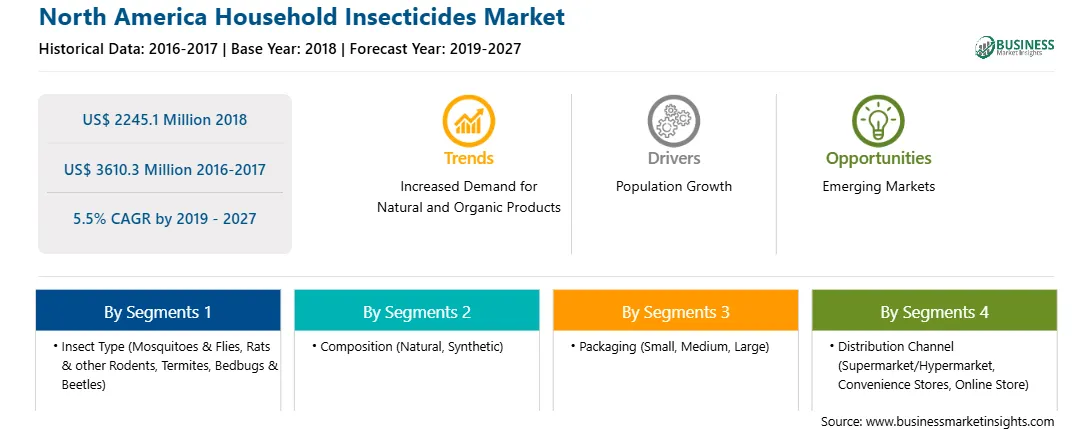

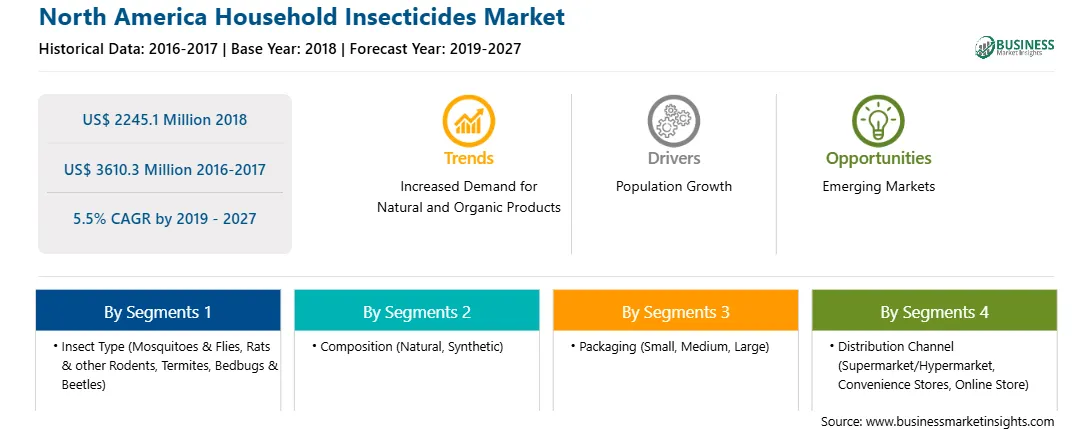

The North America household insecticides market is accounted to US$ 2245.1 Mn in 2018 and is expected to grow at a CAGR of 5.5% during the forecast period 2019 – 2027, to account to US$ 3610.3 Mn by 2027.

US is dominating the North America household insecticides market, followed by Mexico. The market for household insecticides in US is increasing due to the dense populations in major metropolitan areas. US is also a leading producer of household insecticides in North America. The domestic sales of household insecticides in US have increased with the increase in production capacities and a surge in export. The need to protect oneself from deadly vector-borne diseases has led to high demand for insect sprays used in kitchens, bedrooms, outdoors, and lawns. This growing need for household insecticides to control and prevent the proliferation of insects is anticipated to generate significant demand for household insecticides in North America during the forecast period.

Strategic insights for the North America Household Insecticides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2245.1 Million |

| Market Size by 2027 | US$ 3610.3 Million |

| Global CAGR (2019 - 2027) | 5.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Insect Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Household Insecticides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Market Insights

Growing preference for natural household insecticides by a large share of consumer base

Increasing demand for household insecticides made from natural ingredients has led to a surge in the demand for non-synthetic household insecticides for domestic uses. Synthetic insecticides are known to contain harmful chemicals and substances which are perceived to negatively impact the health of individual. The growing awareness related to health and rising concern over the potential harm caused by synthetic insecticides has driven the need for natural insecticides. Natural household insecticides such as plant-based dust, liquid and aerosol formulations offer a wide variety of indoor and outdoor protection from a range of different insect species. Natural household insecticides are eco-friendly, very efficient and safe.

Insect Type Insights

The North America household insecticides market is segmented on the basis of insect type as mosquitoes & flies, rats & other rodents, termites, bedbugs & beetles, and others. The mosquitoes & flies North America household insecticides market is estimated to hold a dominant share in the market in 2018. There has been a rising demand for mosquito insecticides in the North America market. There are two leading and most widely used insecticides that are used in the preparation of household insecticides to be effective against mosquitoes known as malathion and permethrin. Malathion is an organophosphate that is quite often used for the elimination of mosquitoes indoors as well as outdoors and also against a wide range of insects. It is used in a small amount as in the mosquito insecticide as it possesses no harm to humans. Permethrin is another chemical that is widely used in the preparation of mosquito insecticides that belongs to the group of chemicals known as pyrethroids. This chemical is mixed with water or oil and is applied as a mist. This chemical is used in the preparation of mosquito insecticides as it damages the central nervous system of the mosquitoes and is noted to cause no harm to the humans as well as animals. Growing concerns regarding the risks associated with vector-borne diseases carried by mosquitoes and flies in urban areas is expected to fuel the growth of the household insecticides market in North America

Form Insights

The North America household insecticides market is segmented based on composition as natural and synthetic. The synthetic segment accounts for the largest share in the North America household insecticides market, while the natural segment also contributes a significant share in the market. The rising awareness of the effects of insects and it playing the role of epidemic diseases has led to an upsurge in the use of household insecticides and synthetic household insecticides in particular. Synthetic household insecticides are widely used all over North America as they are relatively inexpensive and are very efficient in killing pest and insects. The rising spread of mosquitoes, and other bugs due to deforestation and rapid urbanization is expected to drive the market for synthetic household insecticides market in the forecast period. While growing awareness about the ill-effects of synthetic pesticides has swayed many users towards more eco-friendly natural household insecticides. Manufacturers are launching new natural household insecticides to cater to these demand. The market for natural household insecticides is anticipated to grow in the forecast period.

Packaging Insights

The North America household insecticides market is segmented based on packaging as small, medium, and large. The small segment leads the North America household insecticides market whereas medium segment is expected to grow at fastest growth rate during the forecast period of 2019-2027. The small packaging type of household insecticides generally weighs between 250 gm. to 500 gm. It has been noted that the small packaging insecticides have been frequently used as they are easy to port and can be used before the product expires. It has a short period of use due to its acute weight. The easy portability and low weight of the small packaging household insecticides has been a contributing factor for the expansion of the market all over the globe.

Strategic insights for the North America Household Insecticides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2245.1 Million |

| Market Size by 2027 | US$ 3610.3 Million |

| Global CAGR (2019 - 2027) | 5.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Insect Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Household Insecticides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic Insights

New product development, market initiatives and merger and acquisition were observed as the most adopted strategies in North America household insecticides market. Few of the recent developments in the North America household insecticides market are listed below:

2018:

Neogen Corp announced the addition of DeciMax Place Packs and Blocks — a proven effective and all-weather rodenticide bait available in multiple product formats.

Neogen Corp announced the launch of DeciMax Soft Bait, an effective rodenticide bait that combines superior palatability with the flexibility to use in extreme weather conditions

2017:

Liphatech Inc. launches TakeDown soft bait to fight against anticoagulant-resistant rodent populations

2016:

NORTH AMERICA HOUSEHOLD INSECTICIDES SEGMENTATION

By Insect Type

By Composition

By Packaging

By Distribution Channel

By Country

Company Profiles

The List of Companies

The North America Household Insecticides Market is valued at US$ 2245.1 Million in 2018, it is projected to reach US$ 3610.3 Million by 2027.

As per our report North America Household Insecticides Market, the market size is valued at US$ 2245.1 Million in 2018, projecting it to reach US$ 3610.3 Million by 2027. This translates to a CAGR of approximately 5.5% during the forecast period.

The North America Household Insecticides Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Household Insecticides Market report:

The North America Household Insecticides Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Household Insecticides Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Household Insecticides Market value chain can benefit from the information contained in a comprehensive market report.