety needles are designed to deliver drugs by maintaining safety features for avoiding needlestick injuries. Safety-engineered devices protect healthcare workers from avoidable needlestick injury and risk of infection with Hepatitis or even HIV. Introducing safety devices is essential to remove unnecessary risks from the healthcare professional’s working environment. The demand for safety hypodermic needles is likely to increase with the rising popularity of safety syringes and needles supported by the Needlestick Safety and Prevention Act that reduces unnecessary costs and needlestick injuries. The enforcement of such legislation will stimulate demand for North America hypodermic needles market in the coming years.

Key Market Segments

In terms of type, the safety needles segment accounted for the largest share of the North America hypodermic needles market in 2020. In terms of application, the drug delivery segment accounted for the largest share of the North America hypodermic needles market in 2020. In terms of end user, the hospital segment accounted for the largest share of the North America hypodermic needles market in 2020. Further, based on usage, the disposable segment held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the hypodermic needles market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are EXELINT International, Co., Terumo Corporation, BD, B. Braun Melsungen AG, Catalent Inc., Cardinal Health Inc., Vita Needle Company, Connecticut Hypodermics Inc., Vygon, Barber of Sheffield, RETRACTABLE TECHNOLOGIES, INC., and AIR-TITE PRODUCTS CO., INC.Reasons to Buy Report

NORTH AMERICA HYPODERMIC NEEDLES MARKET SEGMENTATION

By Country

Companies Mentioned

Strategic insights for the North America Hypodermic Needles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,424.0 Million |

| Market Size by 2028 | US$ 2,427.9 Million |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Hypodermic Needles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Hypodermic Needles Market is valued at US$ 1,424.0 Million in 2021, it is projected to reach US$ 2,427.9 Million by 2028.

As per our report North America Hypodermic Needles Market, the market size is valued at US$ 1,424.0 Million in 2021, projecting it to reach US$ 2,427.9 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The North America Hypodermic Needles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hypodermic Needles Market report:

The North America Hypodermic Needles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hypodermic Needles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hypodermic Needles Market value chain can benefit from the information contained in a comprehensive market report.