North America is one of the most significant markets for helicopter landing gear providers, owing to different breakthroughs in helicopter landing gear type and presence of major helicopter manufacturers such as The Bell Helicopter Textron, Inc.; Hughes Helicopters, Inc.; and Sikorsky Aircraft. In case of military helicopters, in particular, US helicopter component manufacturers are preserving their historical technological superiority over international competitors. Due to foreign manufacturers' capacity to swiftly absorb technical improvements in design and manufacturing, both domestic and foreign landing gear systems look to be near to parity. Companies in the US have concentrated their R&D efforts on a few key technologies such as fiberglass blades and landing gear systems. This has occasionally allowed the US to take the lead in specific industries for a length of time. All these factors have resulted in the growth of the landing gear market in the area. In general, the US business and the US government have been open about exchanging non-strategic military type data with foreign firms. This has frequently helped European manufacturers to swiftly deploy technologies, allowing them to focus on R&D budgets and achieve significant advancements in specialized technological fields. The US military is gradually updating its combat helicopters with the help of international manufacturers. Also, increase in helicopter production is among the other factors expected to fuel the demand for helicopter landing gear in North America.

North America is known for having the highest rate of advanced technology adoption due to favorable government policies that foster innovation and enhance infrastructural abilities. As a result, every factor affecting the region's industrial performance obstructs its economic development. The US has become the world's worst-affected country due to the COVID-19 outbreak, causing governments to impose several limitations on industrial, commercial, and public activities in the country in attempt to contain the disease's spread. Despite the stoppage of activity in several industries, the closure of major manufacturing units, and people’s reluctance about joining the work floors, governments of several Countries in North America have maintained their defense spending levels. For instance, the defense spending in the US reached US$ 778 billion in 2020, with a yearly increase on 4.4%. As a result, the COVID-19 pandemic and its consequences are posing a minimal impact on the helicopter landing gear market in North America.

Strategic insights for the North America Helicopter Landing Gear provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

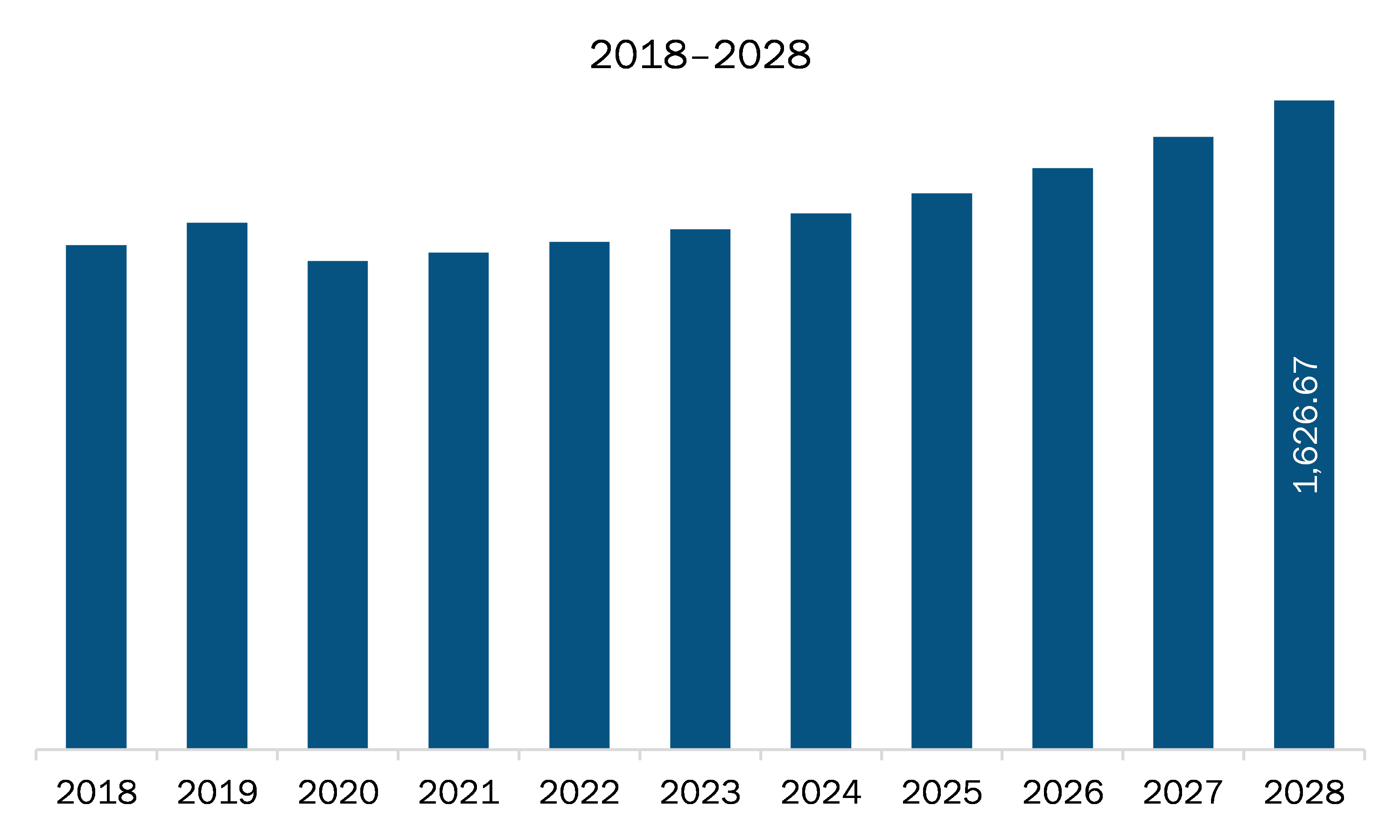

| Market size in 2021 | US$ 1,224.03 Million |

| Market Size by 2028 | US$ 1,626.67 Million |

| Global CAGR (2021 - 2028) | 3.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Helicopter Landing Gear refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The helicopter landing gear market in North America is expected to grow from US$ 1,224.03 million in 2021 to US$ 1,626.67 million by 2028; it is estimated to grow at a CAGR of 3.9% from 2021 to 2028. The exponential growth of helicopters has complemented the establishment of MRO facilities over the years. The scope of MRO facilities is expected to rise in different parts of North America. Owing to the rising adoption of civil helicopters for various commercial purposes such as fighting wildfires, facilitating news & traffic coverage, conducting search & rescue missions, and patrolling gas & oil pipelines, the establishment of MRO facilities is also witnessing a positive trend. The rising use of helicopters is rapidly accelerating the scope of helicopter’s maintenance business. Similarly, ST Engineering is another company engaged in the business of offering integrated MRO services for repair & overhaul of landing gears, and other accessories used on helicopters, Boeing, Airbus, and regional and military aircraft. Therefore, presence of such leading and well-established players in the MRO business for catering to helicopter landing gears is projected to create ample growth opportunities to the market.

The North America helicopter landing gear market is segmented into Type, material, and application. Based on type, the helicopter landing gear are segmented into skids and wheeled. The skids segment held the largest market share in 2020. Based on material, the helicopter landing gear market is segmented into aluminum landing gear set, steel landing gear set, composite landing gear set, and titanium landing gear set. The composite landing gear set segment dominated the market in 2020. Based on application, the helicopter landing gear market is segmented into civil helicopter and military helicopter. Military helicopter segment held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the helicopter landing gear market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are APPH; CIRCOR AEROSPACE, INC.; Dart Aerospace; Eurocarbon B.V.; LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH; Safran; ST ENGINEERING; and Trelleborg Group.

The North America Helicopter Landing Gear Market is valued at US$ 1,224.03 Million in 2021, it is projected to reach US$ 1,626.67 Million by 2028.

As per our report North America Helicopter Landing Gear Market, the market size is valued at US$ 1,224.03 Million in 2021, projecting it to reach US$ 1,626.67 Million by 2028. This translates to a CAGR of approximately 3.9% during the forecast period.

The North America Helicopter Landing Gear Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Helicopter Landing Gear Market report:

The North America Helicopter Landing Gear Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Helicopter Landing Gear Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Helicopter Landing Gear Market value chain can benefit from the information contained in a comprehensive market report.