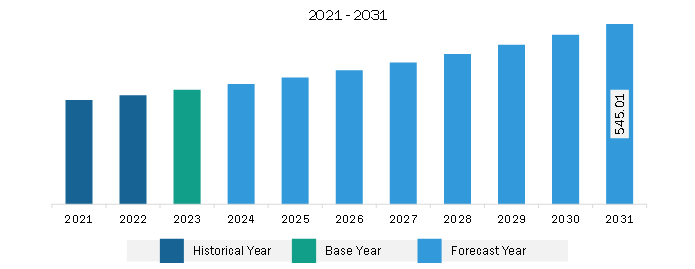

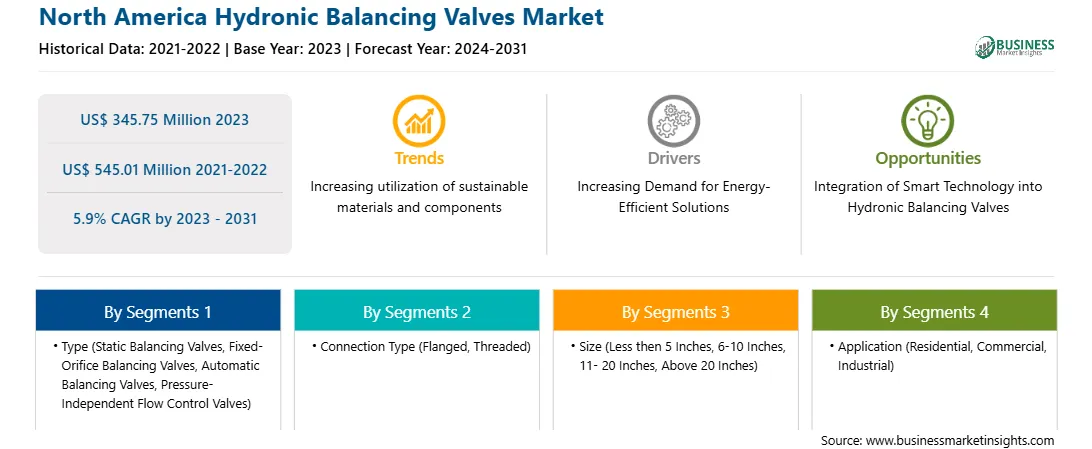

The North America hydronic balancing valves market was valued at US$ 345.75 million in 2023 and is expected to reach US$ 545.01 million by 2031; it is estimated to register a CAGR of 5.9% from 2023 to 2031.

Consumer preference for energy-efficient appliances has been growing in recent times. Energy efficiency can provide long-term benefits by reducing overall electricity demand by lowering the need to invest in new infrastructure for electricity generation and transmission. It also contributes to the diversification of utility resource portfolios and can act as a buffer against the risk of volatile energy procurement expenditure. To attain energy efficiency, many manufacturing industries and commercial manufacturing companies are procuring high-efficiency HVAC systems. An efficient HVAC system utilizes less energy and operates more effectively than conventional systems, lowering the carbon footprint. In hydronic systems, the balancing valves facilitate the distribution of chilled or heated water to all terminals. The growing application of HVAC (Heating, Ventilation, and Air Conditioning) systems in air conditioning and heat pumps for achieving energy and growing implementation of energy efficiency standards for public buildings are boosting the demand for HVAC systems in various industrial and commercial sectors. Furthermore, growing initiatives of state and local governments are promoting energy efficiency programs and policies for public facilities, equipment usage, and government operations, which is boosting the application of HVAC systems. For instance, the renewable portfolio standard for New York was developed and implemented in 2004 and was expanded by Governor Cuomo's Clean Energy Standard (CES) in 2016. The CES has set a target of ~40% and approximately 80% reduction in greenhouse gas emissions by 2030 and 2050, respectively. One of the US states such as North Carolina has implemented renewable energy standards (RES) and the Zero-Emissions Credit (ZEC) requirement to lower carbon emissions. The main energy consumers in municipal-level operations are often the water and wastewater treatment facilities.

High-quality HVAC systems can be used at water and wastewater facilities to decrease energy costs and greenhouse gas emissions, which also increases the application of hydronic balancing valves. Thus, the growing demand for energy-efficient solutions drives the North America hydronic balancing valves market.

There is a rise in the adoption of HVAC systems owing to various features provided in these systems, such as energy efficiency and sustainability. According to Air Conditioning Contractors of America ACCA, HVAC services in North America are set to increase in value from US$ 25.6 billion in 2019 to US$ 35.8 billion by 2030. The growing application of HVAC systems is anticipated to propel the growth of the hydronic balancing valves market during the forecast period.

The hydronic balancing valves market is observing potential growth, owing to the rising adoption of advanced technologies and the increasing need for green construction solutions. Major application sectors such as residential, commercial, and industrial opt to integrate their HVAC systems into building management automation systems that streamline the system’s operation and maintenance. High technological development is boosting the application of advanced HVAC systems, which results in an increased usage of hydronic balancing valves in North America.

There is an increase in the utilization of advanced HVAC systems in various industries focused on energy efficiency and air quality improvement. The demand for hydronic balancing valves is directly influenced by the growth in manufacturing facilities, the pharmaceutical industry, IT, and ITES companies with rapid industrialization, along with the expansion of the service sector. Moreover, the wide presence of hydronic balancing valve manufacturers and suppliers such as Hays Fluid Controls, Victaulic Company, Red-White Valve Corp., Nibco Inc., Xylem Inc., and American Wheatley also fuels the market growth.

Strategic insights for the North America Hydronic Balancing Valves provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 345.75 Million |

| Market Size by 2031 | US$ 545.01 Million |

| Global CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Hydronic Balancing Valves refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America hydronic balancing valves market is categorized into type, connection type, size, application, and country.

Based on type, the North America hydronic balancing valves market is segmented into static balancing valves, fixed-orifice balancing valves, automatic balancing valves, and pressure-independent flow control valves. The static balancing valves segment held the largest market share in 2023.

In terms of connection type, the North America hydronic balancing valves market is segmented into flanged, threaded, and others. The flanged segment held the largest market share in 2023.

By size, the North America hydronic balancing valves market is segmented into less then 5 inches, 6-10 inches, 11- 20 inches, and above 20 inches. The less then 5 inches segment held the largest market share in 2023.

By application, the North America hydronic balancing valves market is segmented into residential, commercial, and industrial. The residential segment held the largest market share in 2023.

By country, the North America hydronic balancing valves market is segmented into the US, Canada, and Mexico. The US dominated the North America hydronic balancing valves market share in 2023.

Caleffi S.p.a.; Danfoss AS; Frese A/S; Global Flow Products LLC; HAYS FLUID CONTROLS; Johnson Controls International Plc; Oventrop GmbH & Co. KG; Red-White Valve Corp.; Victaulic Company; and Xylem Inc. are some of the leading companies operating in the North America hydronic balancing valves market.

The North America Hydronic Balancing Valves Market is valued at US$ 345.75 Million in 2023, it is projected to reach US$ 545.01 Million by 2031.

As per our report North America Hydronic Balancing Valves Market, the market size is valued at US$ 345.75 Million in 2023, projecting it to reach US$ 545.01 Million by 2031. This translates to a CAGR of approximately 5.9% during the forecast period.

The North America Hydronic Balancing Valves Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hydronic Balancing Valves Market report:

The North America Hydronic Balancing Valves Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hydronic Balancing Valves Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hydronic Balancing Valves Market value chain can benefit from the information contained in a comprehensive market report.