GPU databases offer significant improvements over the traditional CPUs database when performing repetitive operations particularly on large amounts of data. This is because GPUs can have thousands of cores of high bandwidth memory on each card. GPU-based databases achieve orders of magnitude speedups and price-performance gains over CPU-based analytic technologies. Stringent government regulations for providing excellent performance in various applications drive the market significantly. For instance, in March 2021, Resizable BAR utilized an advanced feature of PCI Express to increase performance in certain games. Thus, the growing demand for improved performance in various applications such as AI, ML, data analytics, and other application is fueling the adoption of GPU databases, which aids the market growth. GPU databases represent a tremendous opportunity for finance, telco, retail, security/IT, and energy industry. GPUs have also seen extensive usage in the defense-intelligence complex. Also, the constrained requirement of the system is further augmenting the demand for GPU systems. For instance, AMD Smart Access Memory enables faster gaming performance when pairing Ryzen & Radeon. Thus, regulations and specifications are helping to provide excellent performance, creating the demand for GPU database across vertical applications.

Market Overview

In North America, the US is one of the primary markets for the GPU database players due to their increasing adoption of big data solutions to gain insights into customer behavior and preferences. According to a recent Forbes report, in the US, 53% of companies are using big data analytics in 2020, up from 17% in 2019, with the telecommunications and financial services industries getting the fastest adoption. GPU tools help organizations improve their overall customer experience by providing quantifiable metrics and actionable insights into the issues that impact end users. In addition, the increasing digitalization in the enterprise sector fuels the adoption of automated GPU tools in North America. Also, highly informed, and demanding customers increasingly need timely, personalized interaction services. Therefore, the growing adoption of digital channels for interaction will help organizations better understand the underlying needs of their end users through a digital experience. As a result, companies in North America adopt GPU tools that ensure consistent service.

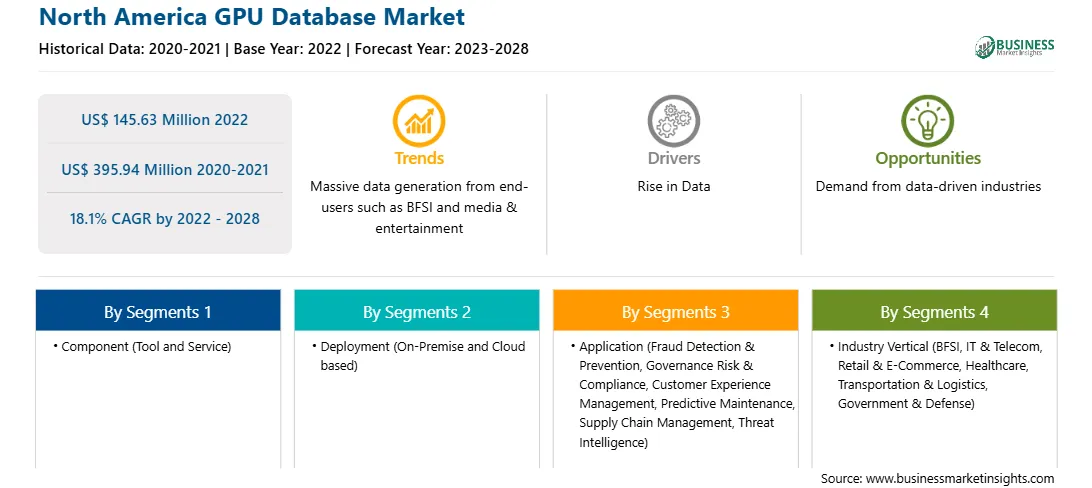

Strategic insights for the North America GPU Database provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America GPU Database refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America GPU Database Strategic Insights

North America GPU Database Report Scope

Report Attribute

Details

Market size in 2022

US$ 145.63 Million

Market Size by 2028

US$ 395.94 Million

Global CAGR (2022 - 2028)

18.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Deployment

By Application

By Industry Vertical

Regions and Countries Covered

North America

Market leaders and key company profiles

North America GPU Database Regional Insights

North America GPU Database Market Segmentation

The North America GPU database market is segmented into component, deployment, application, industry vertical, and country. Based on component, the market is segmented into tool and services segment. The tool segment registered a larger market share in 2022.

Based on deployment, the North America GPU database market is segmented into cloud based and on-premise. The on-premise segment registered a larger market share in 2022.

Based on application, the North America GPU database market is segmented into fraud detection and prevention, governance risk and compliance (GRC), customer experience management, predictive maintenance, supply chain management, threat intelligence, and others. The customer experience management segment registered the largest market share in 2022.

Based on industry vertical, the North America industry vertical market is segmented into BFSI, IT & telecom, retail & e-commerce, healthcare, transportation & logistics, government & defense, and others. The IT & telecom segment registered the largest market share in 2022.

Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Brytlyt; Graphistry; H2O.ai; HEAVY.AI; Jedox; Kinetica DB Inc.; Neo4J, Inc.; Nvidia Corporation; SQream Technologies; and Zilliz are the leading companies operating in the GPU database market in the region.

The North America GPU Database Market is valued at US$ 145.63 Million in 2022, it is projected to reach US$ 395.94 Million by 2028.

As per our report North America GPU Database Market, the market size is valued at US$ 145.63 Million in 2022, projecting it to reach US$ 395.94 Million by 2028. This translates to a CAGR of approximately 18.1% during the forecast period.

The North America GPU Database Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America GPU Database Market report:

The North America GPU Database Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America GPU Database Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America GPU Database Market value chain can benefit from the information contained in a comprehensive market report.