North America includes developed economies, such as the US and Canada, and emerging economies, such as Mexico. Technological developments make North America a highly competitive market for various companies. The companies in this region are continuously developing overall business processes to meet end users’ demands for high-quality products. Presently, the US boasts of robust port infrastructure and maritime sector due to its significant reliance on imported goods and notable outsourcing of manufacturing and production facilities over Asian economies. As per the National Ocean Service, the marine transportation system in the US moves ~80% of the country’s overseas trade in terms of weight. The region is highly inclined to keep its marine transportation system functioning in safe and efficient ways. North America is focused on achieving data about water depth, the shape of the seafloor and coastline, and other physical features of water bodies. Thus, it is highly adopting hydrographic survey software and services, which offer efficient data to improve the water bodies. A National Oceanic and Atmospheric Administration (NOAA) survey ship uses its multibeam echo sounder—a sound transmitting and receiving system—to perform the hydrographic surveys. Thus, to conduct surveys to measure various activities in oceans and rivers, the demand for hydrographic surveys is surging in the region; this, in turn, is accelerating the market growth.

Furthermore, in case of COVID-19, North America is highly affected specially the US. North America is one of the most important regions for adopting and developing new digital technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any negative impact on the growth of industries is expected to affect the economic growth of the region. Presently, the US is the world’s worst-affected country due to the COVID-19 outbreak, with 26,654,965 confirmed cases and 458,544 deaths as of 8th February 2021 by the World Health Organization (WHO). The US is a prominent market for the hydrographic survey for oil & gas and marine sectors. The factory and business shutdowns across the US, Canada, and Mexico impact the adoption of the hydrographic survey market. Due to shortage in the workforce and the practical difficulties in many social distancing cases hindered oil & gas activities in the US, which leads to a halt in various ongoing projects. Thus, it also impacted the integration of hydrographic survey software. The ongoing COVID-19 crisis and critical situation in the US will impact the hydrographic survey market growth of North America negatively for the next few months.

Strategic insights for the North America Hydrographic Survey provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

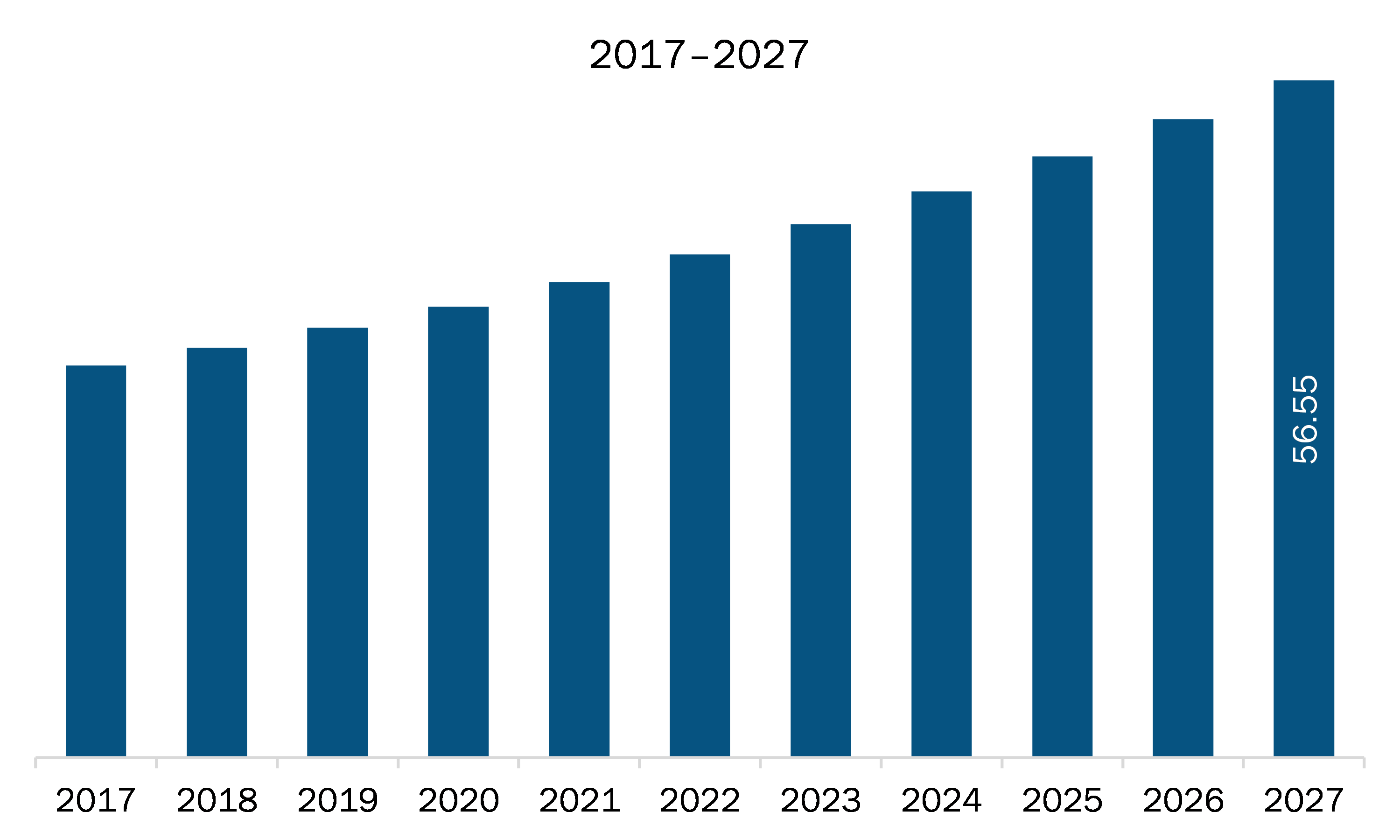

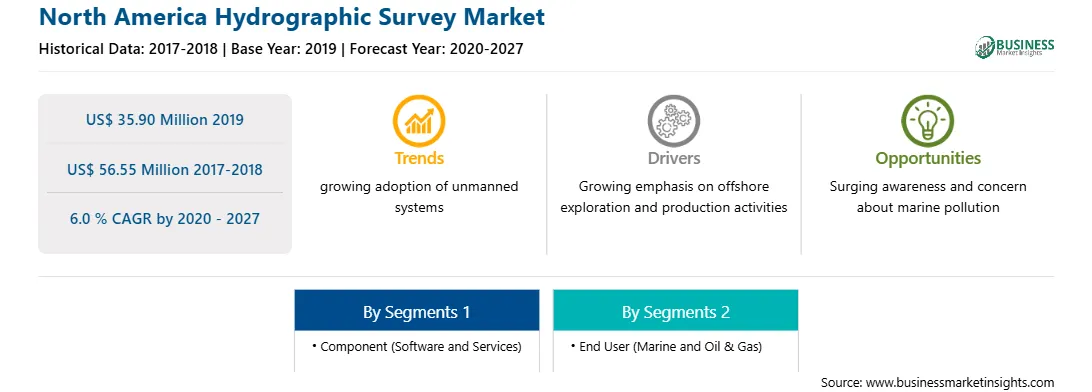

| Market size in 2019 | US$ 35.90 Million |

| Market Size by 2027 | US$ 56.55 Million |

| Global CAGR (2020 - 2027) | 6.0 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Hydrographic Survey refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America hydrographic survey market is expected to grow from US$ 35.90 million in 2019 to US$ 56.55 million by 2027; it is estimated to grow at a CAGR of 6.0 % from 2020 to 2027. Growing demand for energy & power projects is expected to upsurge the North America hydrographic survey market. North American countries such as Mexico and Canada, are likely to offer numerous growth opportunities to the hydrographic survey providers during the forecast period. The growth in industrialization in these economies has led to urbanization, resulting in a rapid increase in energy consumption. Moreover, the demand for energy and power is set to increase with surging household incomes and expanding manufacturing and heavy industries. The number of energy & power projects, including wind and solar projects, is mounting rapidly in North American countries. Thus, the rise in demand for energy and power—leading to the escalation in the related projects—especially in countries like Mexico, is expected to provide numerous profitable business opportunities for hydrographic survey market players during the forecast period across North America region.

In terms of component, the software segment accounted for the largest share of the North America hydrographic survey market in 2019. In terms of end user, the oil & gas segment held a larger market share of the North America hydrographic survey market in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America hydrographic survey market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Esri, HYPACK / Xylem Inc., IIC Technologies, Quality Positioning Services B.V. (QPS), Teledyne Marine (Teledyne Technologies Incorporated), Triton Imaging, Inc.

The North America Hydrographic Survey Market is valued at US$ 35.90 Million in 2019, it is projected to reach US$ 56.55 Million by 2027.

As per our report North America Hydrographic Survey Market, the market size is valued at US$ 35.90 Million in 2019, projecting it to reach US$ 56.55 Million by 2027. This translates to a CAGR of approximately 6.0 % during the forecast period.

The North America Hydrographic Survey Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hydrographic Survey Market report:

The North America Hydrographic Survey Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hydrographic Survey Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hydrographic Survey Market value chain can benefit from the information contained in a comprehensive market report.