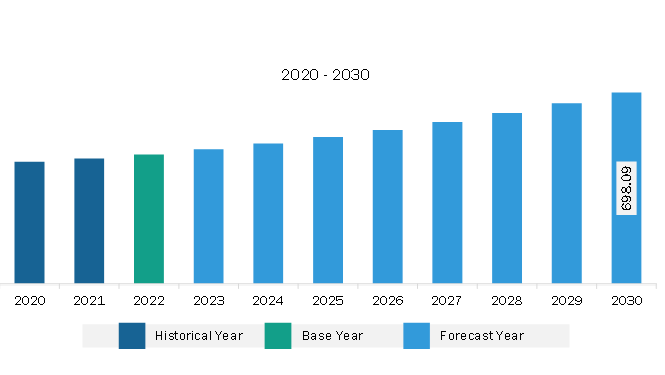

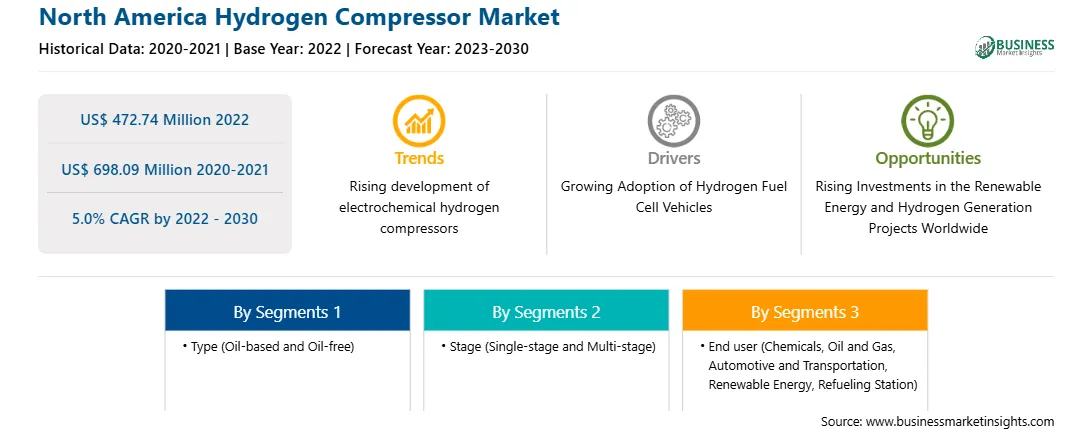

The North America hydrogen compressor market was valued at US$ 472.74 million in 2022 and is expected to reach US$ 698.09 million by 2030; it is estimated to register a CAGR of 5.0% from 2022 to 2030.

The rise in government investments in the development of hydrogen fuel infrastructure and incentives offered to the buyers are allowing the original equipment manufacturers (OEMs) to expand their revenue stream as well as their geographical presence. There is an increase in demand for low-emission and cost-efficient vehicles owing to associated government initiatives and a growing number of high-performance commercial vehicles across the globe. Numerous government policies have been deployed to reduce emissions by vehicles. For instance, in the US, the state of California dedicated funds for the development of 100 hydrogen refueling stations and is aiming to reach ~1.5 million zero-emission vehicles by 2025, driving the demand for hydrogen fuel cell vehicles. Due to rising concerns regarding the depletion of natural resources and environmental degradation, several technologies have been developed and introduced in the market that favor the eco-friendly concept of sustainability. Similarly, rising awareness related to the effects of air pollution and the surge in greenhouse gas emissions is propelling the demand for hydrogen fuel cell vehicles that offer higher fuel economy than internal combustion engine (ICE) vehicles. This vehicle has a fuel economy of more than 63 miles per gallon, while ICE vehicle has 29 miles per gallon on roads. Hydrogen fuel cell vehicles enhance the fuel economy by approximately 3.2%.

Moreover, the fuel cell vehicles can travel approximately 300 miles without refueling.

For instance, the recently launched Honda Clarity offers a zero-emission vehicle in the US with a range of ~366 miles. Hence, achieving better fuel economy and increased driving range is driving the demand for hydrogen compressors. Globally, the adoption of hydrogen fuel cell vehicles is increasing with government support and funding, which boosted investments in hydrogen fuel stations across the globe. According to the Green Car Congress Organization, in 2022, more than 1,000 hydrogen fuel stations were deployed across the globe, and this is growing rapidly with an increase in government investment in hydrogen fuel projects. China has the largest, nearly one-third of the global deployments of hydrogen fuel stations, followed by the US and Japan according to the International Energy Agency. Thus, the growing adoption of hydrogen fuel cell vehicles drives the North America hydrogen compressor market.

The North America hydrogen compressor is segmented into the US, Canada, and Mexico, which have a significant demand for hydrogen compressors owing to the growth in the oil & gas sector. According to the Energy Information Administration in the US, crude oil production in 2022 reached a 0.6 million per day increase of 5.6% compared to 2021. Hydrogen compressor is used in petroleum refineries to ensure leakage-free compression of the oil and gas. In October 2023, Pemex Mexican oil and gas company announced its plan to invest ~US$ 9.2 billion for the expansion of its petroleum refineries.

In North America, the US has the largest market share in 2022, owing to the rapid growth in the oil & gas sector, and is also expected to witness growth in drilling activities in the coming years. The government's growing investment in oil and gas projects in the region is likely to increase the demand for hydrogen compressors. Various oil & gas projects in North America are expected to boost the North America hydrogen compressor market growth. For instance, the US Department of Energy planned to invest US$ 7 billion in launching the seven clean hydrogen hubs across the nation, and the government planned to accelerate the commercial-scale deployment of clean hydrogen. North America is witnessing significant growth in the renewable energy & power sector owing to growing demand for power transmission projects. Hydrogen compressors are used to compress and store energy efficiently. For instance, in November 2021, the US government passed the Bipartisan Infrastructure Law and invested US$ 9.5 billion in the clean hydrogen project initiatives. This funding will help promote clean hydrogen production over the next five years.

Strategic insights for the North America Hydrogen Compressor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 472.74 Million |

| Market Size by 2030 | US$ 698.09 Million |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Hydrogen Compressor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America hydrogen compressor market is categorized into type, stage, end user, and country.

Based on type, the North America hydrogen compressor market is bifurcated into oil-based and oil-free. The oil-based segment held a larger market share in 2022.

In terms of stage, the North America hydrogen compressor market is bifurcated into single-stage and multi-stage. The multi-stage segment held a larger market share in 2022

By end user, the North America hydrogen compressor market is segmented into chemicals, oil and gas, automotive and transportation, renewable energy, refueling stations, and others. The oil and gas segment held the largest market share in 2022.

By country, the North America hydrogen compressor market is segmented into the US, Canada, and Mexico. The US dominated the North America hydrogen compressor market share in 2022.

Atlas Copco AB; Burckhardt Compression AG; Fluitron, Inc.; Gardner Denver Nash, LLC; Howden Group; HAUG Sauer Kompressoren AG; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; and PDC Machines Inc. are among the leading companies operating in the North America hydrogen compressor market.

The North America Hydrogen Compressor Market is valued at US$ 472.74 Million in 2022, it is projected to reach US$ 698.09 Million by 2030.

As per our report North America Hydrogen Compressor Market, the market size is valued at US$ 472.74 Million in 2022, projecting it to reach US$ 698.09 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The North America Hydrogen Compressor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hydrogen Compressor Market report:

The North America Hydrogen Compressor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hydrogen Compressor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hydrogen Compressor Market value chain can benefit from the information contained in a comprehensive market report.