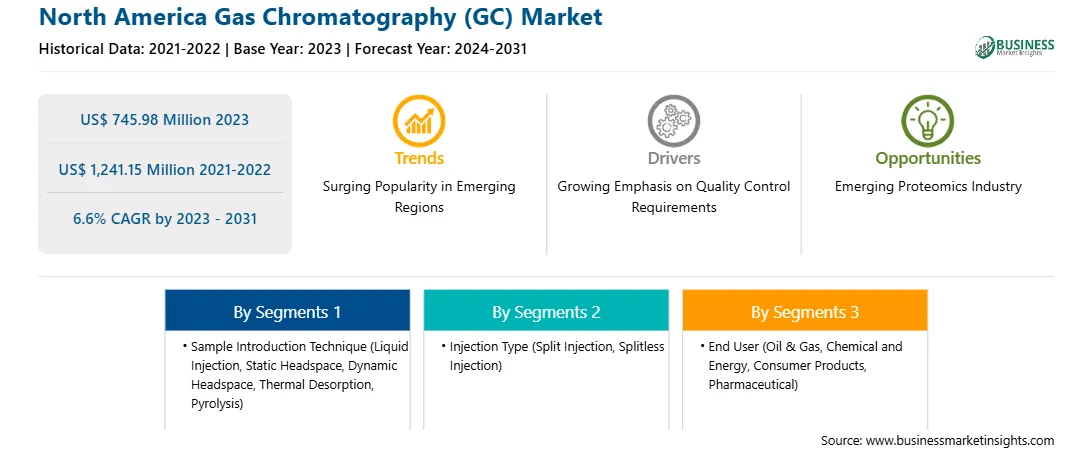

The North America gas chromatography (GC) market was valued at US$ 745.98 million in 2023 and is expected to reach US$ 1,241.15 million by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031.

The development of intelligent, connected features to enhance and simplify user experience is a major trend in the gas chromatography market. Features, including automatic leak detections and troubleshooting diagnostics, enable operators to work more quickly and accurately while producing superior results. Furthermore, proactively assisting users with preventive maintenance procedures lowers unscheduled downtime and sample reruns, which significantly boosts productivity.

Moreover, cross-training operators are in high demand, and even when they are not physically present in a laboratory, they must be informed about what is going on in other ones at the same time. As "Industry 4.0" digital transformation drives resource deployment optimization throughout analytical laboratory organizations globally, remote connectivity is a trend of the future.

Another key trend is the use of less power, water, helium, and other natural resources in the development of many modern instruments. Other trends include green chemistry and sustainable operations. Recently developed, inexpensive, oil-free GC-MS pumps—which operate far more quietly and cleanly and prevent oil spills—are being used more frequently. Another emerging trend is the migration of applications to quicker, greener, and smaller GC systems using effective direct heating technology.

The North America gas chromatography market is segmented into the US, Canada, and Mexico. The region is a pioneer in the adoption of advanced technology for the analysis of a wide variety of samples across various industries. Gas chromatography has widely found its application in the oil & gas industry. According to the International Energy Agency (IEA), the total crude oil production in North America was 46,233,753 Terajoules (TJ) in 2021, an increase of 66% from 2000. Therefore, the growth of the oil and gas industry fosters the North America gas chromatography market growth. The construction of new power plants is rising in the region. For instance, Mexico is planning to build gas-fired power plants to increase the natural gas supply. For instance, in November 2022, US-based New Fortress Energy announced signing a deal with the Mexican government to develop the LNG project Lakach offshore gas field in Mexico, which is expected to be completed in 2024. Gas chromatographs (GC) play a crucial role in optimizing plant performance and determining the calorific value of the LNG for fiscal energy calculation quickly, accurately, and reliably. Hence, the rising number of power plants fuels the demand for gas chromatographs. To cater to this demand for gas chromatography, the region’s market players are launching various solutions. For example, in April 2021, Agilent Technologies Inc. launched the Agilent 8697 Headspace Sampler, the first headspace sampler with integrated gas chromatography communication. It marked the expansion of intelligence capability that was first launched with Agilent Intuvo 9000 GC System in 2016 and later with Agilent 8890 and 8860 GC Systems in 2019. Many researchers are focused on extending the life cycle and safety of Li-ion batteries used in electric vehicles. This leads to the adoption of analytical techniques such as gas chromatography as it is a suitable tool for the Li-ion battery electrolyte degradation mechanisms. Also, government initiatives to boost the electric vehicle market create a lucrative opportunity for the North America gas chromatography market. For instance, the Biden Administration has set a goal to electrify all new light-duty vehicles by 2027 and make all federal vehicle acquisitions electric by 2035.

Strategic insights for the North America Gas Chromatography (GC) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Gas Chromatography (GC) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Gas Chromatography (GC) Strategic Insights

North America Gas Chromatography (GC) Report Scope

Report Attribute

Details

Market size in 2023

US$ 745.98 Million

Market Size by 2031

US$ 1,241.15 Million

Global CAGR (2023 - 2031)

6.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Sample Introduction Technique

By Injection Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Gas Chromatography (GC) Regional Insights

The North America gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the North America gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of North America gas chromatography (GC) market share in 2023.

In terms of injection type, the North America gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of North America gas chromatography (GC) market in 2023.

By detector type, the North America gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of North America gas chromatography (GC) market in 2023.

Based on end user, the North America gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas, chemical and energy segment held the largest share of North America gas chromatography (GC) market in 2023.

By country, the North America gas chromatography (GC) market is segmented into the US, Canada, and Mexico. The US dominated the North America gas chromatography (GC) market share in 2023.

Agilent Technologies Inc; Thermo Fisher Scientific Inc; Shimadzu Corp; Separation Systems, Inc.; Wasson-ECE Instrumentation; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); Restek Corporation; and VUV Analytics are some of the leading companies operating in the North America gas chromatography (GC) market.

The North America Gas Chromatography (GC) Market is valued at US$ 745.98 Million in 2023, it is projected to reach US$ 1,241.15 Million by 2031.

As per our report North America Gas Chromatography (GC) Market, the market size is valued at US$ 745.98 Million in 2023, projecting it to reach US$ 1,241.15 Million by 2031. This translates to a CAGR of approximately 6.6% during the forecast period.

The North America Gas Chromatography (GC) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Gas Chromatography (GC) Market report:

The North America Gas Chromatography (GC) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Gas Chromatography (GC) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Gas Chromatography (GC) Market value chain can benefit from the information contained in a comprehensive market report.