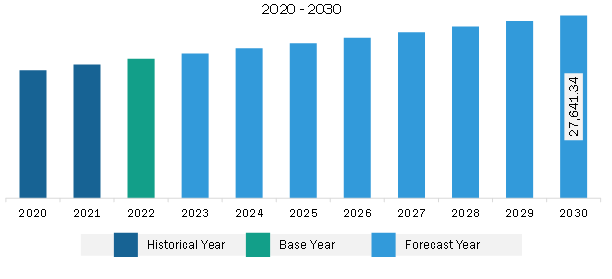

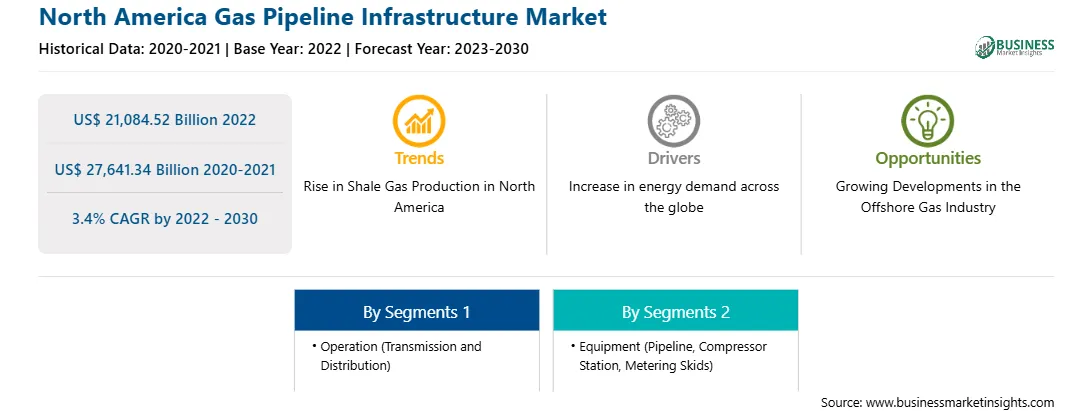

The North America gas pipeline infrastructure market is expected to grow from US$ 21,084.52 billion in 2022 to US$ 27,641.34 billion by 2030. It is estimated to record a CAGR of 3.4% from 2022 to 2030. Growing Developments in the Offshore Gas Industry Fuel North America Gas Pipeline Infrastructure Market

Investment and focus on offshore gas pipeline infrastructure development are growing across the globe. For instance, in 2023, Trinidad and Tobago were given permission by the Biden administration to exploit a significant gas field situated in the Venezuelan territorial seas. Thus, growing investment for the development of offshore gas pipeline infrastructure is anticipated to fuel the growth of the gas pipeline infrastructure market during the forecast period.North America Gas Pipeline Infrastructure Market Overview

North America is one of the leading gas exporters. The mounting demand for energy and the growing application of natural gas are boosting the market development of gas pipeline infrastructure in North America. In 2022, the US showcased the highest natural gas production capacity, followed by Canada and Mexico. Ixachi, Coulomb Phase 2, Quesqui, Nejo (IEPC), Leo, May, Koban, and Powerball are a few of the natural gas-producing fields in North America. The Ixachi plant is in Veracruz, Mexico, and it produced 618.09mmcfd (million cubic feet per day) in 2022. The Coulomb Phase 2 field is owned by Shell and located in the Central Planning Area, the US. The field produced 72.72mmcfd in 2022. Quesqui Field is in Tabasco, Mexico, and is operated by Petroleos Mexicanos. The field produced 485mmcfd in 2022. Also, the growing number of government initiatives and funding for the development of gas pipeline infrastructure is anticipated to boost the market for gas pipeline infrastructure over the forecast period. The natural gas pipeline network in the US is a substantially integrated network that transmits natural gas across the region. The pipeline infrastructure has ~3 million miles of mainline and other pipelines that connect natural gas production sites and storage facilities with primary consumers. In 2021, this natural gas transmission network carried approximately 27.6 trillion cubic feet of natural gas to ~77.7 million consumers. The US Gulf Coast is expected to register significant growth in prime gas infrastructure with over 20 LNG terminal projects and over 2,200 km of proposed or in-construction pipeline over the forecast period. Furthermore, during the Russia-Ukraine war, many countries discontinued their respective operations with Russian oil & gas businesses, which resulted in a shift of gas importers from Russia to the US. The following rise in demand of gas further augmented gas production operations across the US, which fuels the gas pipeline infrastructure market growth in the US.

North America Gas Pipeline Infrastructure Market Revenue and Forecast to 2030 (US$ Billion)

Strategic insights for the North America Gas Pipeline Infrastructure provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Gas Pipeline Infrastructure refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Gas Pipeline Infrastructure Strategic Insights

North America Gas Pipeline Infrastructure Report Scope

Report Attribute

Details

Market size in 2022

US$ 21,084.52 Billion

Market Size by 2030

US$ 27,641.34 Billion

Global CAGR (2022 - 2030)

3.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Operation

By Equipment

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Gas Pipeline Infrastructure Regional Insights

North America Gas Pipeline Infrastructure Market Segmentation

The North America gas pipeline infrastructure market is segmented into operation, equipment, application, and country.

Based on operation, the North America gas pipeline infrastructure market is bifurcated into transmission and distribution. The distribution segment held a larger share of North America gas pipeline infrastructure market in 2022.

In terms of equipment, the North America gas pipeline infrastructure market is categorized into pipeline, compressor station, metering skids, and valves. The pipeline segment held the largest share of North America gas pipeline infrastructure market in 2022.

Based on application, the North America gas pipeline infrastructure market is bifurcated into onshore and offshore. The onshore segment held a larger share of North America gas pipeline infrastructure market in 2022.

Based on country, the North America gas pipeline infrastructure market is segmented into the US, Canada, and Mexico. The US dominated the North America gas pipeline infrastructure market in 2022.

Enbridge Inc, TC Energy Corp, Berkshire Hathaway Inc, Kinder Morgan Inc, and Pembina Pipeline Corp are some of the leading companies operating in the North America gas pipeline infrastructure market.

1. Enbridge Inc

2. TC Energy Corp

3. Berkshire Hathaway Inc

4. Kinder Morgan Inc

5. Pembina Pipeline Corp

6. Saipem SpA

The North America Gas Pipeline Infrastructure Market is valued at US$ 21,084.52 Billion in 2022, it is projected to reach US$ 27,641.34 Billion by 2030.

As per our report North America Gas Pipeline Infrastructure Market, the market size is valued at US$ 21,084.52 Billion in 2022, projecting it to reach US$ 27,641.34 Billion by 2030. This translates to a CAGR of approximately 3.4% during the forecast period.

The North America Gas Pipeline Infrastructure Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Gas Pipeline Infrastructure Market report:

The North America Gas Pipeline Infrastructure Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Gas Pipeline Infrastructure Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Gas Pipeline Infrastructure Market value chain can benefit from the information contained in a comprehensive market report.