North America is largest market for gastroparesis with the US holding the largest market share followed by Canada. The growth in North America is characterized by rising prevalence of gastroparesis. In addition, aging population and growing prevalence of diabetes are also projected to offer lucrative opportunity for the growth of the North America gastroparesis market during the forecast period. In addition, extensive research in pharmaceutical and biotechnology companies is further expected stimulate the growth of gastroparesis market in North America.

Although the healthcare sector had witnessed SARS, H1N1, and other outbreaks in the last few years, the severity of the COVID-19 has made the situation more complicated due to its mode of transmission. North America has been witnessing a growing number of COVID-19 cases since its outbreak. In patients with chronic GI illnesses, COVID-19 may initially present as a flare of their underlying GI conditions as viruses have historically been implicated in exacerbations of GI disorders, including gastroparesis. Moreover, according to the world gastroenterology organization, there has been observed a rise in GI complications after COVID-19 symptoms. Patients with COVID-19 may complain of digestive symptoms such as poor appetite, nausea, vomiting, diarrhea, symptoms, or disease activity for pre-existing digestive diseases such as inflammatory bowel disease. However, according to a review of Diabetic Gastroparesis for the Community Pharmacist published in 2016, over 29.1 million people in the US have diabetes and have faced with the complications associated with the disease. Diabetes is the most common systemic disease that causes gastroparesis. Moreover, according to data published by National Center for Biotechnology Information (NCBI) in September 2020, nausea and vomiting from detailed consideration as symptoms of COVID?19 is surprising as it can be an early presenting symptom. Thus, there has been observed a rise in the sale of prokinetic agents and antiemetic agents. However, due to disruption in supply chain and governmental orders restricting certain activities in response to COVID-19, including changes in on-site operations to reduce manufacturing capacity and implement social distancing, reductions in suppliers’ ability to source, ship raw materials in alignment with demands, work stoppages, slowdowns, and delays, the market may show a slowdown.

Strategic insights for the North America Gastroparesis provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

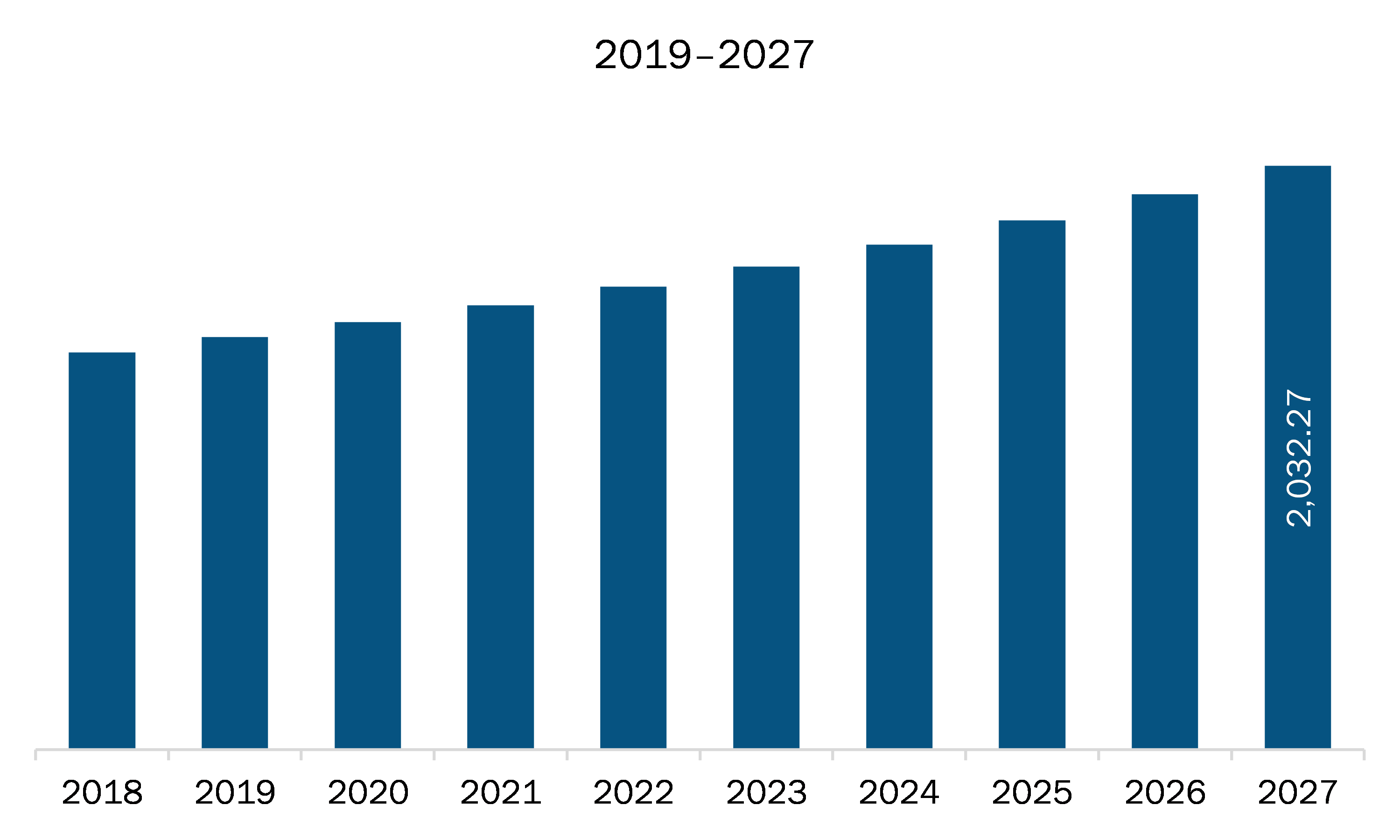

| Market size in 2020 | US$ 1,488.03 Million |

| Market Size by 2027 | US$ 2,032.27 Million |

| Global CAGR (2020 - 2027) | 4.6% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Gastroparesis refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The gastroparesis market in North America is expected to grow from US$ 1,488.03 million in 2020 to US$ 2,032.27 million by 2027; it is estimated to grow at a CAGR of 4.6% from 2020 to 2027. Pharmaceutical and medical devices companies are focusing on R&D to develop new products for the treatment of gastroparesis. Academic institutes and research centers are also actively involved in drug discoveries. In December 2018, the International Foundation for Gastrointestinal Disorders announced launch of AGA-Shire Research Scholar Award to boost the studies in functional gastrointestinal (GI) and motility disorders. The organization announced the grant of ~US$ 300,000 along with other facilities. The findings of such studies are estimated to propel new product developments in the market, which would provide lucrative opportunities for the growth of the gastroparesis market players during the forecast period.

The North America gastroparesis market is segmented on the basis of type, drug class, distribution channel, and country. The North America gastroparesis market, by type, is segmented into idiopathic, diabetic, post-surgical, and others. The idiopathic segment held the largest share of the market in 2019. The North America gastroparesis market, by drug class type, is segmented into prokinetic agents, botulinum toxin injection, and antiemetic agents. The prokinetic agents segment held the largest share of the market in 2019. Based on distribution channel, the North America gastroparesis market is segmented into retail pharmacies, hospital pharmacies, and others. The hospital pharmacies segment held the largest share of the market in 2019. Based on country, the North America gastroparesis market is segmented into US, Canada, and Mexico. US held the largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the gastroparesis market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allergan Plc; ANI Pharmaceuticals, Inc.; Bausch Health Companies Inc. (Salix Pharmaceuticals, Ltd.); Cinrx Pharma, LLC (Cindome Pharma); EVOKE PHARMA; Ipca Laboratories Ltd.; Johnson and Johnson Services, Inc.; NEUROGASTRX, INC.; Pfizer Inc.; and TEVA PHARMACEUTICAL INDUSTRIES LTD.

The North America Gastroparesis Market is valued at US$ 1,488.03 Million in 2020, it is projected to reach US$ 2,032.27 Million by 2027.

As per our report North America Gastroparesis Market, the market size is valued at US$ 1,488.03 Million in 2020, projecting it to reach US$ 2,032.27 Million by 2027. This translates to a CAGR of approximately 4.6% during the forecast period.

The North America Gastroparesis Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Gastroparesis Market report:

The North America Gastroparesis Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Gastroparesis Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Gastroparesis Market value chain can benefit from the information contained in a comprehensive market report.