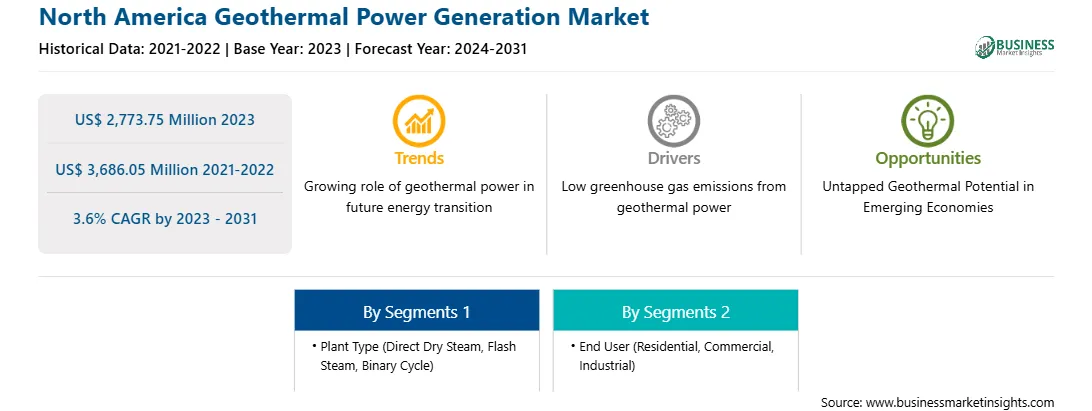

The North America geothermal power generation market was valued at US$ 2,773.75 million in 2023 and is expected to reach US$ 3,686.05 million by 2031; it is estimated to register a CAGR of 3.6% from 2023 to 2031.

Strategic insights for the North America Geothermal Power Generation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,773.75 Million |

| Market Size by 2031 | US$ 3,686.05 Million |

| Global CAGR (2023 - 2031) | 3.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Plant Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Geothermal Power Generation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Geothermal Power Generation Market Segmentation

The North America geothermal power generation market is categorized into plant type, end user, and country.

Based on plant type, the North America geothermal power generation market is segmented into direct dry steam, flash steam, and binary cycle. The flash steam segment held the largest market share in 2023.

In terms of end user, the North America geothermal power generation market is categorized into residential, commercial, and industrial. The industrial segment held the largest market share in 2023.

By country, the North America geothermal power generation market is segmented into the US and Mexico. The US dominated the North America geothermal power generation market share in 2023.

Northern California Power Agency, Turboden SpA, Toshiba Energy Systems and Solutions Corp, Berkshire Hathaway Inc, NIBE Industrier AB, General Electric Co, Fuji Electric Co Ltd, Carrier Global Corp, and Danfoss AS. are some of the leading companies operating in the North America geothermal power generation market.

The North America Geothermal Power Generation Market is valued at US$ 2,773.75 Million in 2023, it is projected to reach US$ 3,686.05 Million by 2031.

As per our report North America Geothermal Power Generation Market, the market size is valued at US$ 2,773.75 Million in 2023, projecting it to reach US$ 3,686.05 Million by 2031. This translates to a CAGR of approximately 3.6% during the forecast period.

The North America Geothermal Power Generation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Geothermal Power Generation Market report:

The North America Geothermal Power Generation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Geothermal Power Generation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Geothermal Power Generation Market value chain can benefit from the information contained in a comprehensive market report.