The North America forging market is highly competitive and businesses are committed toward the adoption of strategic initiatives, such as capacity expansion, product launches, and mergers & acquisitions, to strengthen their presence and position in the industry. North America is among the largest consumers of forged parts due to high product demand from aerospace, automotive, oil & gas, and construction sectors. North America accounted for over 18% of the global market share of the automotive production in 2019, as per the International Organization of Motor Vehicle Manufacturers. In addition, forging facilities in the region are likely to employ an experienced and qualified workforce that is constantly trained and recertified, as forging will be a profession of choice in the coming years and also a valued source of high paying jobs. Further, industry-wide collaborations and joint efforts between forging firms, suppliers, universities, and government laboratories are expected to enable the US forging industry to leverage its resources in advanced technology implementation and production and implementation. The forging equipment and material providers are likely to work on the crucial areas to lower the costs of these products in the future and achieve its vision. Growing use of forged steel in automotive industry and developments in forging equipment & process are the major factor driving the growth of the North America forging market.

Furthermore, in case of COVID-19, North America is highly affected specially the US. North America has the highest adoption and growth levels of new technologies, with favorable government policies to boost innovation and improve infrastructure capabilities. Therefore, any effect on industries is expected to have a negative influence on the economic growth of the region. The current scenario has led to shutdown of many industries such as automotive, construction, etc. However, this is not expected to significantly impact the overall price of product. Forging market is expected to remain stable in Q’1 2020 mainly due to temporary shutdown of many automotive factories in response to COVID-19 outbreak. Despite the outbreak of COVID-19, top suppliers continue to dominate the market in the 2ndhalf of 2019 and this is expected to remain same for the rest of the year. It is becoming apparent with the COVID-19 pandemic spreading across the United States that few can escape its scope, presenting significant challenges to all industries. This had temporarily closed down all production plants across all industries and has affected the supply chain and logistics industry of the country adversely However, owing to nationwide lockdown across major economies like United States and Canada, the supply chain of major techniques of forging was adversely affected, thereby impacted the manufacturing of the same. Thus, the above-mentioned factors indicate that the outbreak of the pandemic has an adverse impact on the market across the region.

Strategic insights for the North America Forging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

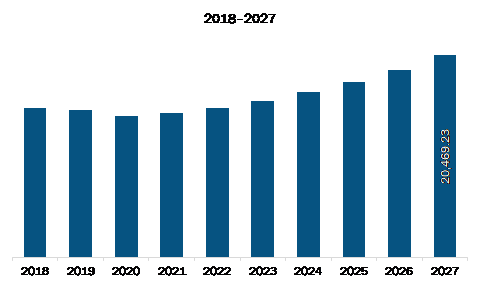

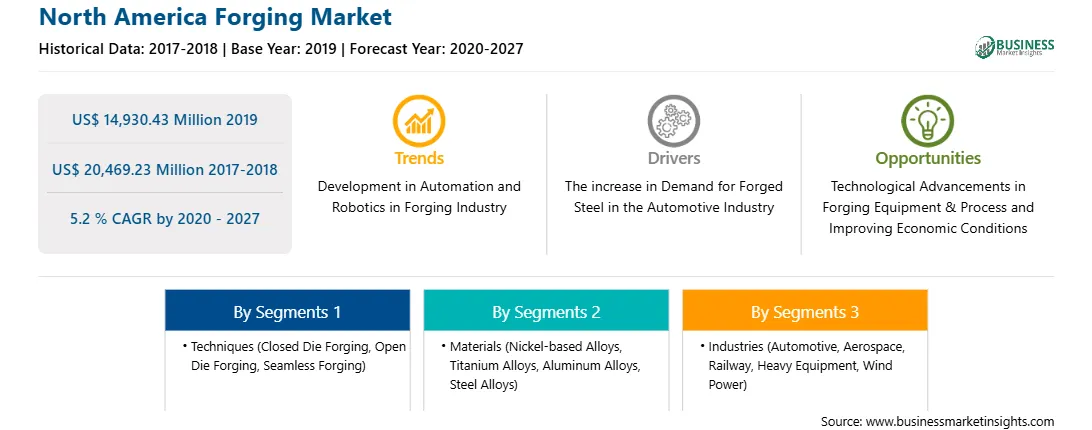

| Market size in 2019 | US$ 14,930.43 Million |

| Market Size by 2027 | US$ 20,469.23 Million |

| Global CAGR (2020 - 2027) | 5.2 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Techniques

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Forging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America forging market is expected to grow from US$ 14,930.43 million in 2019 to US$ 20,469.23 million by 2027; it is estimated to grow at a CAGR of 5.2 % from 2020 to 2027. Benefit of forging over other fabrication techniques is expected to escalate the North America forging market. The forging process results in the structural modification of metals. The heated metals change mechanically to make the desired products under controlled conditions, which have uniform grain size and flow characteristics. This results in the refinement of forged metals and reduces the porosity. As a consequence, the obtained final product has superior metallurgical and mechanical characteristics as well as improved directional strength. Further, forging techniques also enhance structural integrity, which ensures optimum performance under field conditions per part or component. The forging process makes the metal ductile and tough, and imparts it a capability to withstand fatigue, while providing the grain flow with uniformity. Advantages of forging over fabrication such as more refinement of metal, less porosity, better strength etc. are expected to increase its demand in coming years, driving the North America forging market.

In terms of techniques, the closed die forging segment accounted for the largest share of the North America forging market in 2019. In terms of materials, the steel alloys segment held a larger market share of the North America forging market in 2019. Further, the automotive segment held a larger share of the North America forging market based on industries in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America forging market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alcoa Corporation; All Metals & Forge Group; Consolidated Industries, Inc.; Fountaintown Forge, Inc.; Pacific Forge Incorporated; Patriot Forge Co.; Precision Castparts Corp.; Scot Forge.

The North America Forging Market is valued at US$ 14,930.43 Million in 2019, it is projected to reach US$ 20,469.23 Million by 2027.

As per our report North America Forging Market, the market size is valued at US$ 14,930.43 Million in 2019, projecting it to reach US$ 20,469.23 Million by 2027. This translates to a CAGR of approximately 5.2 % during the forecast period.

The North America Forging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Forging Market report:

The North America Forging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Forging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Forging Market value chain can benefit from the information contained in a comprehensive market report.