High-throughput screening (HTS) is a drug discovery process that allows automated testing of large numbers of chemical and/or biological compounds for a specific biological target. High-throughput screening methods are extensively used in the pharmaceutical industry, leveraging robotics and automation to quickly test the biological or biochemical activity of many molecules, usually drugs. They accelerate target analysis, as large-scale compound libraries can quickly be screened in a cost-effective way. HTS is a useful tool for assessing for instance pharmacological targets, pharmacologically profiling agonists and antagonists for receptors (such as GPCRs) and enzymes.

Strategic insights for the North America High Throughput Screening provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

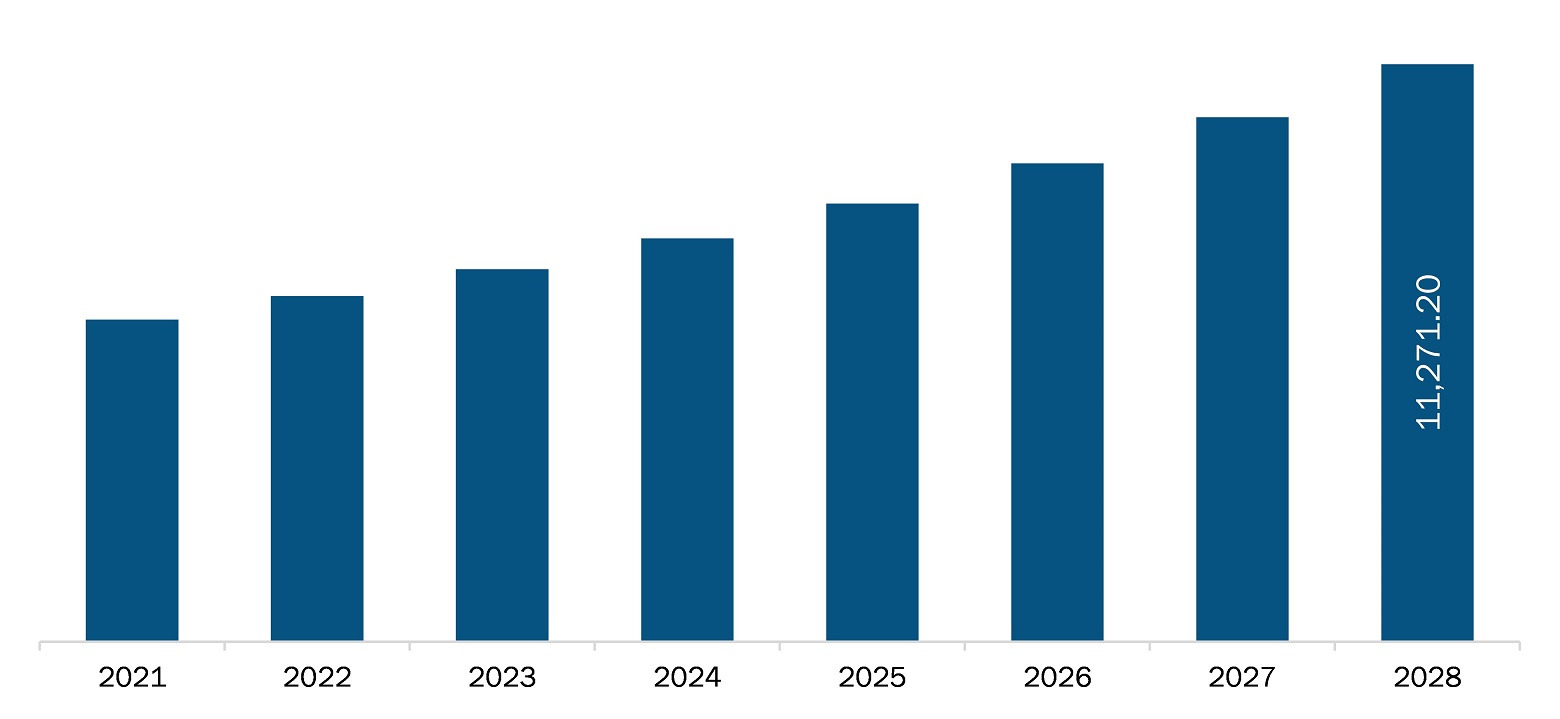

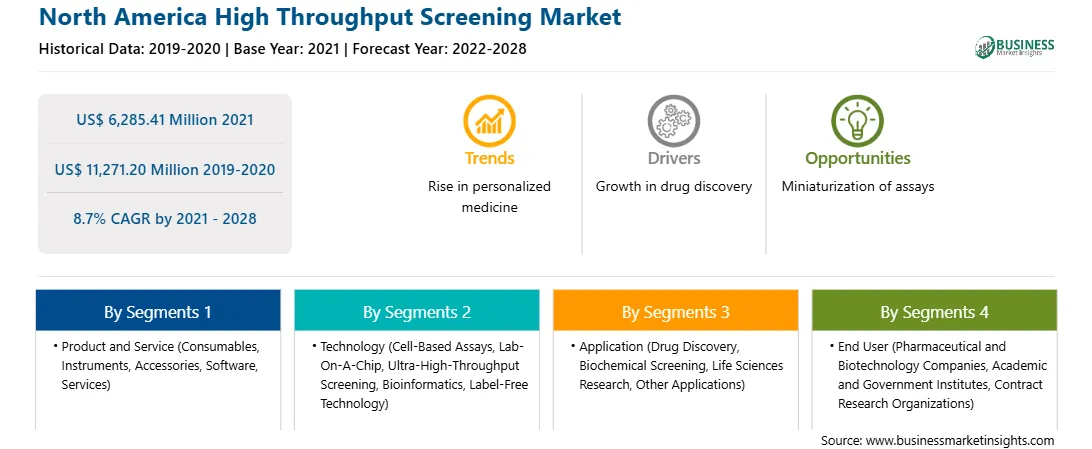

| Market size in 2021 | US$ 6,285.41 Million |

| Market Size by 2028 | US$ 11,271.20 Million |

| Global CAGR (2021 - 2028) | 8.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product and Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America High Throughput Screening refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America high throughput screening market is expected to reach US$ 11,271.20 million by 2028 from US$ 6,285.41 million in 2021; it is estimated to register a CAGR of 8.7% from 2021 to 2028. Driving factors such as an increase in investment in research and development by the pharmaceutical and biotechnology industry and the introduction of technologically advanced products in the high throughput screening market are driving the growth of the market. However, the lack of proper automation methods is obstructing the growth of the market.

An increase in R&D investments by pharmaceutical and biotechnology companies and extensive drug pipelines for the treatment of various chronic diseases such as cancer, cardiovascular disorders, metabolic disorders, immunological disorders, and neurological disorders are the prominent drivers for the high throughput screening market. Several big and small pharmaceutical companies are engaged in the development and manufacturing of new and novel molecules for various life-threatening conditions. This has led to the adoption of automated high-throughput screening (HTS) techniques to screen huge chemical libraries to meet the needs of ever-increasing drug target molecules. Pharma and biotech companies have substantially invested in high throughput screening techniques in the past decade. High-throughput screening has been regarded as a key technology in the drug discovery process. More than US$ 2.5 billion are annually spent on HTS products and HTS services in the US alone. Large pharmaceutical companies invest up to US$ 35 million annually in screening technologies. The major proportion of these investments goes in the development of new assays. Thus, an increase in investment in research and development by pharmaceutical and biotechnology industry will help boost the market growth. Furthermore, there is an increase in demand for high throughput screening owing to the need for screening the new chemical entities with more efficient and productive optimization of drug molecules. Technological advancements in high throughput screening techniques and the launch of innovative systems by various market players are expected to propel the market growth.

North America has been witnessing a growing number of COVID-19 cases since its outbreak. At present, the majority of the diagnostic laboratories and research institutes are engaged in diagnosing COVID-19 patients. Currently, the COVID-19 diagnostic testing industry is witnessing an upsurge on account of a growing number of cases coupled with the increasing emergency use authorizations of testing from the regulatory bodies. In addition, with the WHO declaring the COVID-19 outbreak a pandemic, a mix of established pharmaceutical and biopharmaceutical companies and small start-ups have stepped forward to develop treatments that target the infection. Moreover, researchers and physicians in several countries focus on various other existing drugs to examine their potential to treat COVID-19. An increase in drug discovery projects for the development of COVID-19 treatments is expected to drive the growth of the market as high-throughput screening products are used for drug discovery.

The North America high throughput screening market, based on product and service is subsegmented into consumables, instruments, accessories, software, and services. The consumables segment is further subsegmented into reagents and assay kits and laboratory equipment. Furthermore, the instruments are further sub-divided into liquid handling systems and detection systems. In 2021, the consumables segment is expected to hold the largest share of the market and is expected to register the highest CAGR during 2021–2028.

The North America high throughput screening market, based on technology, was subsegmented into cell-based assays, lab-on-a-chip, ultra-high-throughput screening, bioinformatics, and label-free technology. In 2021, the cell-based assays segment is expected to hold the largest share of the market, while the lab-on-a-chip segment is expected to register the highest CAGR during the forecast period.

The North America high throughput screening market, based on application, is subsegmented into drug discovery, biochemical screening, life sciences research, and other applications. In 2021, the drug discovery segment is expected to hold the largest share of the market and is expected to register the highest CAGR during the forecast period.

The North America high throughput screening market, based on end user, was segmented into pharmaceutical and biotechnology companies, academic and government institutes, contract research organizations (CRO), and others. In 2021, the pharmaceutical and biotechnology companies segment is expected to hold the largest share of the market. However, the contract research organizations (CRO) segment is expected to register the highest CAGR during the forecast period.

A few of the primary and secondary sources associated with this report on the North America high throughput screening market are the Pharmaceutical Research and Manufacturers of America (PhRMA), United States Agency for International Development (USAID), and Center for Drug Evaluation and Research (CDER).

The North America High Throughput Screening Market is valued at US$ 6,285.41 Million in 2021, it is projected to reach US$ 11,271.20 Million by 2028.

As per our report North America High Throughput Screening Market, the market size is valued at US$ 6,285.41 Million in 2021, projecting it to reach US$ 11,271.20 Million by 2028. This translates to a CAGR of approximately 8.7% during the forecast period.

The North America High Throughput Screening Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America High Throughput Screening Market report:

The North America High Throughput Screening Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America High Throughput Screening Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America High Throughput Screening Market value chain can benefit from the information contained in a comprehensive market report.