Technological advancements have led to a competitive market in the region as the population gets attracted to several technological developments owing to high spending powers. With the increasing adoption of air conditioning, heating, and ventilation systems in commercial buildings of North America, the HVAC industry is constantly growing in the region. The HVAC sensors enable manufacturers to offer advancements such as improved temperature sensing, pressure sensing, and air quality improvement in HVAC systems. Besides, the rising adoption of connected HVAC systems is creating ample opportunities for the market players to develop advanced sensors detecting occupancy and light for energy saving. Further, rising demand for air quality improvement systems in the US is propelling the adoption of air quality sensors in HVAC systems. The market players are offering advanced sensors for new HVAC systems and retrofit sensing solutions for existing systems to improve their performance. For instance, in November 2020, Honeywell International Inc. introduced a new line of indoor air quality sensors (IAQ) and electronic air cleaners (EACs) with UV systems. The IAQ sensors integrated in the HVAC system improve the air quality of indoor spaces. These IAQ sensors are also suitable for retrofit installation in an existing HVAC system in buildings. The company is offering advanced sensors for both new and retrofit installation to upgrade the HVAC systems, which is a positive sign for the market growth. Factors such as rise in construction sector and increasing demand for HVAC sensors in the automotive sector are driving the growth of the North America HVAC sensors market.

Furthermore, in case of COVID-19, North America is highly affected specially the US. According to the American Institute of Architects (AIA), the construction sector in the US has been hit hard by the COVID-19 outbreak. The construction activity declined in 2020 and the trend is likely to prevail in 2021. The construction activities in terms of hospitality industry are declined by approximately 20%, by approximately 8% in the retail sector, and close to 11% in commercial offices. However, the construction of healthcare facilities and public safety have surged in 2020. The industries that install higher volumes of HVAC systems have been hit at various levels of degree by the COVID-19 pandemic. Hotels, hospitality, and restaurants, have been struggling due to concerns over contracting the virus, even after they could reopen. The Canadian and Mexican HVAC sensors market also witnessed and are experiencing similar tremors owing the widespread of COVID-19 virus. The commercial sector in the two countries have been witnessing significant shocks. Apart from commercial sector, the residential HVAC systems industry in Canada and Mexico also observed decline in sales owing to the concerns over rapid spread of the virus under cooler environments.

Strategic insights for the North America HVAC Sensors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

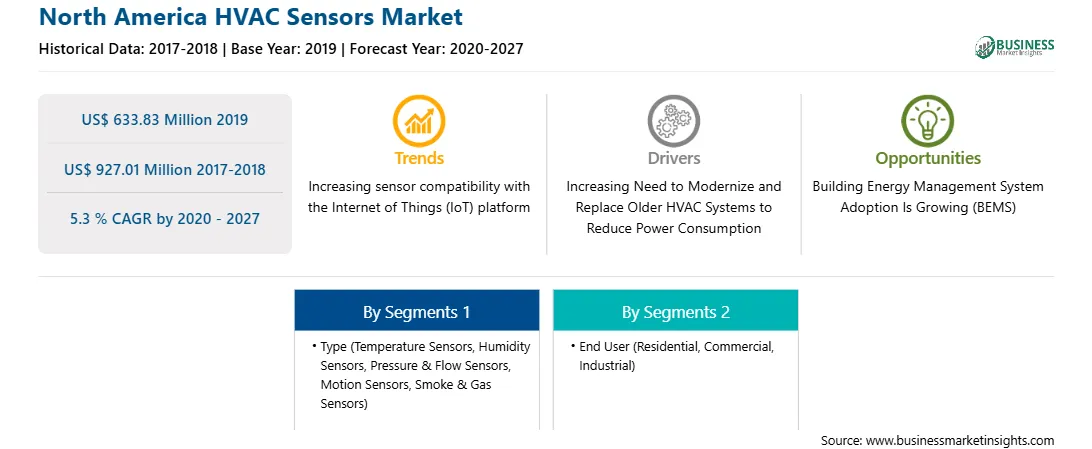

| Market size in 2019 | US$ 633.83 Million |

| Market Size by 2027 | US$ 927.01 Million |

| Global CAGR (2020 - 2027) | 5.3 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America HVAC Sensors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America HVAC sensors market is expected to grow from US$ 633.83 million in 2019 to US$ 927.01 million by 2027; it is estimated to grow at a CAGR of 5.3 % from 2020 to 2027. Execution of smart, connected, and energy efficient IOT-enabled HVAC systems is expected to accelerate the market. HVAC system is one of the major electricity consumers, particularly in a commercial or residential building. At present, air conditioners and electric fans contribute to ~20% of the total electricity consumption in a building. The growing energy demands from HVAC systems is resulting in rising costs of electricity; therefore, the HVAC manufacturers are seeking ways to enhance their products’ energy efficiency and offer customers tools that can help them monitor their devices/systems. Advanced IoT-enabled sensors facilitate users to gain information on outdoor radiant temperature, indoor air temperature, circulation patterns, air speed, and indoor and outdoor humidity, among others. The information collected by the smart sensors is transferred to central database that connects the HVAC system to the internet. Through this, the status is then exported to apps and dashboards. It further enables importing information such as weather forecasts as well as user preferences. Automatic HVAC systems can be adjusted as per the forecasts and user preferences without the user input. IoT is transforming standalone systems into connected devices with integrated sensors facilitating building owners in saving energy consumption significantly in HVAC systems. The demand for smart IoT-enabled HVAC systems is anticipated to propel in coming days with the decreasing price of IOT-enabled sensors, which will drive the North America HVAC sensors market.

In terms of type, the temperature sensors segment accounted for the largest share of the North America HVAC sensors market in 2019. In terms of end user, the commercial segment held a larger market share of the North America HVAC sensors market in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America HVAC sensors market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BELIMO AIRCONTROLS (USA), INC.; Emerson Electric Co.; Honeywell International Inc.; Johnson Controls, Inc.; Schneider Electric; Sensata Technologies, Inc.; Sensirion AG; Siemens AG; TE Connectivity Ltd.

The North America HVAC Sensors Market is valued at US$ 633.83 Million in 2019, it is projected to reach US$ 927.01 Million by 2027.

As per our report North America HVAC Sensors Market, the market size is valued at US$ 633.83 Million in 2019, projecting it to reach US$ 927.01 Million by 2027. This translates to a CAGR of approximately 5.3 % during the forecast period.

The North America HVAC Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America HVAC Sensors Market report:

The North America HVAC Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America HVAC Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America HVAC Sensors Market value chain can benefit from the information contained in a comprehensive market report.