The surge in the consumption of high-quality convenience food owing to changing lifestyles is one of the biggest trends in the food industry. Convenience food, such as frozen snacks, frozen meals, and frozen ready-to-eat products, allow consumers to save time and effort associated with ingredient shopping, meal preparation, cooking, consumption, and post-meal cleaning activities. The development and popularity of these food items are ascribed to many social changes; the most notable are the increasing number of smaller households and the rising millennial population worldwide. Due to hectic work schedules, millennials prefer quick, easy meals without compromising taste and nutrition. According to the 2020 Current Population Survey, there were 36.1 million single-person households in the US, accounting for 28% of all households. The growing number of one or two-person families has fueled the demand for ready-to-eat, portion-controlled foods. Frozen food products are also growing in demand as they have an extended shelf-life, are suitable for single-person consumption, and can be prepared quickly. According to the “Power of Frozen” report published by the American Frozen Food Institute and Food Industry Association, frozen food sales in the US increased by 21% in 2020. Fast-food franchises such as McDonald's, Wendy's, Johny Rocket, KFC, Burger King, and Hardy’s substantially impact the North America frozen French fries market. Further, convenience foods satisfy the needs of consumers and are readily available in retail outlets or stores as well as various fast-food chains, hotels, and quick-service restaurants. The rise in retail outlets, convenience stores, and supermarkets has increased the availability of ready-to-eat food, propelling the frozen snacks industry to new heights. Thus, the growing consumption of convenience food, such as frozen French fries, is influencing the market growth.

The North America frozen French fries market is segmented into the US, Canada, and Mexico. The region is one of the major markets for frozen French fries due to the well-established food processing industry and rising trends of takeaway, dine-in, and on-the-go consumption. Many significant frozen French fries manufacturers, such as H.J. Heinz Company, J.R. Simplot Company, and McCain Foods Limited, operate actively in the region. These companies have expanded their business across the region and hold significant market share. They have a widespread distribution network in the region, which helps them to cater to a large number of audiences. Manufacturers are constantly investing to expand their business. For instance, in July 2022, Lamb Weston Holding announced an investment of US$ 415 million in a new French fries processing line in Idaho, US. Such strategic development initiatives by manufacturers in the region are driving the growth of the North America frozen French fries market. The demand for frozen French fries in North America has surged owing to the increasing consumption of convenience food due to a busy lifestyle and hectic work schedule. Rising disposable income, urbanization, and changing lifestyles further boost market growth. The high purchasing power of consumers results in rising demand for premium frozen potato products. Moreover, consumers are increasingly adopting a healthy lifestyle and demanding gluten-free, low-carb, whole-grain, and organic diet products. The well-established frozen food industry is also one of the primary factors driving the growth of the North America frozen French fries market.

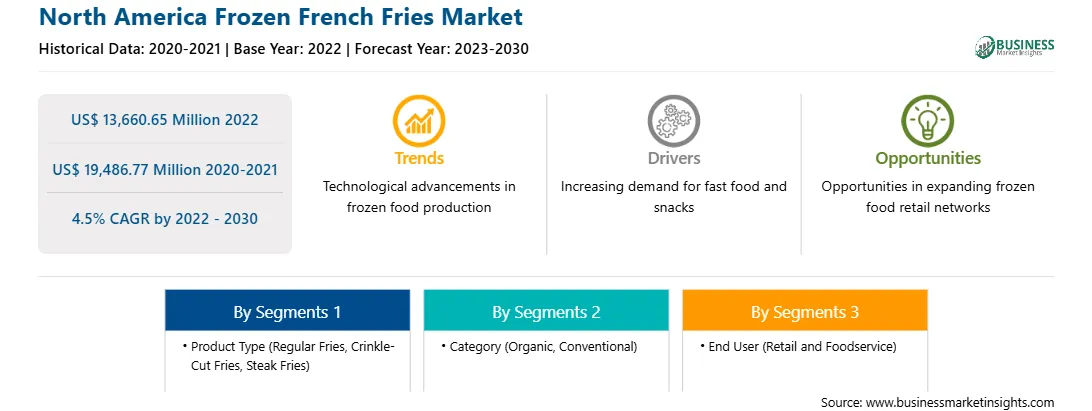

The North America frozen French fries market is segmented into product type, category, end user, and country.

Based on product type, the North America frozen French fries market is segmented into regular fries, crinkle-cut fries, steak fries, and others. In 2022, the regular fries segment registered the largest share in the North America frozen French fries market.

Based on category, the North America frozen French fries market is bifurcated into organic and conventional. In 2022, the conventional segment registered the largest share in the North America frozen French fries market.

Based on end user, the North America frozen French fries market is segmented into retail and foodservice. In 2022, the foodservice segment registered the largest share in the North America frozen French fries market.

Based on country, the North America frozen French fries market is segmented into the US, Canada, Mexico. In 2022, the US registered the largest share in the North America frozen French fries market.

Agristo NV, Aviko B.V., Bart’s Potato Company, Farm Frites International B.V., Himalaya Food International Ltd, J.R. Simplot Company, Lamb Weston Holdings Inc, McCain Foods Limited, and The Kraft Heinz Co are some of the leading companies operating in the North America frozen French fries market.

Strategic insights for the North America Frozen French Fries provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 13,660.65 Million |

| Market Size by 2030 | US$ 19,486.77 Million |

| Global CAGR (2022 - 2030) | 4.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Frozen French Fries refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Agristo NV

2. Aviko B.V.

3. Bart?s Potato Company

4. Farm Frites International B.V.

5. Himalaya Food International Ltd

6. J.R. Simplot Company

7. Lamb Weston Holdings Inc

8. McCain Foods Limited

9. The Kraft Heinz Co

The North America Frozen French Fries Market is valued at US$ 13,660.65 Million in 2022, it is projected to reach US$ 19,486.77 Million by 2030.

As per our report North America Frozen French Fries Market, the market size is valued at US$ 13,660.65 Million in 2022, projecting it to reach US$ 19,486.77 Million by 2030. This translates to a CAGR of approximately 4.5% during the forecast period.

The North America Frozen French Fries Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Frozen French Fries Market report:

The North America Frozen French Fries Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Frozen French Fries Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Frozen French Fries Market value chain can benefit from the information contained in a comprehensive market report.