North America Healthcare Mobility Solutions Market

No. of Pages: 172 | Report Code: TIPRE00024519 | Category: Technology, Media and Telecommunications

No. of Pages: 172 | Report Code: TIPRE00024519 | Category: Technology, Media and Telecommunications

Healthcare mobility solutions help the healthcare organizations to stream workflow and effectively manage workforce and patient data. These solutions comprises of mobile applications and enterprise solution platforms. Enterprise solutions offered by various healthcare IT firms provide various advantages such as cost-effectively healthcare management and efficient management of healthcare resources.

Strategic insights for the North America Healthcare Mobility Solutions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

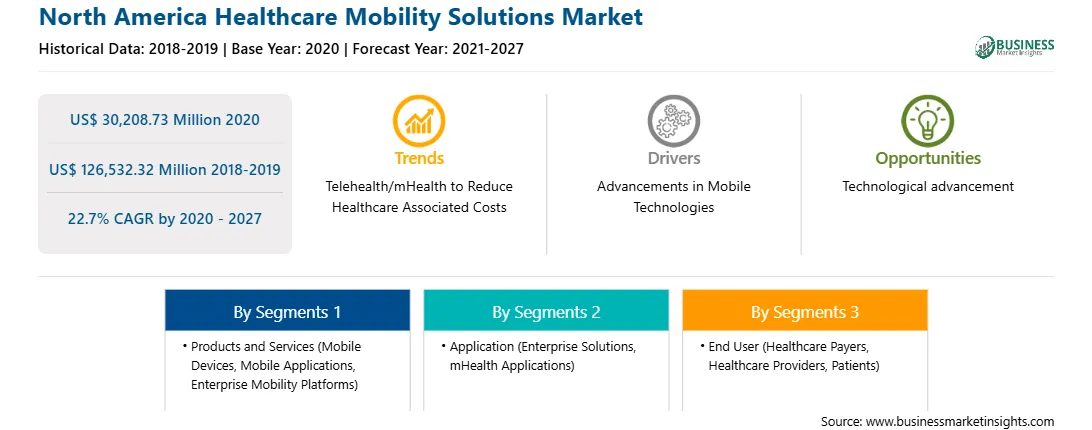

| Market size in 2020 | US$ 30,208.73 Million |

| Market Size by 2027 | US$ 126,532.32 Million |

| Global CAGR (2020 - 2027) | 22.7% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Products and Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Healthcare Mobility Solutions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America healthcare mobility solutions market is expected to reach US$ 126,532.32 million by 2027 from US$ 30,208.73 million in 2020; it is estimated to grow at a CAGR of 22.7% from 2020 to 2027. The growth of the market is attributed to factors such as the increasing adoption of telemedicine and mhealth solutions, and escalating use of mobile devices. However, data security issues, technical challenges, and the lack of awareness associated with healthcare mobility solutions hinder the market growth.

Advancements and use of telemedicine and mHealth technologies have been benefiting physicians, patients, promoters, facilities, and communities through improved health outcomes. These technologies have increased patient engagement along with promoting appropriate use of mobile technologies. They are widely preferred for booking appointments for diagnostics, consultation, treatment, and many more clinical aspects. The use of telemedicine and mHealth allows healthcare providers to provide patient care beyond clinics. Telemedicine apps are also employed to provide medical education services as they allow students to visualize experiments conducted by experts and share the knowledge to students and patients with highest ease. Thus, the increasing adoption of telemedicine and mHealth applications is driving the mobility solutions market growth. Mobile devices have become significant enablers of healthcare IT, and they are widely being used by healthcare providers as the most convenient means to treat patients, as well as to monitor their progress. Since the initiation of digital healthcare, there has been increased use of mobile devices. Further, the use of mobile devices has increased tenfold amid the COVID-19 pandemic, which has propelled various companies to diversify. Thus, due to various advantages, there has been a boost in the use of medical devices in the healthcare sector, which is fuelling the adoption of healthcare mobility solutions.

North America is recording the growing number of COVID-19 confirmed cases. During 2020, the COVID-19 outbreak pandemic raised problems with ongoing health systems across the US. Key bodies, such as WHO and CDC, have been pushing for ways to reduce physical interactions between healthcare providers and patients, also referred to as medical distance, to counteract the outbreak. Telehealth systems are now becoming a force for health care delivery amid the pandemic as it allows high-quality remote care while saving time and space. It has been successful in promising areas such as dermatology, cardiology, and diabetic therapy. Thus, the COVID-19 pandemic has a relatively positive impact on the healthcare mobility solutions market in North America.

Based on products and services, the North America healthcare mobility solutions market is segmented into mobile devices, mobile applications, and enterprise mobility platforms. The mobile devices segment held the largest share of the market in 2019. The same is estimated to register the highest CAGR in the market during the forecast period.

Based on application, the North America healthcare mobility solutions market is bifurcated into enterprise solutions and mHealth applications. The enterprise solutions segment held a larger market share in 2019 and is estimated to register a higher CAGR in the market during the forecast period.

By end user, the North America healthcare mobility solutions market is segmented into healthcare providers, healthcare payers, and patients. The healthcare providers segment held the largest share of the market in 2019. Also, the same segment is estimated to register the highest CAGR in the market during the forecast period.

A few of the primary and secondary sources referred to while preparing the report on the North America healthcare mobility solutions market are the United States Department of Agriculture (USDA), World Health Organization (WHO), and National eHealth Authority (NeHA).

The North America Healthcare Mobility Solutions Market is valued at US$ 30,208.73 Million in 2020, it is projected to reach US$ 126,532.32 Million by 2027.

As per our report North America Healthcare Mobility Solutions Market, the market size is valued at US$ 30,208.73 Million in 2020, projecting it to reach US$ 126,532.32 Million by 2027. This translates to a CAGR of approximately 22.7% during the forecast period.

The North America Healthcare Mobility Solutions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Healthcare Mobility Solutions Market report:

The North America Healthcare Mobility Solutions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Healthcare Mobility Solutions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Healthcare Mobility Solutions Market value chain can benefit from the information contained in a comprehensive market report.