The North America home sequential compression devices market is divided into the US, Canada, and Mexico. North America is likely to capture significant share of the global market in 2021, The key factors that are driving the growth of the significantly by rising number of orthopedic and spinal surgeries; growing number of patients suffering from DVT, varicose veins, and lymphedema; increasing incidence of sports injuries; and the presence of a number of compression therapy product manufacturers in the region.

The fear of COVID-19 has hit the business across the world. COVID-19 virus outbreak was first observed in December 2019 in Wuhan (China), and it has spread to ~100 countries across the world, with the World Health Organization (WHO) stating it as a public health emergency. The global impacts of COVID-19 are being felt across several markets. Although the healthcare sector had witnessed SARS, H1N1, and other outbreaks in the last few years, the severity of the COVID-19 has made the situation more complicated due to its mode of transmission. North America has been witnessing a growing number of COVID-19 cases since its outbreak. For instance, according to Worldometer, the number of cases increased to 34,540,845, with 620,249 deaths reported in the US as of July 1st, 2021. The cases are also increasing in Mexico and Canada. In Mexico, the cases have reached 2,519,269, with 233,047 deaths. Similarly, in Canada, there are about 1,415,284 COVID cases, with 26,295 deaths reported so far. The chaotic situation was created in the medical industry across the countries, the demand for diagnostics and therapeutic devices have dramatically increased in all healthcare settings. Home based diagnostic and therapeutic has also witnessing surge in demand. This is expected to support home sequential compression devices market growth, as most of the individuals opting for home care therapeutics due to fear of hospital acquired infection.

Strategic insights for the North America Home Sequential Compression Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

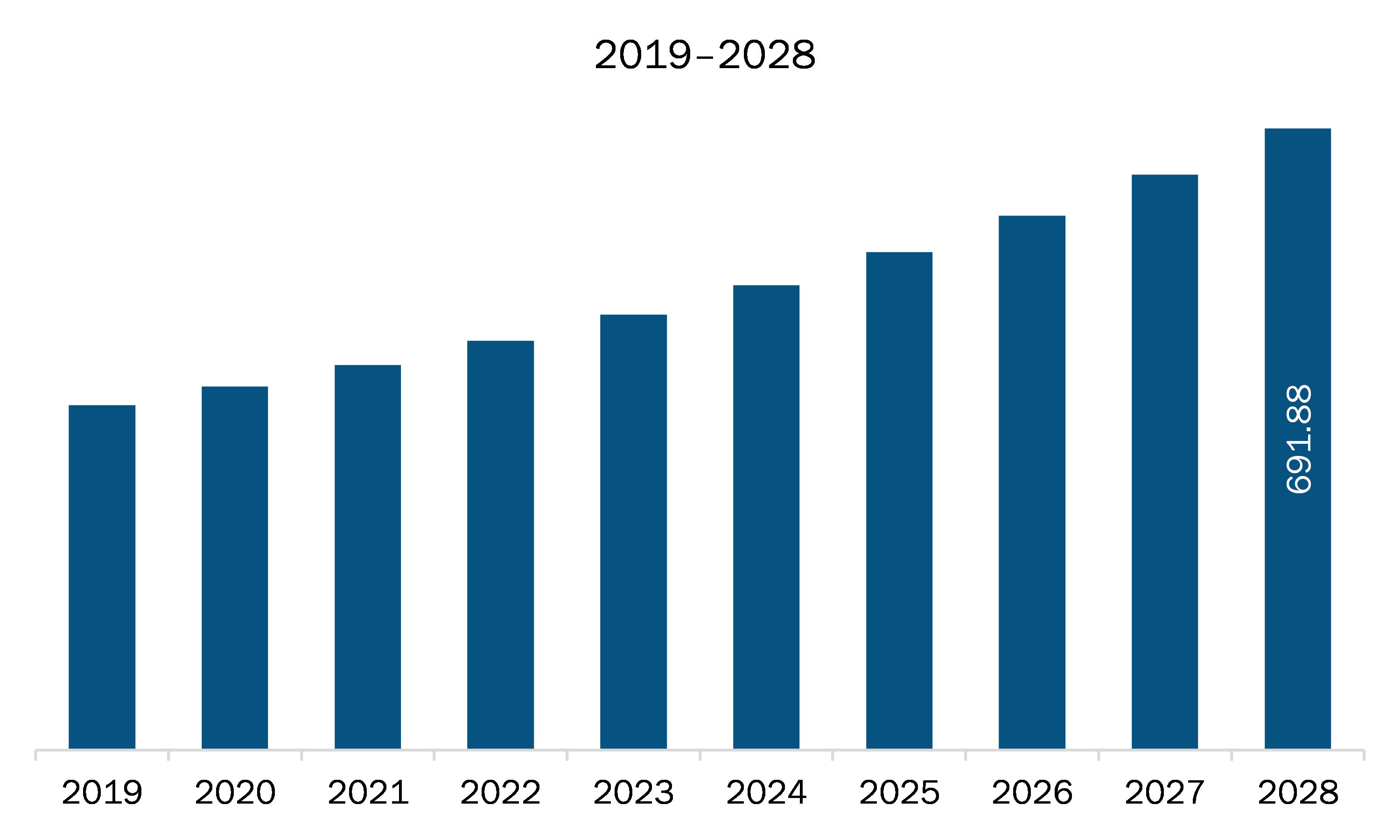

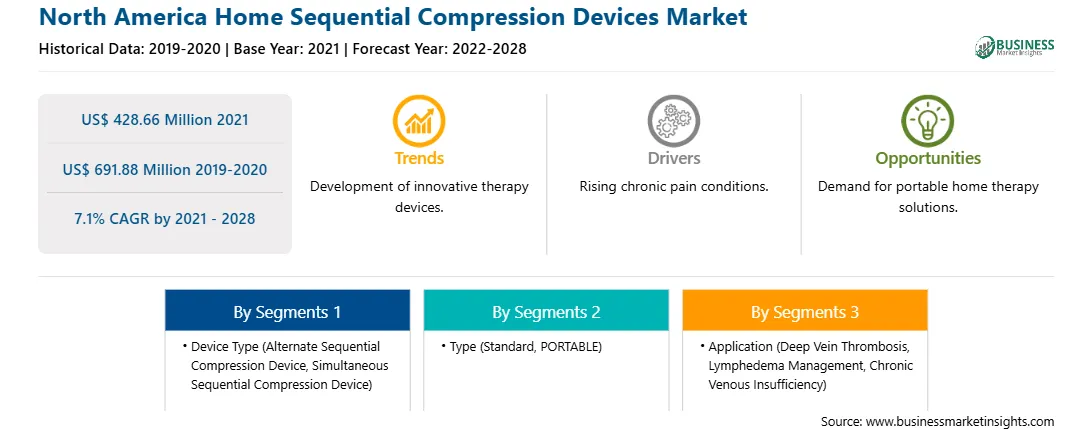

| Market size in 2021 | US$ 428.66 Million |

| Market Size by 2028 | US$ 691.88 Million |

| Global CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Home Sequential Compression Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The home sequential compression devices market in North America is expected to grow from US$ 428.66 million in 2021 to US$ 691.88 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. Sequential compression devices are comparatively expensive, and thus their use contradicts the patients’ preference for low-cost treatment options. Moreover, the users may not need these devices for long enough to spend high amounts on them. The disorders such as deep vein thrombosis is observed during the pregnancy. The condition is expected to last for a limited time and needs therapy for a specific which varies based on the nature of and condition of the patient. span. In response to this observation, medical device providers have started offering home sequential compression devices on rent at reasonable charges. For instance, Medcom Group, US, offers high-quality and durable medical and rehab equipment and services, including rental services for medical and rehab equipment. It offers Medcom Shoulder CPM – 2-Week Rental (with 3–8-week options available) and PS1 Pronation/Supination CPM – 2 Week Rental (with 3–8-week options available), and other products. Thus, device rental is likely to emerge as a significant trend in the home sequential compression devices market in the coming years.

The North America home sequential compression devices market is segmented on the bases of device type, type, application, and country. The North America home sequential compression devices market, by type is segmented into alternate sequential compression device (ASCD), simultaneous sequential compression device (SSCD). The simultaneous sequential compression device (SSCD) segment held the largest share of the market in 2021. North America home sequential compression devices market based on the type is segmented into standard and portable. In 2021, the standard segment is likely to hold the largest share of the market. The North America home sequential compression devices market by application, is segmented into deep vein thrombosis (DVT), lymphedema management, chronic venous insufficiency (CVI) and others. The deep vein thrombosis (DVT), segment is likely to hold the largest share of the market in 2021. The North America home sequential compression devices market, by country is segmented into US, Canada, and Mexico.

A few major primary and secondary sources referred to for preparing this report on the home sequential compression devices market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AIROS Medical; Arjo Medical Devices; BIOCOMPRESSION SYSTEMS; Breg Inc.; Cardinal Health Inc; DJO Global, Inc.; DSMAREF CO.LTD; Mego Afek ltd.; Precision Medical Products; and Tactile Medical.

The North America Home Sequential Compression Devices Market is valued at US$ 428.66 Million in 2021, it is projected to reach US$ 691.88 Million by 2028.

As per our report North America Home Sequential Compression Devices Market, the market size is valued at US$ 428.66 Million in 2021, projecting it to reach US$ 691.88 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The North America Home Sequential Compression Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Home Sequential Compression Devices Market report:

The North America Home Sequential Compression Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Home Sequential Compression Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Home Sequential Compression Devices Market value chain can benefit from the information contained in a comprehensive market report.