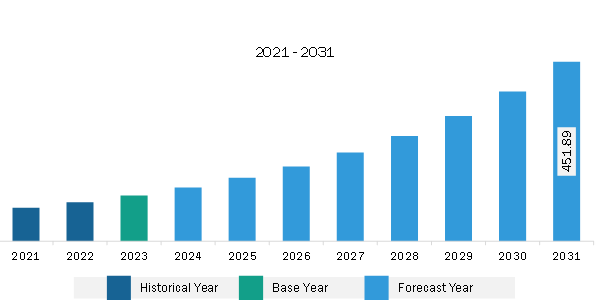

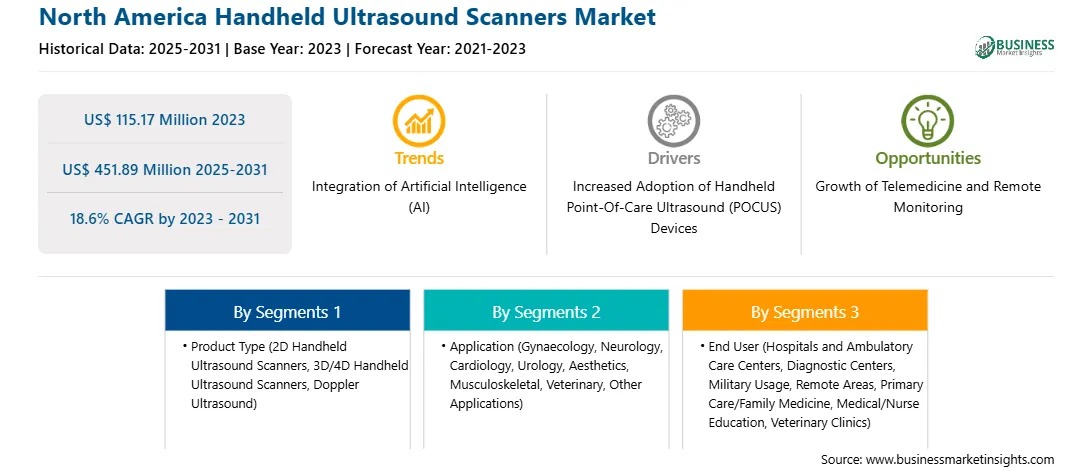

The North America handheld ultrasound scanners market was valued at US$ 115.17 million in 2023 and is expected to reach US$ 451.89 million by 2031; it is estimated to register a CAGR of 18.6% from 2023 to 2031. Increased Adoption of Handheld Point-Of-Care Ultrasound (POCUS) Devices Fuels North America Handheld Ultrasound Scanners Market

Point of care ultrasound (POCUS) is a flexible diagnostic tool that enables physicians to incorporate ultrasound imaging directly into patient evaluation and intervention. This instant access to medical imaging can speed up the process of diagnosis and treatment, which is especially helpful in emergencies. Therefore, POCUS has the potential to significantly improve patient outcomes in addition to increasing the efficacy of medical treatment. As POCUS makes better use of time and resources, it also has the potential to reduce healthcare expenditures. The use of point-of-care ultrasound (POCUS) devices is growing quickly among medical professionals, owing to their portability, the speed with which findings can be obtained to inform clinical judgment, and the fact that patients are not exposed to radiation. Many physicians now have better access to ultrasound owing to the recent proliferation of handheld ultrasound technologies. Physicians in emergency medicine, critical care, cardiology, and other specialties are increasingly utilizing POCUS for real-time diagnostic imaging, allowing for faster decision-making and improved patient outcomes. This shift toward decentralized ultrasound has led to a significant increase in demand for handheld scanners.

Advancements in technology have dramatically improved the image quality and functionality of handheld POCUS devices. Modern scanners offer high-resolution imaging, advanced features such as Doppler and strain imaging, and user-friendly interfaces that simplify operation. This technological leap has made POCUS a more reliable and versatile diagnostic tool, attracting broader adoption across clinical settings. For instance, Butterfly Network, Inc., a digital health business, received FDA approval in January 2024 for Butterfly iQ3, a next-generation handheld point-of-care ultrasound (POCUS) system. The new gadget is the third version of the world's first single-probe, whole-body ultrasound system based on semiconductor technology. With its all-new ergonomic form, Butterfly iQ3 will process data twice as quickly for optimal picture resolution, sensitivity, and penetration. It will also have faster 3D capabilities, enabling new automated image-capturing modes like IQ Slice and IQ Fan.

The cost-effectiveness of handheld POCUS devices compared to traditional ultrasound machines is a significant factor driving the market. These portable scanners offer a more affordable alternative, particularly for smaller clinics and hospitals with limited budgets. The lower procurement cost and the ability to perform point-of-care imaging make handheld POCUS devices a financially viable solution for improving patient care. Thus, the increasing demand for POCUS in various clinical settings and technological advancements boost the North America handheld ultrasound scanners market growth.North America Handheld Ultrasound Scanners Market Overview

According to a Cancer Statistics report published by the American Cancer Society Journal in January 2024, ~2 million new cases of cancer and 611,720 deaths from cancer are projected to occur in the US in 2024. The rising prevalence of cancer increases the demand for ultrasound imaging devices, including handheld ultrasound scanners. A handheld ultrasound scanner is a compact and portable ultrasound device designed for use in small spaces, at a patient's bedside, or in the field in real time to aid in the early diagnosis and treatment of cancer. Various studies are being conducted in the region to assess the use of handheld scanners for the detection of breast, prostate, and ovarian cancers, among others. For instance, according to an article published in the American Society of Clinical Oncology Journal in January 2020, a study was designed to demonstrate the performance of an intelligent Breast Exam (iBE) device as a triage device in the low- and middle-income countries setting by testing a large asymptomatic population of women undergoing routine, state-of-the-art screening in the US. The study suggested that iBE and clinical breast examination can work together to reduce the need for additional diagnostic imaging in resource-limited areas. Furthermore, developments by the market players in the US are further expected to enhance market growth. For instance, in February 2024, Butterfly Network announced the commercial launch of Butterfly iQ3, the company's third-generation handheld point-of-care ultrasound (PoCUS) system, in the US. This new technology features two advanced 3D imaging capabilities, iQ Slice and iQ Fan. These tools are designed to simplify image capturing.

North America Handheld Ultrasound Scanners Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the North America Handheld Ultrasound Scanners provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Handheld Ultrasound Scanners refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Handheld Ultrasound Scanners Strategic Insights

North America Handheld Ultrasound Scanners Report Scope

Report Attribute

Details

Market size in 2023

US$ 115.17 Million

Market Size by 2031

US$ 451.89 Million

Global CAGR (2023 - 2031)

18.6%

Historical Data

2025-2031

Forecast period

2021-2023

Segments Covered

By Product Type

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Handheld Ultrasound Scanners Regional Insights

North America Handheld Ultrasound Scanners Market Segmentation

The North America handheld ultrasound scanners market is categorized into product type, application, end user, and country.

Based on product type, the North America handheld ultrasound scanners market is segmented into 2D handheld ultrasound scanners, 3D/4D handheld ultrasound scanners, and doppler ultrasound. The 2D handheld ultrasound scanners segment held the largest market share in 2023.

In terms of application, the North America handheld ultrasound scanners market is bifurcated into gynaecology, neurology, cardiology, urology, aesthetics, musculoskeletal, veterinary, and other applications. The gynaecology segment held the largest market share in 2023.

By end user, the North America handheld ultrasound scanners market is segmented into hospitals and ambulatory care centers, diagnostic centers, military usage, remote areas, primary care/family medicine, medical/nurse education, veterinary clinics, and others. The hospitals and ambulatory care centers segment held the largest market share in 2023.

By country, the North America handheld ultrasound scanners market is segmented into US, Canada, and Mexico. The US dominated the North America handheld ultrasound scanners market share in 2023.

GE HealthCare Technologies Inc, Siemens Healthineers AG, Koninklijke Philips NV, FUJIFILM SonoSite Inc, EchoNous Inc, Shenzhen Mindray Bio-Medical Electronics Co Ltd, Clarius Mobile Health Corp, Butterfly Network Inc, TERASON DIVISION TERATECH CORPORATION, Vave Health, ESAOTE SPA, Nipro Medical Corp, ASUSTek Computer Inc, and FUKUDA DENSHI are some of the leading companies operating in the North America handheld ultrasound scanners market.

The North America Handheld Ultrasound Scanners Market is valued at US$ 115.17 Million in 2023, it is projected to reach US$ 451.89 Million by 2031.

As per our report North America Handheld Ultrasound Scanners Market, the market size is valued at US$ 115.17 Million in 2023, projecting it to reach US$ 451.89 Million by 2031. This translates to a CAGR of approximately 18.6% during the forecast period.

The North America Handheld Ultrasound Scanners Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Handheld Ultrasound Scanners Market report:

The North America Handheld Ultrasound Scanners Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Handheld Ultrasound Scanners Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Handheld Ultrasound Scanners Market value chain can benefit from the information contained in a comprehensive market report.