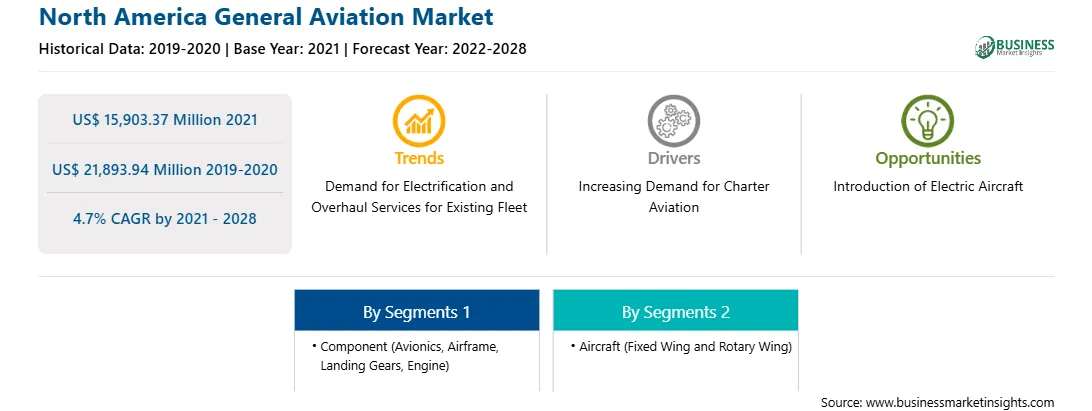

Factors such as increasing demand for charter aviation and surging demand for electric aircraft across North America propel the growth of the market. However, predicted onset of the third wave of COVID-19 outbreak by research organizations across the world may hamper the market growth.

Charter operators are expanding their service lines by adding newer routes to them. Along with this, the growing need for non-scheduled business travel compels them to add new aircraft to their existing fleets, which propels the demand for business jets and turboprops across North America. On the other hand, the demand for light sport and trainer aircraft is persistently high across the region. The rising interest of millennials toward aircraft piloting as their career is boosting the demand for aviation training, thus contributing to the surge in general aviation aircraft deliveries across different regions. Moreover, a few of the charter aviation vendors have also witnessed a rise in their revenues during the pandemic year i.e. FY 2020. Also, the corporate sectors across the region are major consumers of charter aviation due to the burgeoning requirement of air travel for attending cross-border meetings and operational sessions planned among business personnel. The abovementioned factors are also generating high demands for helicopters for domestic travel operations for commercial and tourism purposes. Thus, the elevated demand for charter operations across different regions is bolstering the general aviation aircraft market growth.

The US has witnessed the most severe impact of COVID-19 pandemic in 2020. The general aviation manufacturers and service providers in the region are adversely affected due to nationwide lockdowns and travel restrictions, shut down of production facilities, and shortage of employees. The massive outbreak of the virus has created a health crisis and an economic crisis in the US. It has led to major disruptions in the aerospace industry, impacting everything from supply chain and manufacturing to product sales. Moreover, in the US, the number of general aviation aircraft deliveries (excluding helicopters) declined by nearly 12–13% and reached to an estimated value of 1,555 units in 2020 from nearly 1,771 units in 2019, according to the market research study. In addition, the world’s largest general aviation aircraft manufacturer i.e. Textron Aviation, Inc. (based on the US) mentioned that the demand for aircraft products was cyclical during 2020, and lower demand had adversely affected their financial results. Demand for business jets, turbo props, and commercial helicopters had been cyclical and difficult to forecast due to the pandemic. Therefore, future demand for these products could be significantly and unexpectedly less than anticipated and/or less than previous period deliveries. Similarly, there is an uncertainty that their existing commercial backlog for aircraft products would convert to revenues as the conversion depends on production capacity, customer needs, and credit availability across the market. However, recovery in demands for business jets and private leisure aircraft along with helicopters for different applications is anticipated to boost the manufacturing and sales of the general aviation in the region in the coming years.

Strategic insights for the North America General Aviation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15,903.37 Million |

| Market Size by 2028 | US$ 21,893.94 Million |

| Global CAGR (2021 - 2028) | 4.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America General Aviation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

By Component

By Aircraft

By Country

Company Profiles

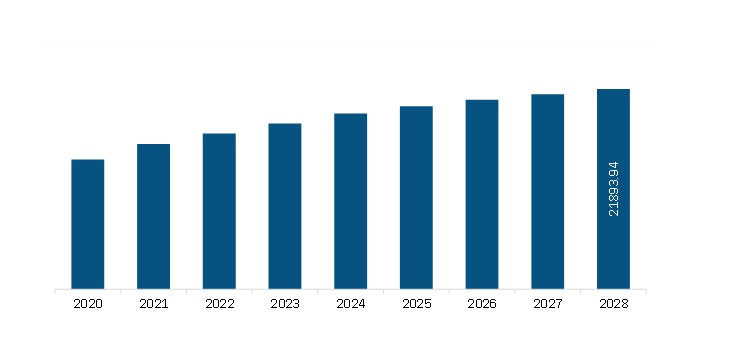

The North America General Aviation Market is valued at US$ 15,903.37 Million in 2021, it is projected to reach US$ 21,893.94 Million by 2028.

As per our report North America General Aviation Market, the market size is valued at US$ 15,903.37 Million in 2021, projecting it to reach US$ 21,893.94 Million by 2028. This translates to a CAGR of approximately 4.7% during the forecast period.

The North America General Aviation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America General Aviation Market report:

The North America General Aviation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America General Aviation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America General Aviation Market value chain can benefit from the information contained in a comprehensive market report.