The North America household vacuum cleaners market is a highly

North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the downfall of household vacuum cleaners manufacturing activities during the early years of 2020. However, the COVID-19 outbreak has emphasized the significance of cleanliness and hygiene practices among the populace. Cleaning of the floors has become essential. Vacuuming can significantly lessen the amount of virus by capturing and retaining debris, dust, and other particles. This factor is anticipated to bolster the demand for household vacuum cleaners in North America in coming years.

Strategic insights for the North America Household Vacuum Cleaners provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

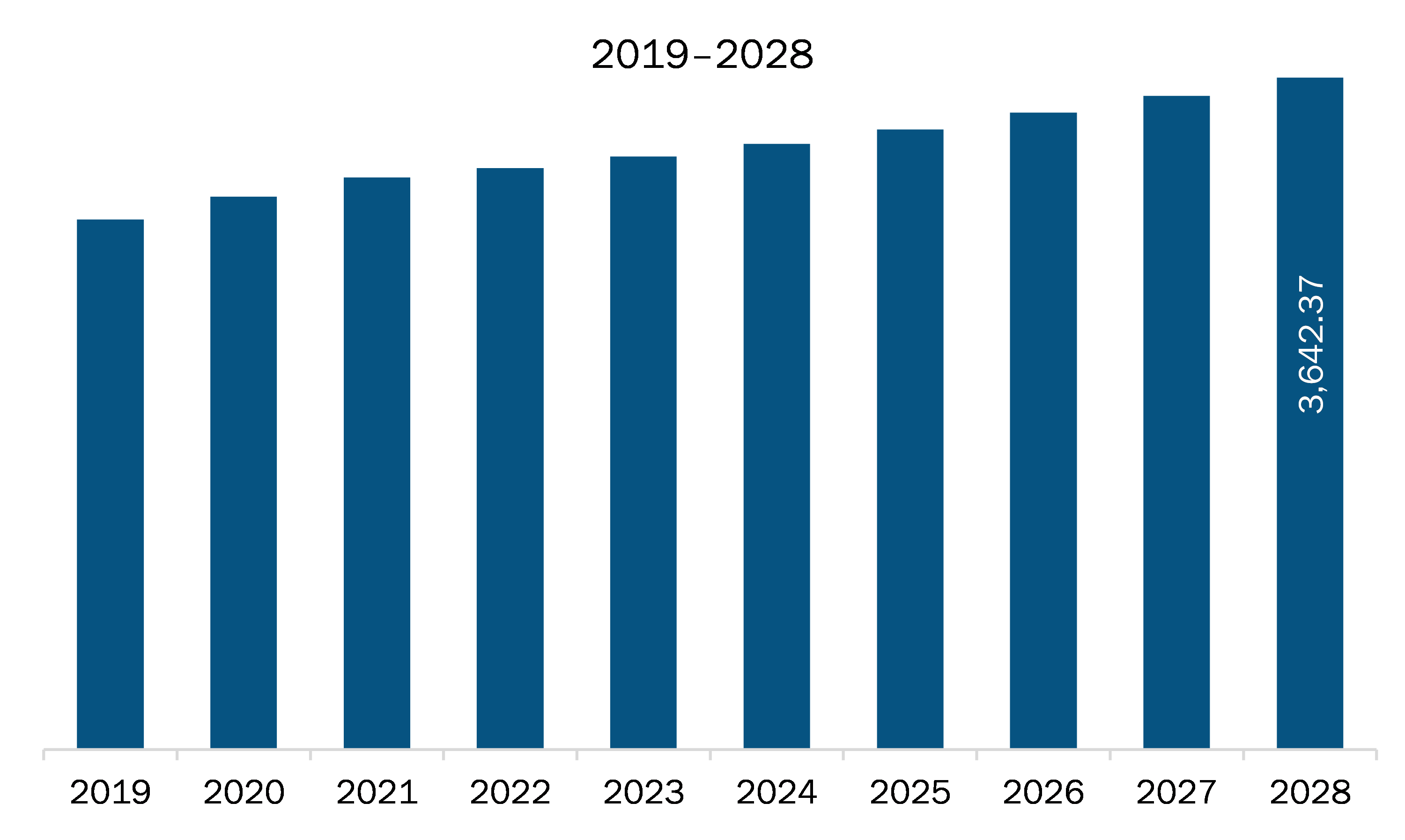

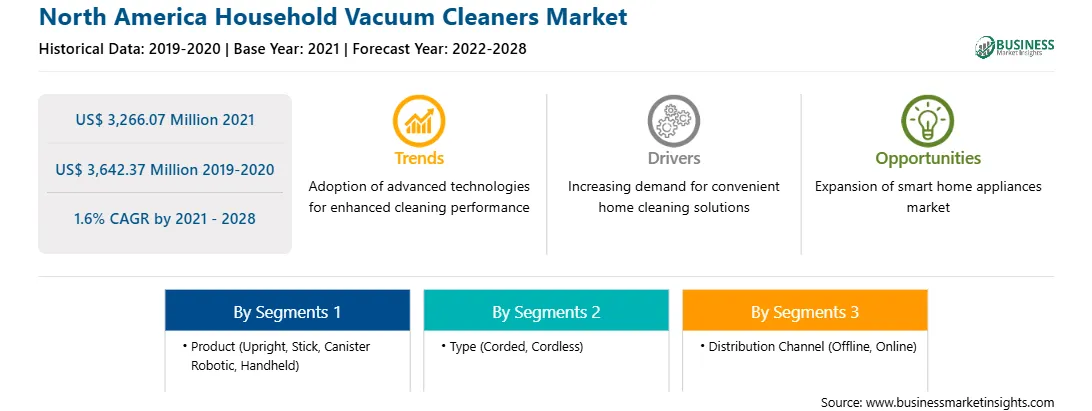

| Market size in 2021 | US$ 3,266.07 Million |

| Market Size by 2028 | US$ 3,642.37 Million |

| Global CAGR (2021 - 2028) | 1.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Household Vacuum Cleaners refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The household vacuum cleaners market in North America is expected to grow from US$ 3,266.07 million in 2021 to US$ 3,642.37 million by 2028; it is estimated to grow at a CAGR of 1.6% from 2021 to 2028. Cleaning houses manually has been a conventional method of maintaining hygiene and cleanliness at home. However, houses can be cleaned more effectively and in much less time with the help of household vacuum cleaners, compared to traditional ways of cleaning. However, the need for vacuum cleaners in the household is not just limited to cleaning, nowadays, as the devices are also being considered to keep the environment germ-free. Vacuum cleaners not only provide better and more effective means of cleaning floors but also purify the air. Companies are investing in R&D to introduce new household vacuum cleaners with advanced motor technologies to further enhance the machine's energy-efficiency and performance. For instance, in September 2019, Miele announced its new cordless household vacuum cleaner with built-in high-efficiency particulate absorbing (HEPA) filters. The HEPA filters significantly enhance indoor air quality and reduce the chances of allergies and asthma by preventing the release of pollutants in air. As a result, the growing preference for household vacuum cleaners for maintaining hygiene is propelling the market growth.

Based on product, the canister segment accounted for the largest share of the North America household vacuum cleaners market in 2020. Based on type, the corded segment accounted for the largest share of the North America household vacuum cleaners market in 2020. Based on distribution channel, the offline segment accounted for the largest share of the North America household vacuum cleaners market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America household vacuum cleaners market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Bissel Inc.; Electrolux; Koninklijke Philips N.V.; Stanley Black & Decker, Inc.; Haier Group; Dyson Limited; Eureka Forbes; Groupe SEB; Miele and Oreck Corporation.

The North America Household Vacuum Cleaners Market is valued at US$ 3,266.07 Million in 2021, it is projected to reach US$ 3,642.37 Million by 2028.

As per our report North America Household Vacuum Cleaners Market, the market size is valued at US$ 3,266.07 Million in 2021, projecting it to reach US$ 3,642.37 Million by 2028. This translates to a CAGR of approximately 1.6% during the forecast period.

The North America Household Vacuum Cleaners Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Household Vacuum Cleaners Market report:

The North America Household Vacuum Cleaners Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Household Vacuum Cleaners Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Household Vacuum Cleaners Market value chain can benefit from the information contained in a comprehensive market report.