North America Frozen Bakery Products Market

No. of Pages: 119 | Report Code: TIPRE00023705 | Category: Food and Beverages

No. of Pages: 119 | Report Code: TIPRE00023705 | Category: Food and Beverages

The North America frozen bakery products market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. The widespread trend of socializing in cafes among urban millennials and the youngest segment of the population is accelerating the growth of the chained foodservice industry, which is growing the market for frozen bakery products. Further, cafes and restaurants have emerged as a comfortable and convenient spot for families, millennials, and working young professionals to relax and socialize, thereby propelling the growth of the market. In addition, rapid infrastructure development in emerging economies, such as new airports and expressways, has created opportunities for numerous foodservice outlets and coffee chains to open new outlets. Owing to this, the increasing preference of consumers for fast food, frozen food, and other ready-to-eat (RTE) food items such as breads and rolls, pizza and pizza crust, cakes and pastries, and cookies and biscuits is driving the demand for frozen bakery products.

In case of COVID-19, North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of frozen bakery products manufacturing activities. Downfall in other food & beverages producing sectors has subsequently impacted the demand for frozen bakery products during the early months of 2020. Moreover, decline in the overall bakery products producing activities has led to the discontinuation of frozen bakery products manufacturing projects, thereby reducing the demand for frozen bakery products. Similar trend was witnessed in other North American countries such as Mexico, Canada, Panama, and Costa Rica. However, the countries are likely to overcome this drop in demand with the economic activities regaining their pace, especially in the beginning of 2021.

Strategic insights for the North America Frozen Bakery Products provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

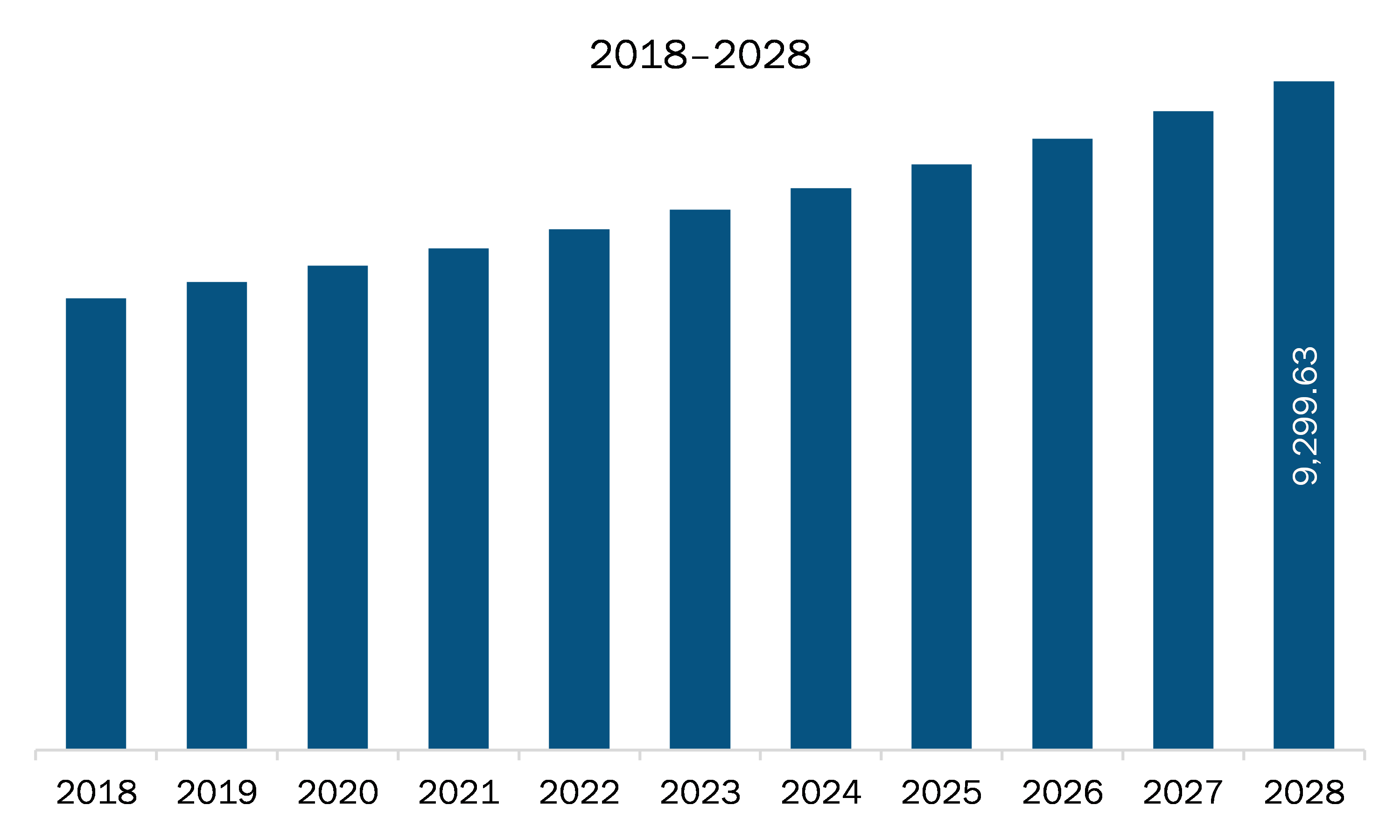

| Market size in 2021 | US$ 6,978.61 Million |

| Market Size by 2028 | US$ 9,299.63 Million |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Frozen Bakery Products refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The frozen bakery products market in North America is expected to grow from US$ 6,978.61 million in 2021 to US$ 9,299.63 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028. Freezing has become one of the most effective methods for preserving the flavor, texture, and nutritional value of bakery products over long periods of storage. It combines the advantages of low temperatures in terms of preventing microbial development, reducing chemical reactions, and delaying cellular metabolic reactions. With advancements in freezing technology, the individual quick frozen (IQF) method has emerged as a promising technology for preserving frozen bakery products for longer periods of time while preserving their sensory and physio-chemical properties. The invention the IQF method is largely responsible for high-quality frozen bakery products. IQF is a freezing technique that prevents large ice crystals from forming in food. Large ice crystals can damage cells and crystal fibers in conventional freezing, causing food products to dry out. IQF foods, on the other hand, create tiny ice crystals that protect the food product's fibers. Microencapsulation is a relatively new technique that can assist manufacturers in extending the shelf life and improving the texture of their gluten-free frozen bakery products. This technology is used to resolve the cardboard quality of refrigerated pizza and rising crust pizza, scoop and bake frozen muffins, and frozen biscuit dough to extend the shelf life of frozen and refrigerated dough and biscuits. Therefore, the adoption of IQF technology to maintain the freshness of frozen bakery products will provide ample opportunities for the market players operating in the frozen bakery products market.

Based on product type, the bread and rolls segment accounted for the largest share of the North America frozen bakery products market in 2020. Based on category, the conventional segment held a larger market share of the North America frozen bakery products market in 2020. Based on end-use, the food service segment held a larger market share of the North America frozen bakery products market in 2020. The food service includes businesses, institutions, and companies responsible for preparing any meal outside the home. The food service industry includes quick-service restaurants, full-service restaurants, schools, and cafeterias. The prominent players in the food service industry use frozen bakery products for making food items and for selling purposes. The restaurants also supply frozen bakery products to retail stores and earn profits. Frozen bakery products such as cakes & pastries, pizza crust, donuts, and cookies have always been in demand in quick service and cafe menus. The use of frozen bakery products in restaurants and cafés justifies the prices for value-focused consumers by emphasizing on the quality of frozen bakery products. The customers can easily walk in restaurants and cafes to purchase frozen bakery products as per the menu, along with the experience of being in a premium restaurant, café, or a hotel.

A few major primary and secondary sources referred to for preparing this report on the North America frozen bakery products market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Dawn Food Products, Inc.; Europastry, S.A.; Lantmannen Unibake; Grupo Bimbo S.A.B. de C.V, Aryzta Ag; General Mills, Inc.; Cole's Quality Foods Inc.; Conagra Brands, Inc.; Associated British Food Plc. and Bridgford Foods Corporation.

The North America Frozen Bakery Products Market is valued at US$ 6,978.61 Million in 2021, it is projected to reach US$ 9,299.63 Million by 2028.

As per our report North America Frozen Bakery Products Market, the market size is valued at US$ 6,978.61 Million in 2021, projecting it to reach US$ 9,299.63 Million by 2028. This translates to a CAGR of approximately 4.2% during the forecast period.

The North America Frozen Bakery Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Frozen Bakery Products Market report:

The North America Frozen Bakery Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Frozen Bakery Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Frozen Bakery Products Market value chain can benefit from the information contained in a comprehensive market report.